Asian optimism

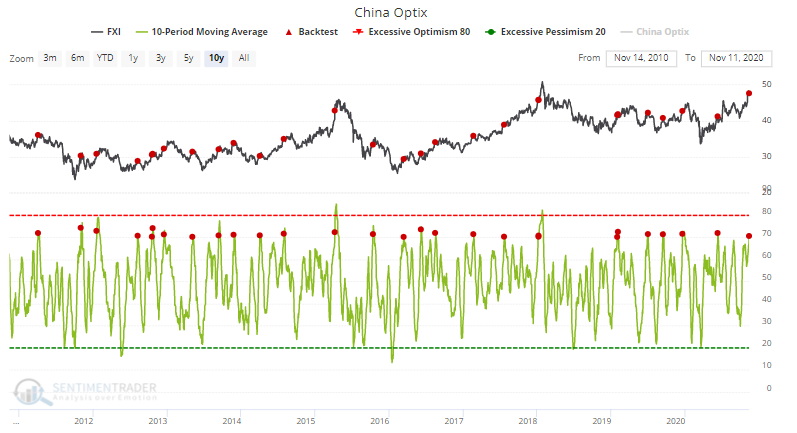

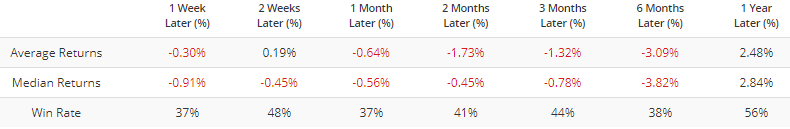

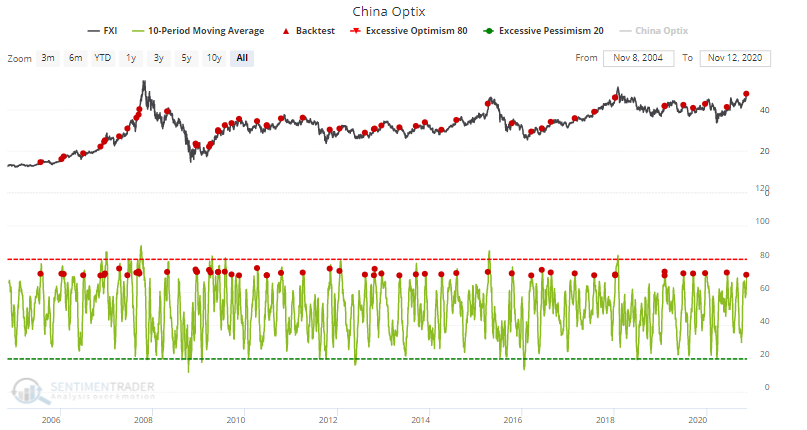

Japanese and Asian equities surged over the past 2 weeks, pushing sentiment and breadth readings in Asia to the highest levels in months. China Optix's 10 dma is now extremely elevated (at 70):

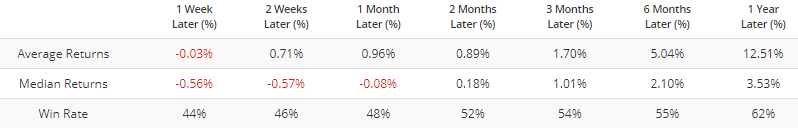

When we only look at the historical signals over the past 10 years (years in which Chinese equities mostly chopped sideways), Chinese equities usually faced losses over the next few months:

But if we incorporate more historical data, Chinese forward returns weren't that bearish, primarily due to a bunch of bullish signals during the 2005-2007 bull market:

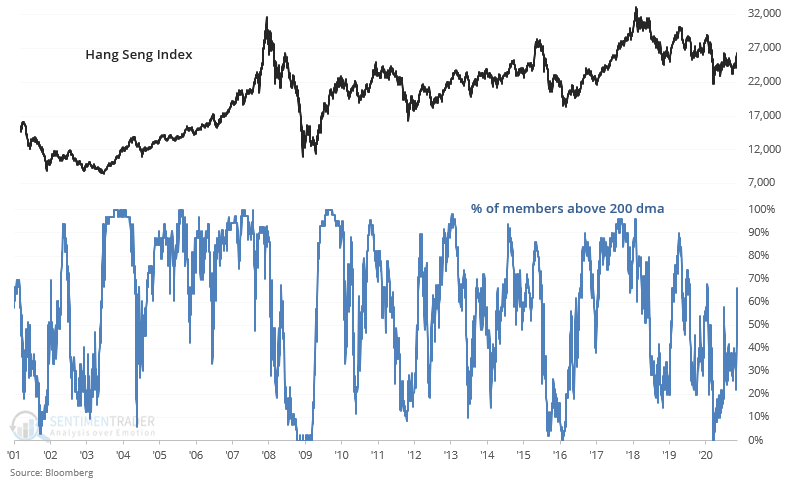

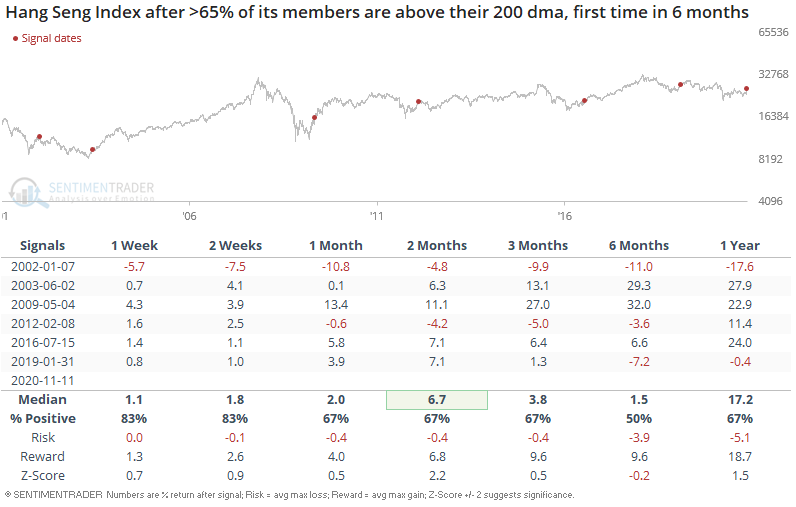

In Hong Kong, an increasing % of the Hang Seng Index is in a long term uptrend (above their 200 dma):

When the Hang Seng Index saw a resurgence of breadth in the past, forward returns over the next 2 months were more bullish than random:

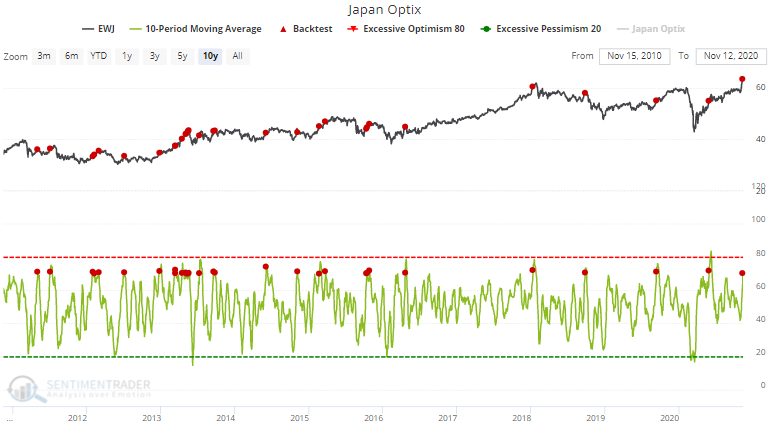

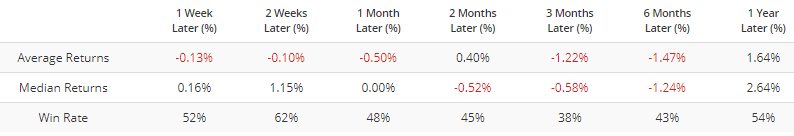

In Japan, a 2 week stock market rally pushed Japanese Optix's 10 dma to an extremely high reading (above 70):

As was the case in China, the past 10 years saw this leading to more bearish than random results for Japanese equities over the past 3 months:

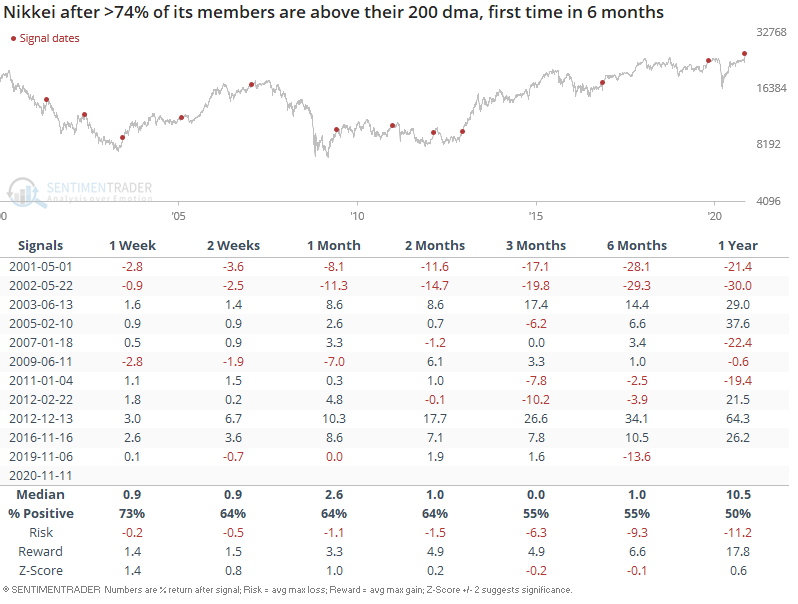

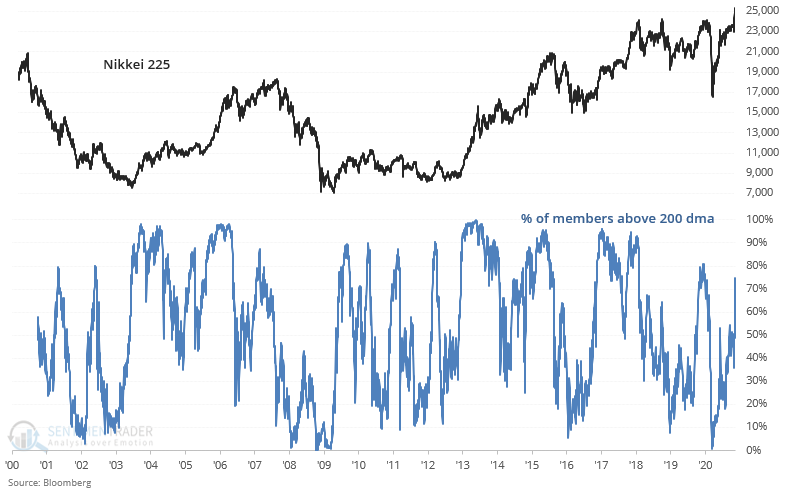

The resurgence also pushed the % of Japanese equities in an uptrend to the highest level since February:

This sometimes led to a small Nikkei pullback in the short term: