Big Money turns positive for the 1st time in 2 years

Over the past 20 years, we've seen ample evidence that equating "big money" with "smart money" is often a mistake. Institutional investors can fall prey to the same biases caused by group-think as mom-and-pop.

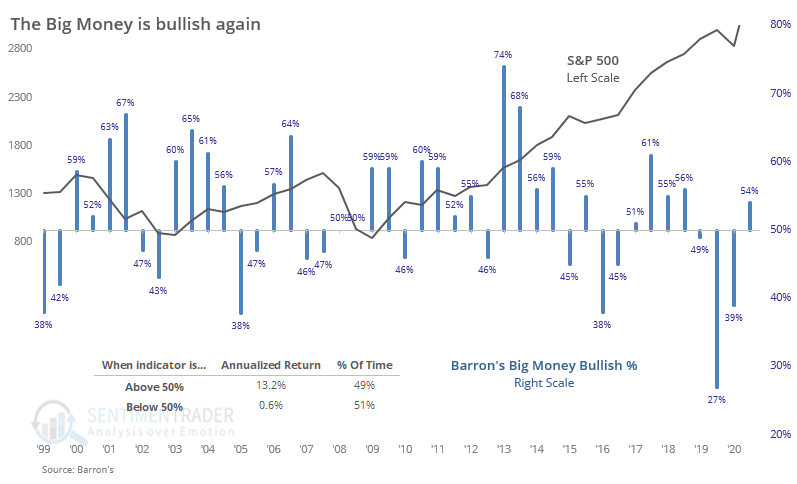

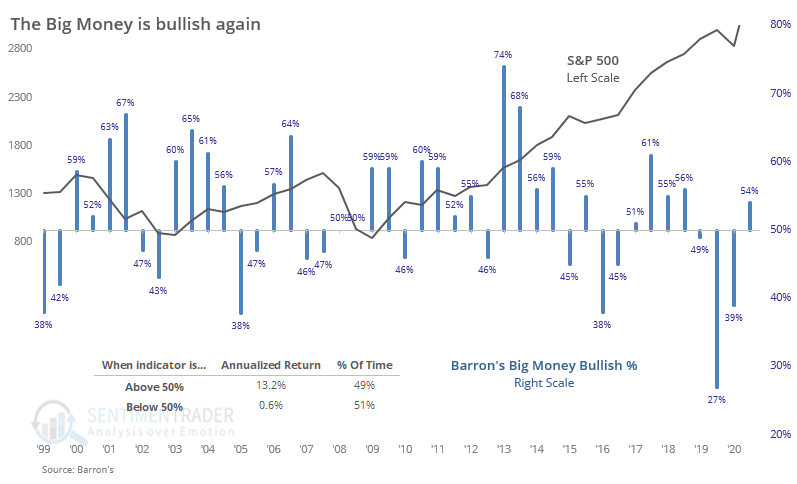

The latest Big Money poll by Barron's shows that large money managers have turned positive again. After 3 straight semi-annual polls showing a bullish percentage below 50%, the latest results show a majority of bulls.

In the spring, this group had been very negative on stocks, with fewer than 40% of managers expecting stocks to rise over the next 6 months. Optimism that low tended to be a good sign for forward returns. Now the percentage of optimistic managers is the highest since October 2018.

In general, the S&P 500 has performed better when more than half of the managers were bullish. The S&P 500's annualized return was +13.2% following those surveys, versus a lowly +0.6% when less than half of managers were bullish.

Like we saw in the spring, the exception is when they're really pessimistic, then returns turn more positive. That's true with many sentiment indicators - whey they're showing a risk-off attitude, it's bad for stocks until it gets to the point of showing extreme pessimism, then they're more useful as contrary indicators.

In the decades that we've been covering this survey, it has proved only modestly useful. It's a good sign when managers are bullish and a very mild warning (if even that) when managers are extremely bullish. It's a modest negative when managers are pessimistic, but quite bullish when they're extremely pessimistic.

This suggests that their current attitude of mild optimism is a slight positive for stocks going forward.