Backward oil

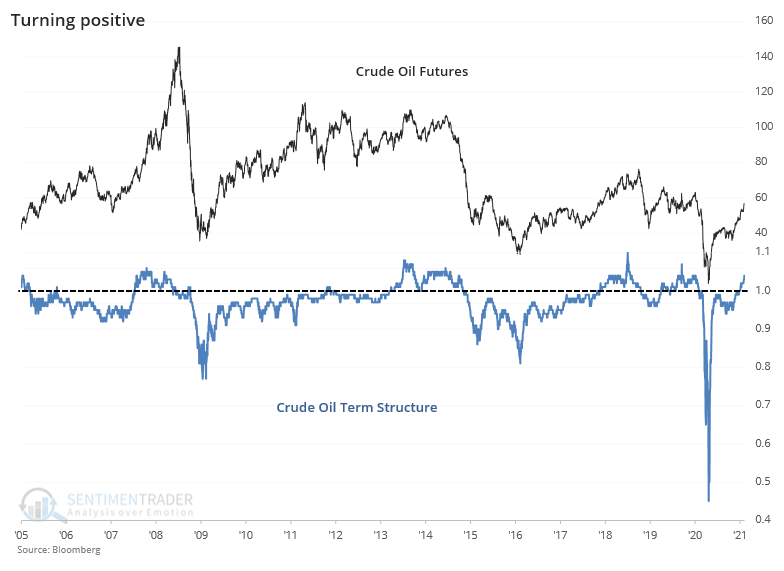

Thanks to demand, the front-month crude oil futures contract is being priced quite a bit higher than back months. When traders panic, the reverse happens.

As the Wall Street Journal notes:

There is no shortage of oil, but one sign the market is tightening stems from the relationship between current and future prices. Spot prices have climbed to a premium over prices for crude to be delivered down the line, showing that traders are willing to pay more for immediate access to oil.

On Friday, WTI contracts for oil that will be delivered next month cost $5.16 more per barrel than contracts for crude that will change hands in March 2022. That is the biggest premium for front-month futures since the start of the pandemic and contrasts with a historically large discount last April, when a glut of oil pushed WTI prices below zero.

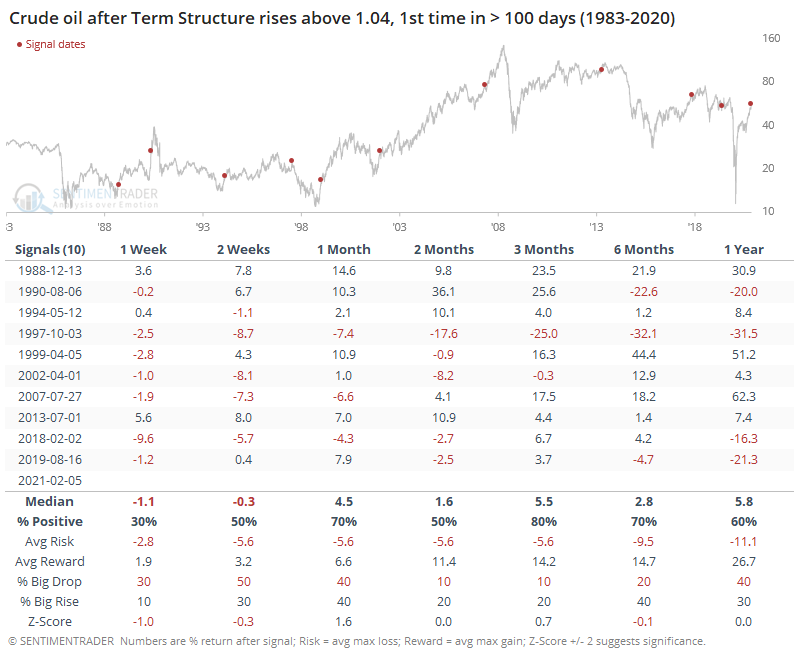

That has turned the Term Structure higher than it has been in a year.

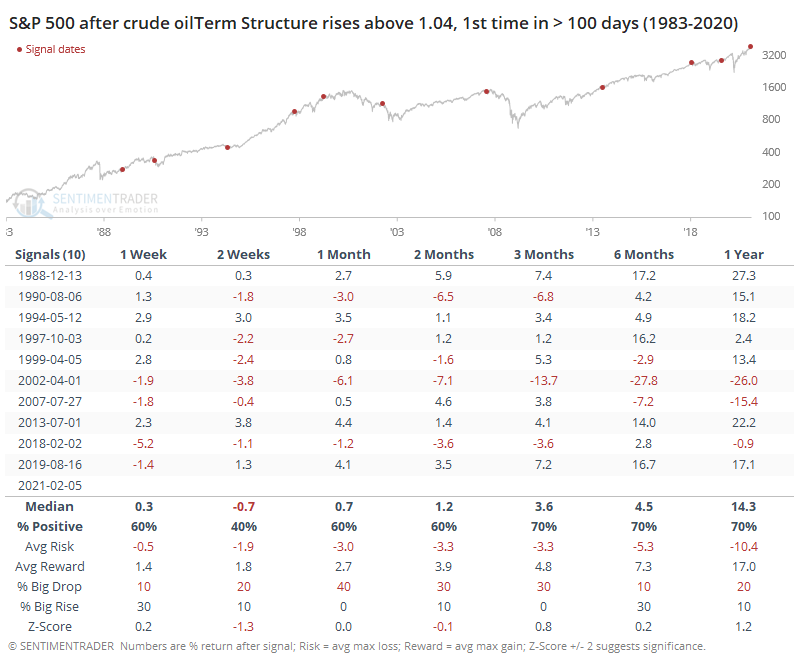

As a sign for the stock market, it had mixed success with mostly "blah" results up to two months later.

Same goes for oil itself, with mixed returns over the next couple of months, but fairly positive 3 months later.

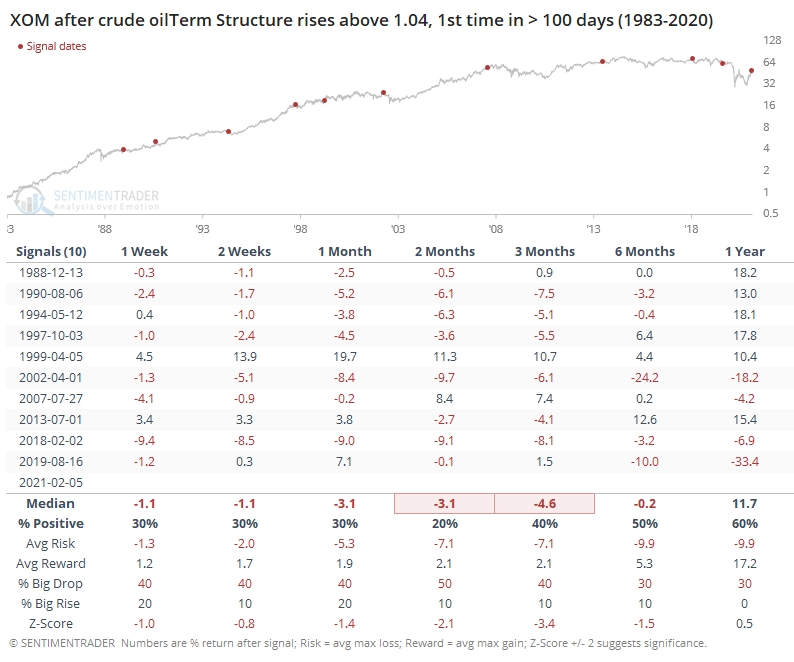

Curiously, these signals have led to very poor returns for majors like Exxon. Only the signal in 1999 didn't lead to a negative return on some medium- to long-term time frame.