Cautious in currencies

Key Points

- Foreign currencies have been sinking steadily in recent months

- In the very short-term, most currencies appear to be oversold and could stage a reflex rally at any time

- Despite this oversold situation, some long-entrenched seasonal trends suggest that traders might still wish to tread lightly on playing the long side of the currency markets

The state of currencies

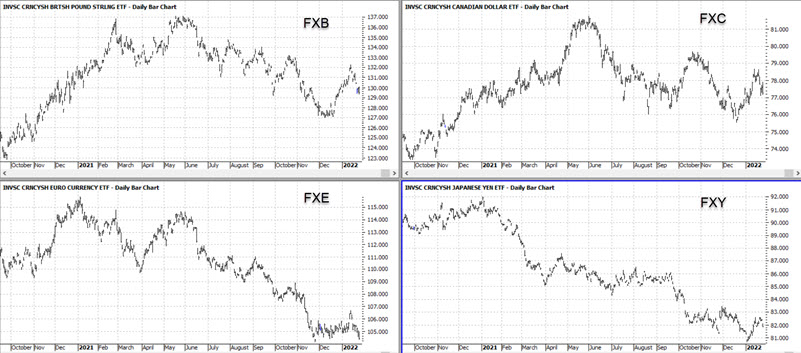

The chart below displays the bar charts for four ETFs that track individual foreign currency futures. They are FXB (Invesco CurrencyShares British Pound Sterling Trust), FXC (Invesco CurrencyShares Canadian Dollar Trus), FXE (Invesco CurrencyShares Euro Currency Trust), and FXY (Invesco CurrencyShares Japanese Yen Trust). The charts are courtesy of ProfitSource.

As you can see, all four of the currencies represented in the chart above have been dismal performers but might be reaching a point where a countertrend bounce could occur. Despite this, caution may still be in order.

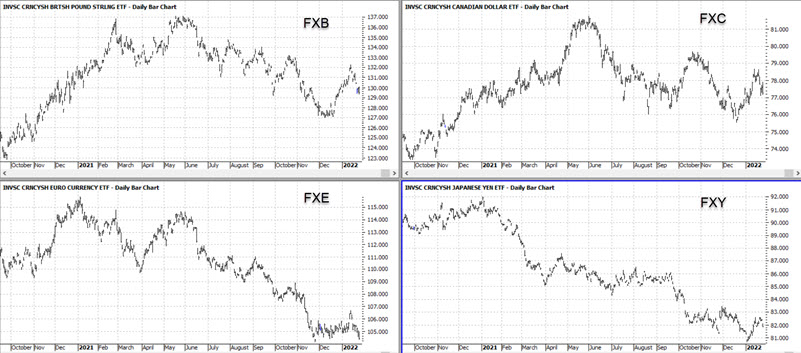

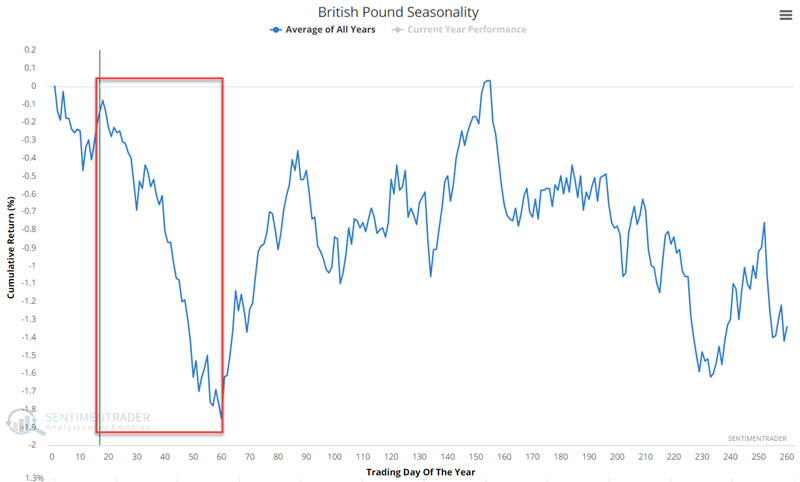

British Pound

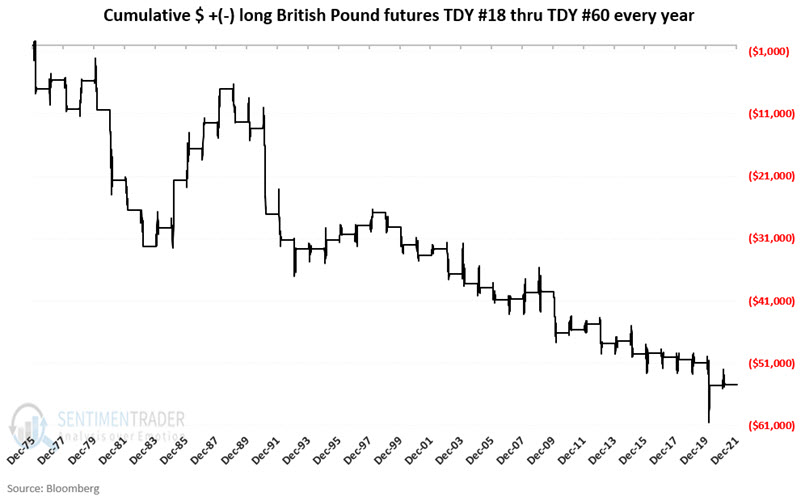

The chart below displays the annual seasonal trend for British Pound futures. We notice a seasonally unfavorable period that extends from Trading Day of the Year (TDY) #18 through TDY #60. For 2022, this period extends from January 27 through March 29.

The chart below displays the cumulative hypothetical $ gain/loss achieved by holding a long position in British Pound futures only during this unfavorable period every year since 1976.

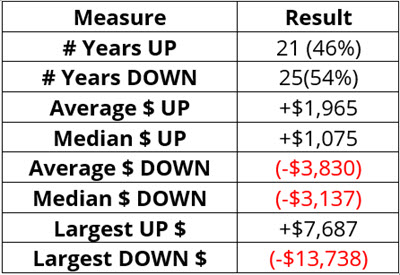

The table below summarizes hypothetical results achieved by holding a long position in British Pound futures only during this unfavorable period every year since 1976.

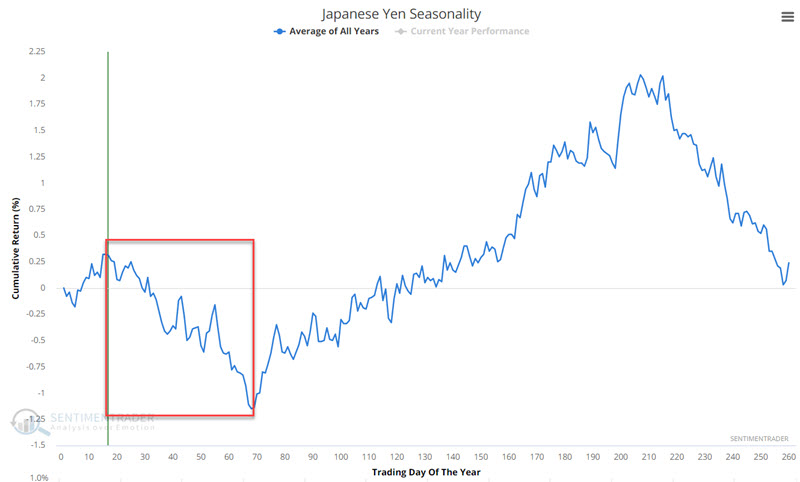

Japanese Yen

The chart below displays the annual seasonal trend for Japanese Yen futures. We notice a seasonally unfavorable period that extends from Trading Day of the Year (TDY) #18 through TDY #60. For 2022, this period extends from January 27 through April 7.

The chart below displays the cumulative hypothetical $ gain/loss achieved by holding a long position in Japanese Yen futures only during this unfavorable period every year since 1976.

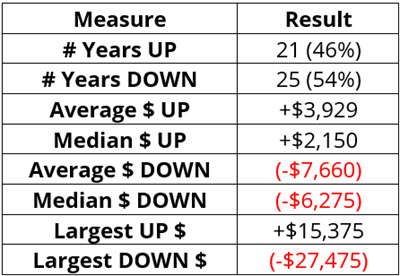

The table below summarizes hypothetical results achieved by holding a long position in Japanese Yen futures only during this unfavorable period every year since 1976.

The difference in the number of winners versus losers is not that great. However, the average and median losing periods are significantly larger than the average and median winning periods.

What the research tells us…

Despite rising inflation, the U.S. dollar has remained relatively strong, and foreign currencies have come under a great deal of pressure. In addition, foreign currencies face extremely unfavorable seasonal headwinds during the 1st quarter. As a result, a long position in foreign currencies would have to be viewed as a highly speculative play.