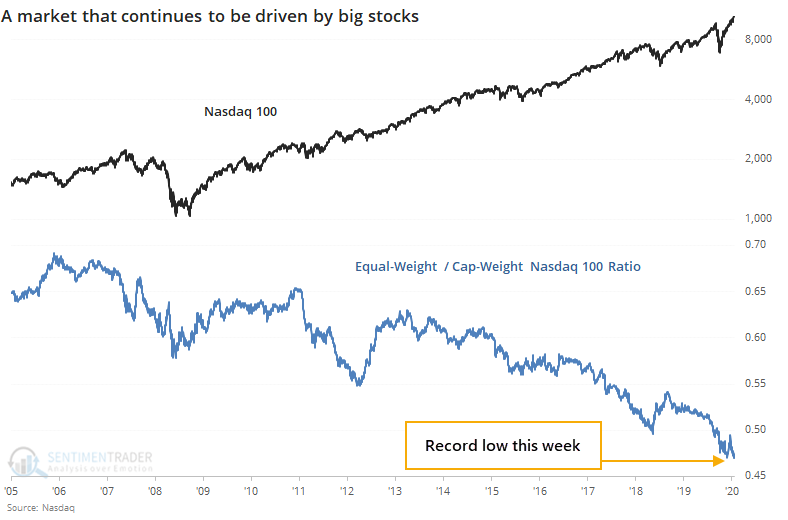

Big stock rallies are driving the equal-weight Nasdaq 100 to new relative lows

The major indexes continue to be driven by big stocks. That's not a new insight, but it's also not changing.

Yet again this week, the Nasdaq 100 (NDX) has hit new highs. The NDX is a modified capitalization-weighted index, so the largest stocks can drive returns in the index, up to a point.

While it doesn't have much history, there is also a version of the NDX that weights each of the stocks equally. While the NDX we all watch has been hitting new highs, the equal-weight version of the index has been doing okay, too. It's just not doing as well, and it has declined to a new low relative to the cap-weighted version.

For the main NDX, this has been a mixed sign. Same for the broader market. The rise of big stocks has been almost incessant over the past 15 years, so the ratio of the equal-weight to cap-weight index never really had much of a consistent chance to outperform even after big divergences like this.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at index performance after big divergences in equal-weight indexes

- Stocks have rallied strongly over the past 3 months, but the synthetic VIX remains high - what that's meant since 1962

- The RSI on Chinese stocks is the highest in 6 years

- The Shanghai Composite has rallied 7 days in a row

- Speculative volume has been pouring into Chinese stocks

- The McClellan Oscillator for the Shanghai is nearly at a record high

- The Nasdaq has rallied more than 1% on many days over the past 5 months