Buy signals

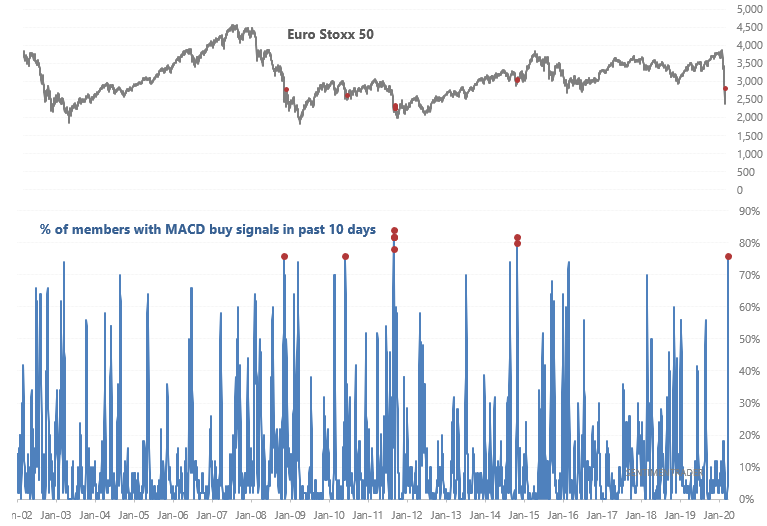

Global markets crashed over the past few weeks and are now starting to turn upwards. This sort of price action usually witnesses a surge in "the % of members with a MACD buy signal in the past 10 days".

For example, here's the Euro Stoxx 50. An extremely large % of stocks with a MACD buy signal:

MACD is a very popular indicator which in my opinion, has a spotty track record. Sometimes it works and sometimes it doesn't, but it certainly won't stop marketers on Twitter from telling you "HISTORIC/EPIC/EXTREME NUMBER OF STOCKS WITH MACD BUY SIGNALS! PREPARE FOR IMMEDIATE AND MASSIVE REVERSAL!" Nothing sells a narrative better than hype.

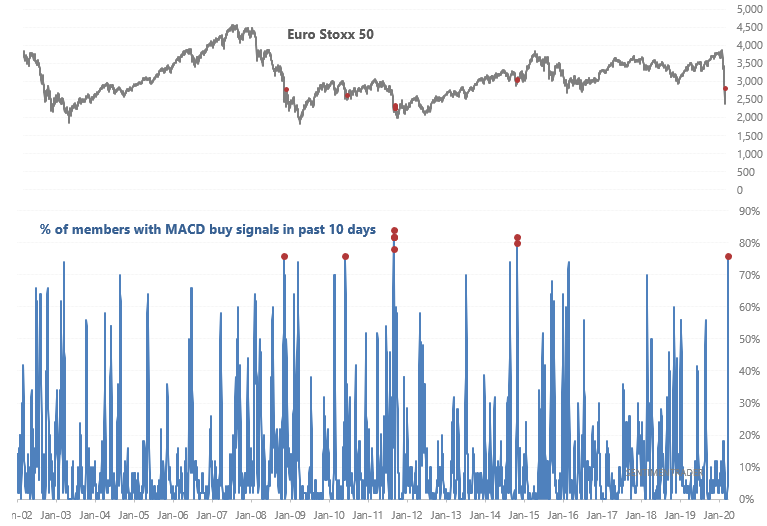

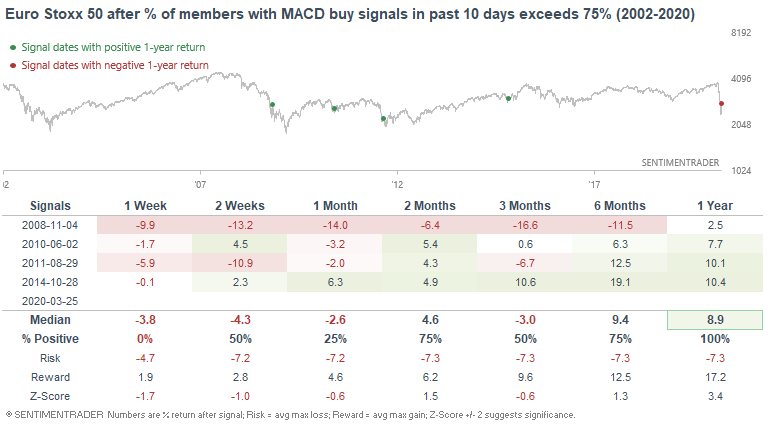

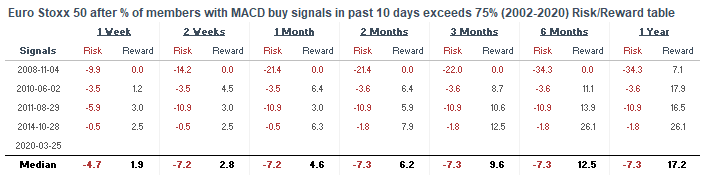

With that being said, there have only been a few other cases with so many Euro Stoxx 50 MACD buy signals. Returns over the next few weeks for European stocks were volatile, although the Euro Stoxx 50 usually rallied over the next year:

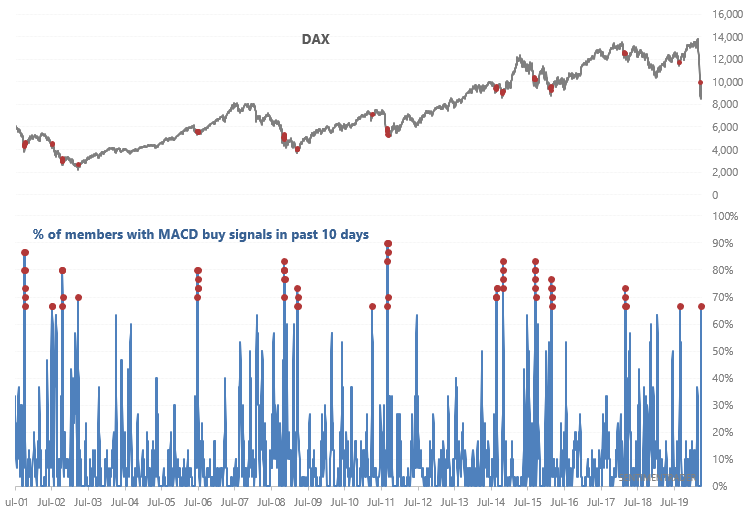

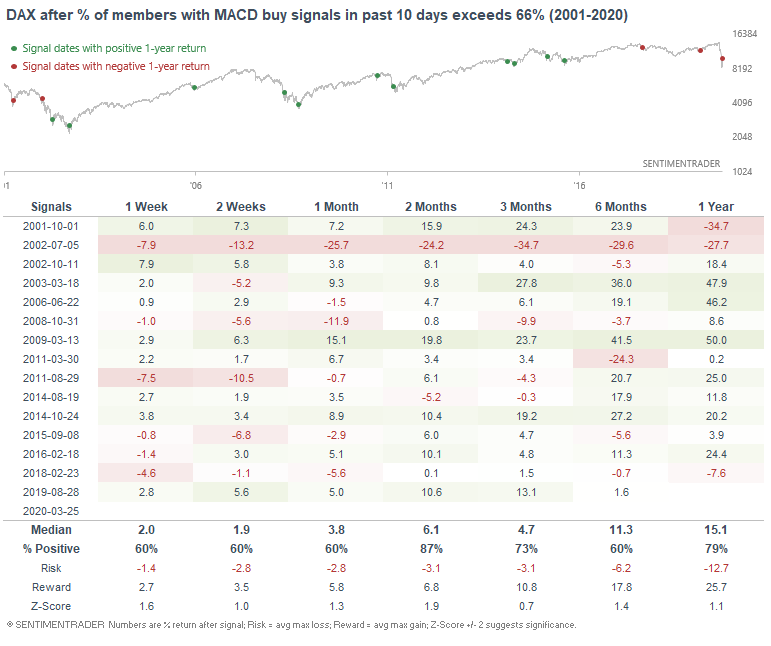

The story is similar in Germany - a large % of stocks with MACD buy signals:

This time, the DAX usually rallied over the next 2 months:

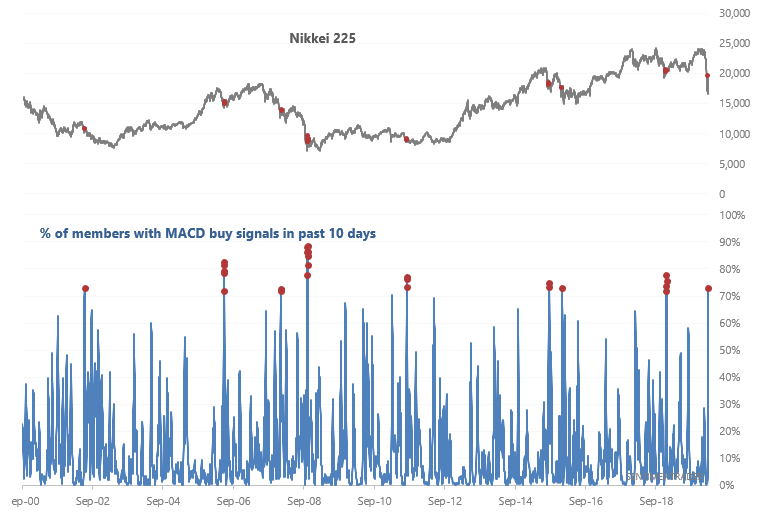

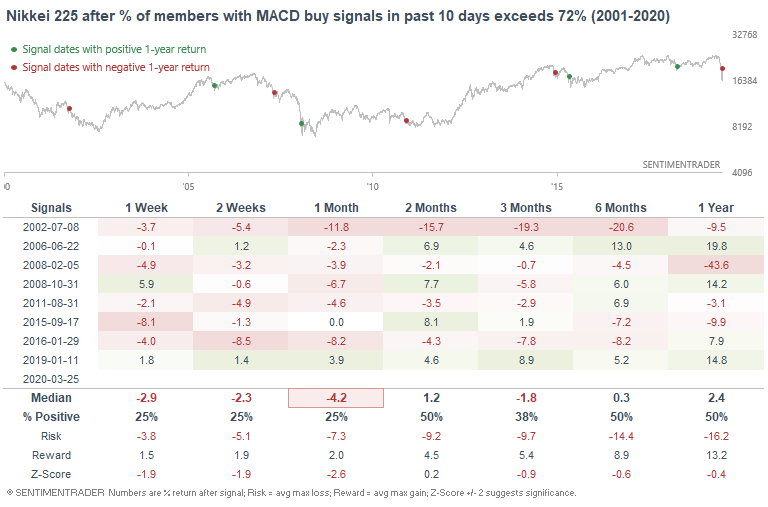

A large % of members with MACD buy signals in Japan:

When this happened in the past, the Nikkei's returns over the next few weeks and months were poor. Notice how this indicator yields very different results when applied to different markets. Bullish in some markets, mixed in other markets, bearish in other markets.

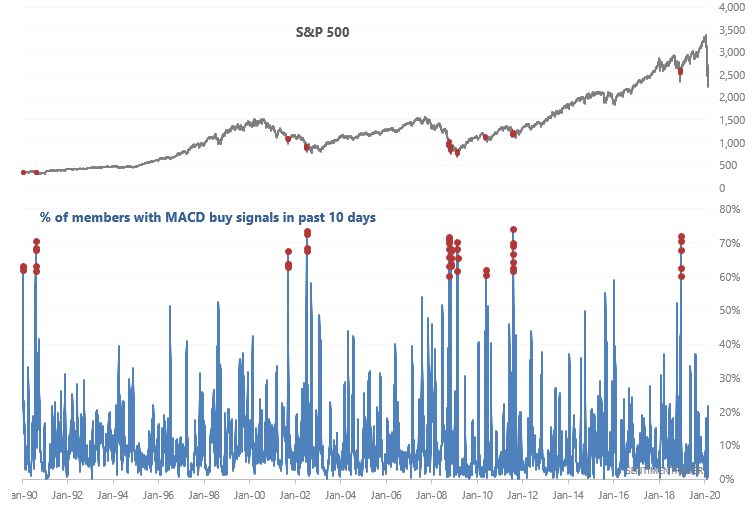

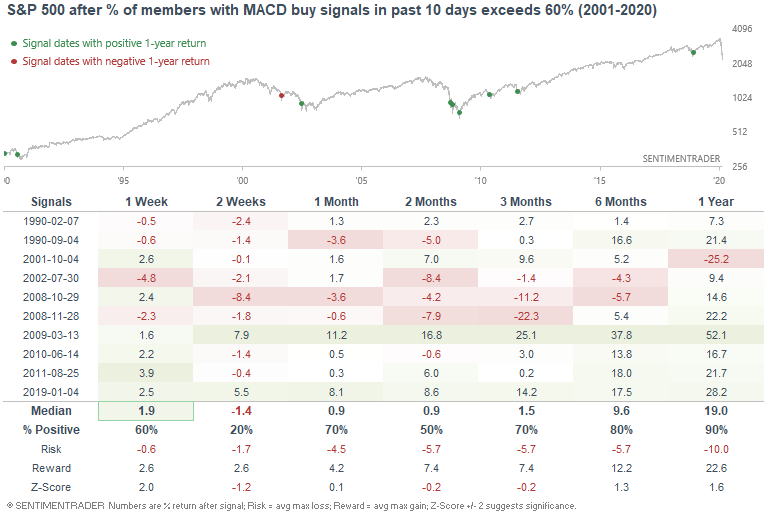

This indicator isn't at an extreme yet in the U.S., but will certainly spike over the next 1-3 days if the U.S. stock market doesn't crash. If this figure rises above 60% over the next few days....

It'll be a bullish sign for U.S. equities, particularly over the next year.

Overall, I would rate this indicator as a modest bullish sign right now.