Bond sentiment turns sour

In a blurb in yesterday's Daily Report, we noted that for the first time in more than 6 months, investors pulled money out of bond mutual funds and ETFs. That's according to the Investment Company Institute, which monitors flows a bit differently than other organizations.

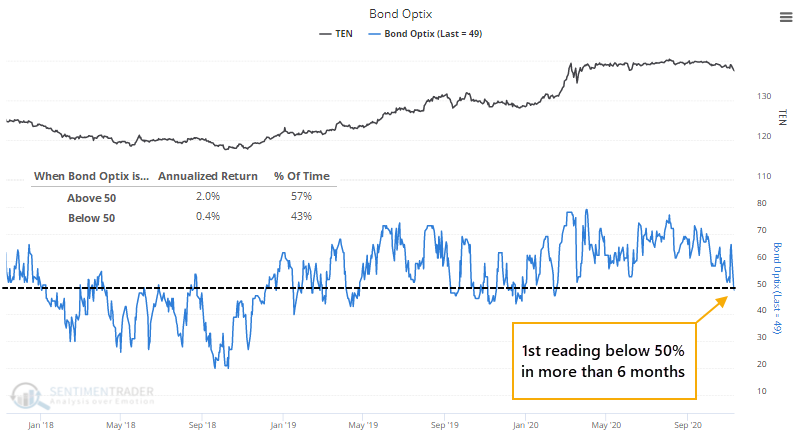

The flows are just one piece of evidence that sentiment toward the bond market has soured. That can also be seen in the Bond Optimism Index (Optix) which just dipped below 50 for the first time since the spring.

Like most of our Optimism Indexes, a market tends to do better when there is risk-on behavior, which typically just means the Optix is above 50. It's only when optimism gets extremely high that forward returns tend to suffer. For the Bond Optix, the 10-year Treasury note futures contract showed an annualized return when the Optix was above 50 that was 5x the return when it was below 50.

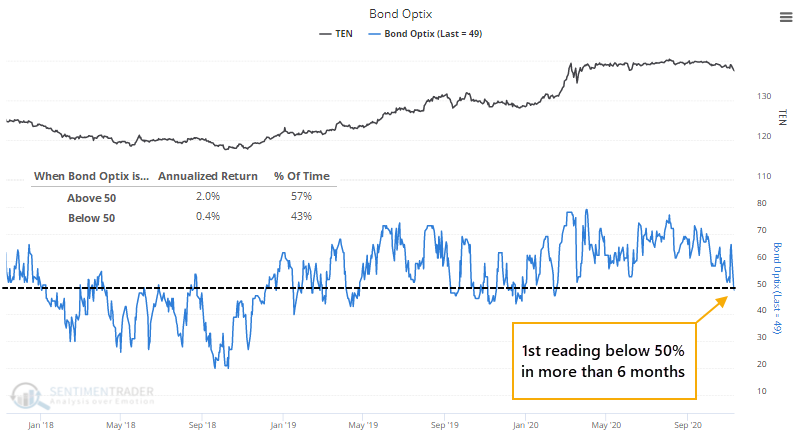

The drop in the Optix below 50 ends a record stretch for the model. It held above that threshold for 187 sessions, exceeding the prior record from 2016.

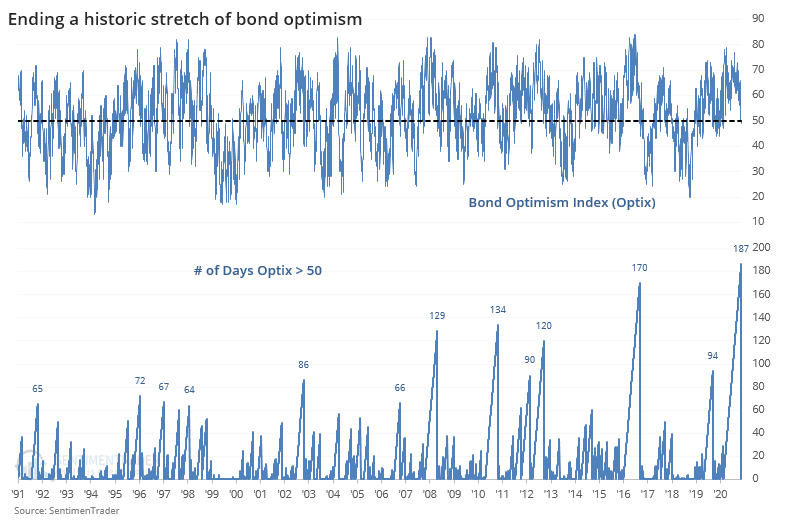

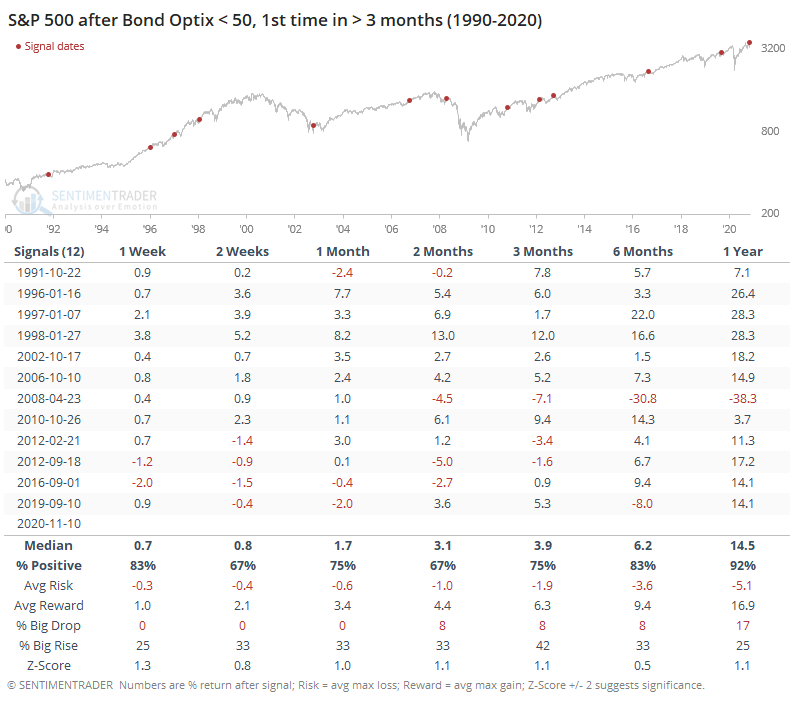

The table below shows every time the Bond Optimism Index held above 50 for at least 3 months, then fell below.

While the 10-year contract rebounded most of the time over the short-term, it fell back over the next 2-3 months, with a poor risk/reward and much larger probability of a big drop than a big rise (see this Knowledge Base article for more detail about the terms). Every one of the signals showed either a loss or less than a 1% gain sometime between 2-6 months later.

These drops in the bond market meant rising interest rates, but that wasn't much of a headwind for the stock market.

After these displays of waning optimism for bonds, the S&P 500 fared well in the months ahead. Over the next 3 months, the S&P rallied 8 out of 12 times, with really one a single loss of any consequence. Its overall risk/reward was good, and there was a 42% chance of a big rise versus only an 8% chance for a big drop within the first 3 months.

Note and bond prices have shown a modest tendency to rise when there is an outflow from mutual funds and ETFs focused on that market. But a wider perspective shows that other measures are weakening too, and aren't yet to a point that would indicate widespread pessimism. Under these conditions, bond prices have a stronger tendency to decline than rise. If Thursday's bond rally holds and turns the Optimism Index back above 50, then it will be a better sign, but the fact that it's already dipped below 50 suggests a tougher slog ahead.