Bulls Say They're Hesitant While Active Managers Jump In

This is an abridged version of our Daily Report.

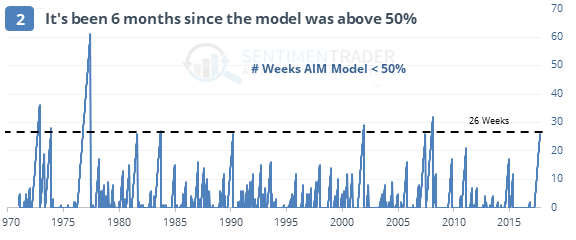

Maybe bulls are just superstitious

Even though investors are buying, they won’t say they’re bullish in sentiment surveys. The AIM Model, which monitors an array of longstanding surveys, has been below 50% for 6 months, one of the longest streaks since 1970.

Nobody wants to short

Among active investment managers, even the most bearish one is betting on a rally, which is a break from other surveys which mostly show apathetic sentiment. Unlike other surveys, this one has less of a contrarian bent, however.

Call buyers return

On the ISE exchange, there were more than 200 call options bought on Thursday for every 100 puts. That’s typically interpreted as a sign of excessive optimism from options traders. One of the great things about the Backtest Engine is we can see if that’s actually the case.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |