Biotech Is Taking Off

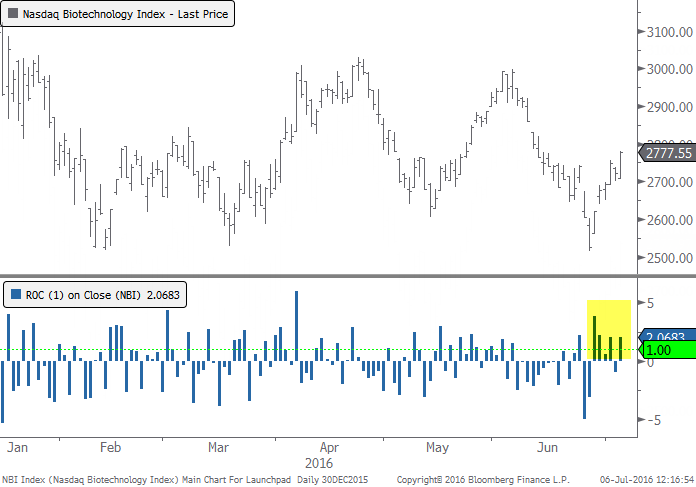

One of the hottest sectors over the past week has been biotechnology, up another 2% on Wednesday (depending on the index).

This marks a large thrust off the low on June 27. On that day, the Nasdaq Biotechnology Index had closed at its lowest price in more than a year, suggesting that the past week might be a sign of returning buying interest that could last a while.

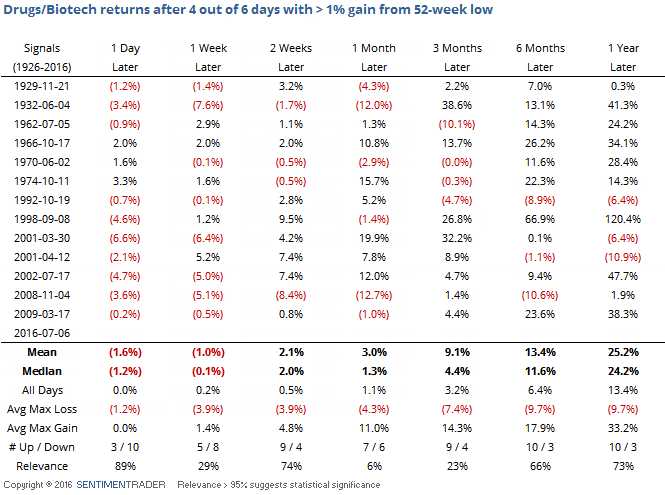

The Nasdaq Biotech index only goes back to 1994 so history is relatively limited. But using Fama French data back to 1926 using the "Drugs" industry, we can get a rough approximation of instances prior to the past 20 years.

Using this data, let's look for every time that drugs/biotech blasted off of a 52-week low by enjoying at least 4 out of 6 sessions with a 1% gain.

Short-term results were painful, as the stocks typically gave back some of the gains within the next week. After that, returns were much more positive, with the most intriguing arguably being six months later when the index was higher 10 out of 13 times with a nearly 2-to-1 risk/reward ratio. The "relevance" scores aren't very high, but mostly that's due to upside volatility, which is a good problem to have. There were a couple of large losses over the medium- to long-term, but for the most part these blast-offs were good signs for the sector in the months ahead.