Buyers push stocks to yet another surge

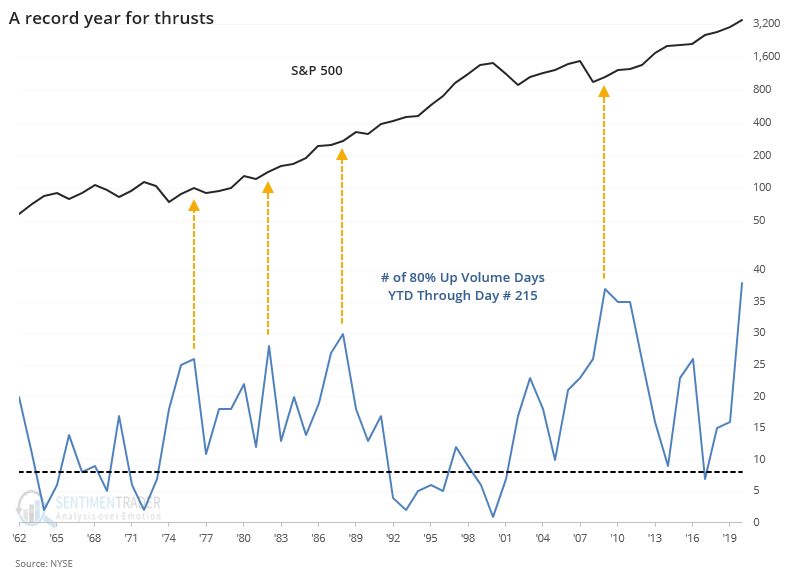

This has been quite a year in many respects. One of the most remarkable is the sheer number of days when buyers went almost all-in on stocks.

There was a historic surge of days with buyers focusing their volume overwhelming in advancing stocks in March through May. Then again in early October, we saw another significant cluster.

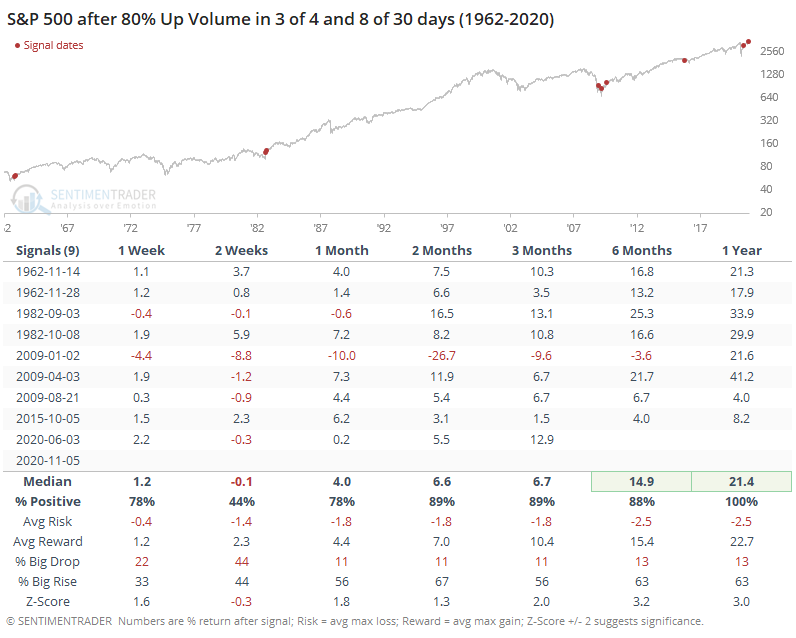

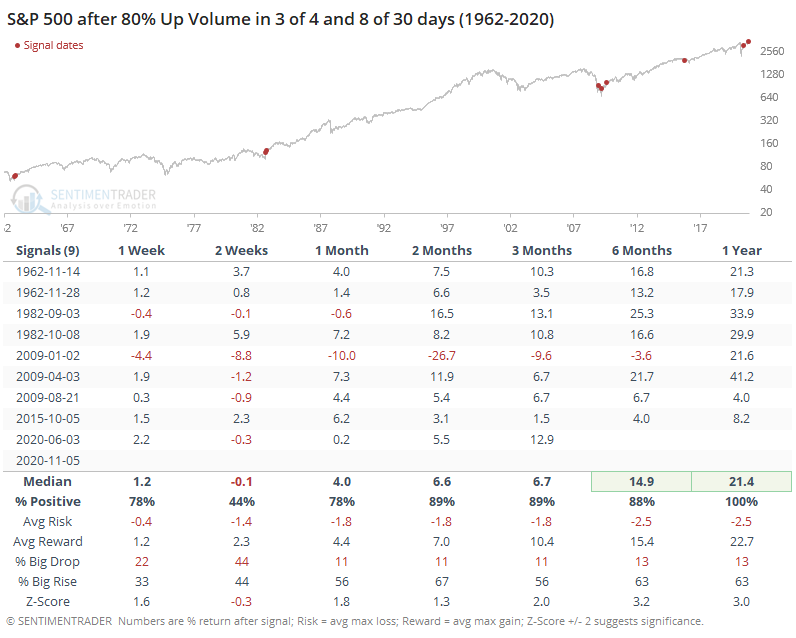

This week triggered another round, with 3 out of the past 4 sessions having better than 80% Up Volume on the NYSE. That just adds to what we'd seen in October, so there have also been at least 8 sessions out of the past 30 with such positively skewed volume.

When these clusters have triggered before, stocks breathed a bit short-term but showed excellent gains and risk versus reward over the next 6-12 months.

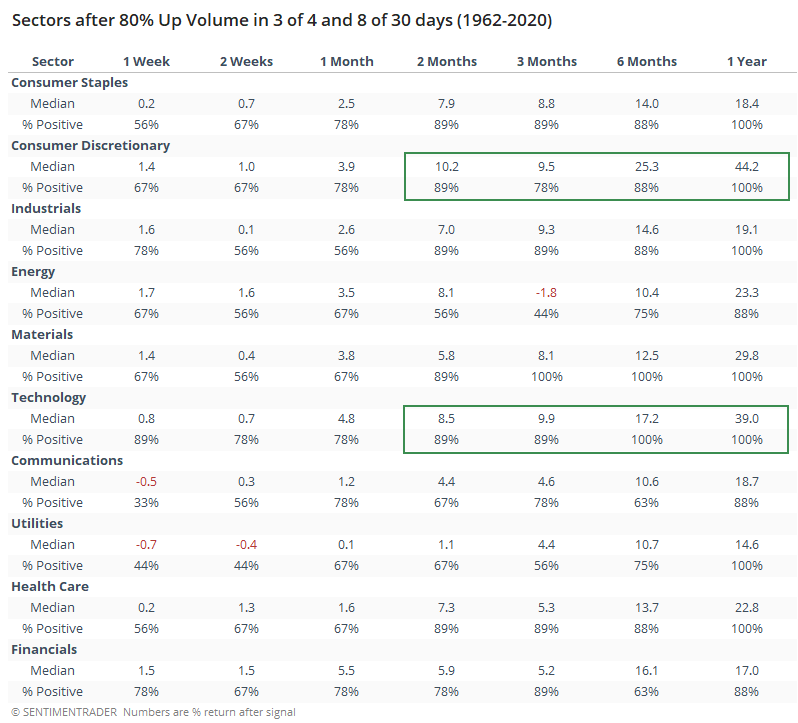

Not surprisingly, the sectors showing the best returns after clusters like this were the higher-beta ones, like Consumer Discretionary and Technology.

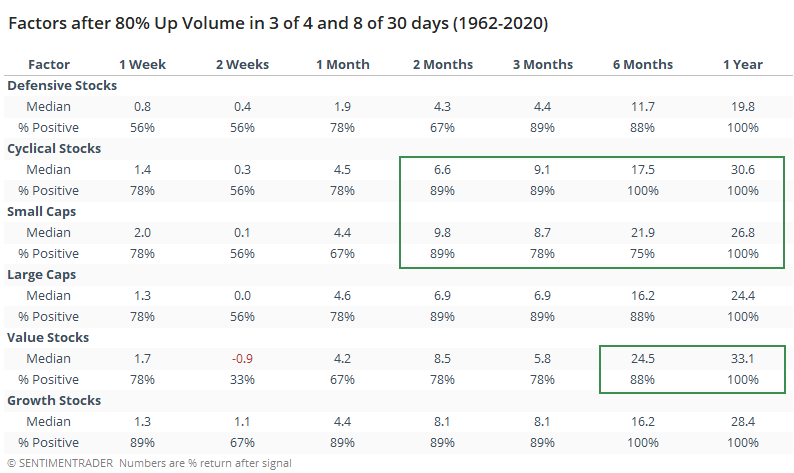

The factors showed the same bias, with the best returns in Cyclical and Small-Cap stocks over the medium- to long-term. Value stocks also performed well, with an average gain of more than 33% over the next 12 months.

This year has now surpassed 2009 as having the greatest number of days with 80% or more Up Volume through session #215.

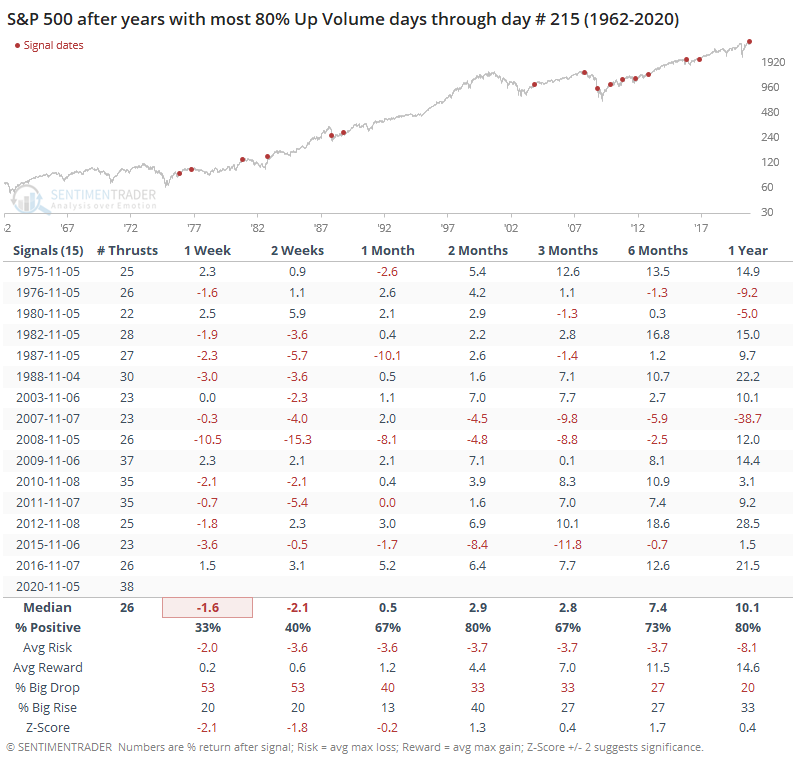

After the years with the most thrusts at this time of year, short-term returns were poor, but medium-term ones were good with 3 losses out of 15 signals over the next 2 months.

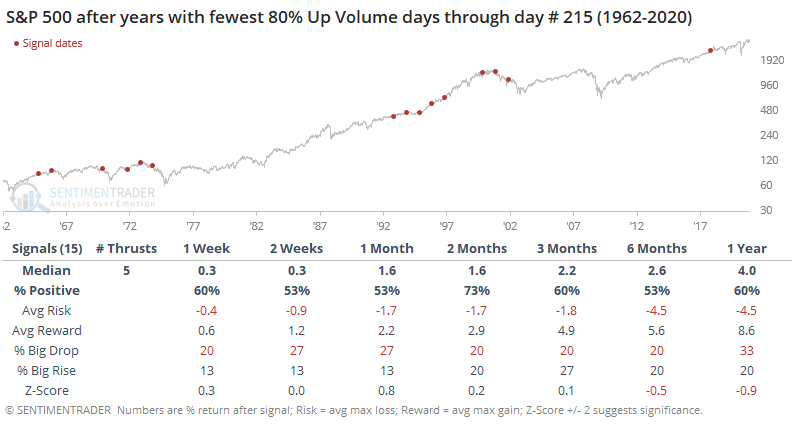

After years with the fewest number of 80% Up Volume days, returns were more muted over the medium- to long-term.

Just because we see a cluster of days with huge Up Volume doesn't mean there can be no weakness going forward - we saw that clearly enough in October. Short-term returns aren't the most consistent time frame for these, anyway. The continued pressure from buyers that was on display yet again this week continues to be a strong argument for higher prices over the medium- to long-term.