Back Above A Technical Level As Volatility Drops And A/D Line Hits A High

This is an abridged version of our Daily Report.

Indexes reclaim technical levels

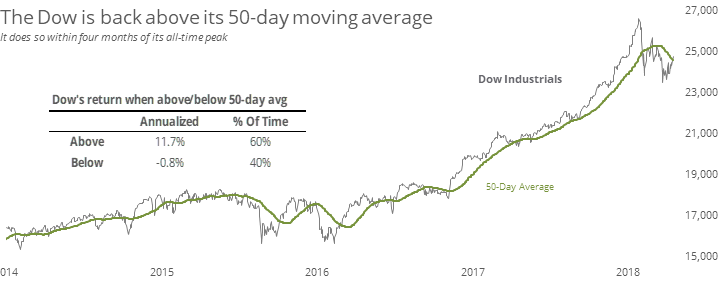

According to media reports, Tuesday’s jump in the Dow and S&P above their 50-day averages was important. The Dow does tend to have markedly better annualized returns when trading above its average.

But as an all-clear signal after a correction, regaining the 50-day average was a poor predictor.

Back to (the new) normal

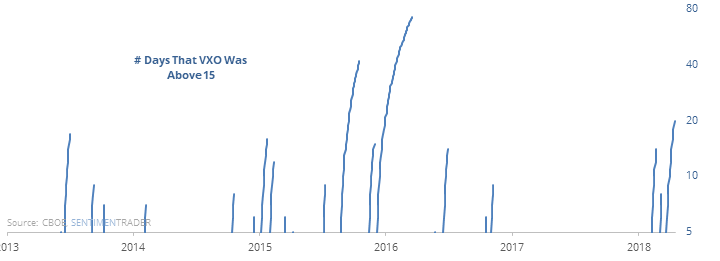

Volatility indexes are returning to the low levels they had been at prior to the volatility spikes. For the “old” VIX index, it is back below 15 for the first time in a month while suffering a volatility spike.

It has tended to jump again in the short-term and was not a good all-clear sign.

A positive lead

The S&P 500 is still more than 5% below its 52-week high. At the same time, its Cumulative Advance/Decline Line has just closed at a new record high. That seems like a good sign, but it has been a false positive and unreliable as a leading indicator.

Sugar is hated again

Sugar has overtaken the most-hated commodity crown again, with an Optimism Index that has dropped below 20, ranking among the lowest readings since 1991.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |