Applying sentiment indicators to different models

2 months ago I looked at what would happen if you applied 8 different sentiment indicators to the unemployment rate model. This post takes that 1 step further.

2 sentiment indicators

I whittled down the 8 indicators and focused on the ones that have data from the 1960s-present.

Going through various combinations of these indicators demonstrates that combining the Stock/Bond ratio and NYSE HiLo Logic Index adds the most additional alpha and increases risk-adjusted returns.

So with that being said, here's what happens when you apply the Stock/Bond ratio and NYSE HiLo Logic Index to the following models:

- Simple Trading Model With Fundamentals

- Macro Index Model

- Conference Board LEI Model

- Dual Trend Model With Fundamentals

Here's how we apply these 2 sentiment indicators:

- If the original model says SELL stocks, then sell stocks and buy the Bloomberg Barclays U.S. Aggregate Bonds Index.

- If the original model says BUY stocks, and neither "Stock/Bond ratio was >2.5 sometime over the past 2 months", nor "NYSE HiLo Logic Index's 10 dma was >3 sometime over the past 2 months", BUY stocks.

- If the original model says BUY stocks, and "Stock/Bond ratio was >2.5 sometime over the past 2 months", or "NYSE HiLo Logic Index's 10 dma was >3 sometime over the past 2 months", SELL stocks and buy the Bloomberg Barclays U.S. Aggregate Bonds Index.

In a nutshell, follow the original model, but sell stocks and buy bonds if either of these 2 sentiment signals sent a bearish signal sometime over the past 2 months.

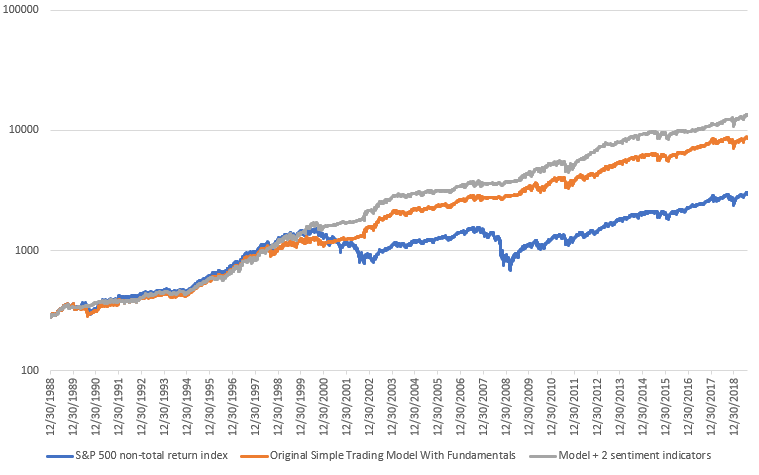

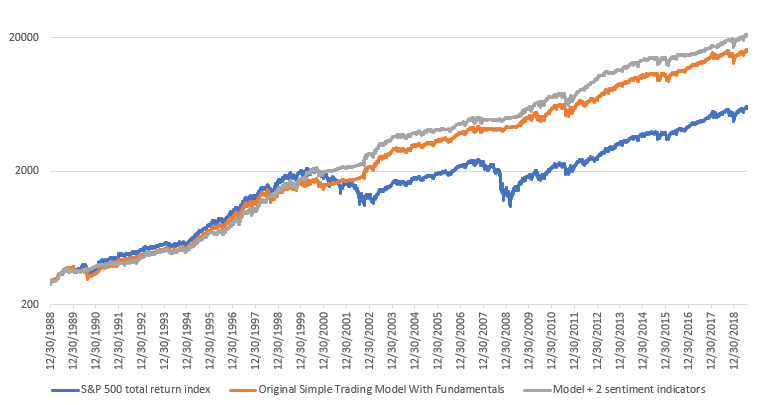

Simple Trading Model With Fundamentals + 2 sentiment indicators

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Simple Trading Model With Fundamentals has an average annual return of 11.87% per year

- Simple Trading Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 13.44% per year

*These returns do not include the S&P 500's dividends reinvested. Including dividends reinvested, average annual returns would be higher.

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Simple Trading Model With Fundamentals has a Sharpe ratio of 0.67

- Simple Trading Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 0.88

*These Sharpe ratios are lower than what you might expect, since they do not include the S&P 500's dividends reinvested. Including dividends reinvested, Sharpe would be higher.

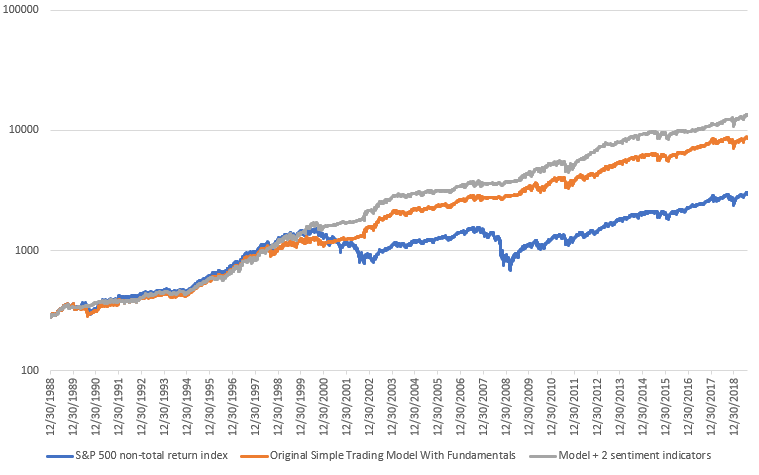

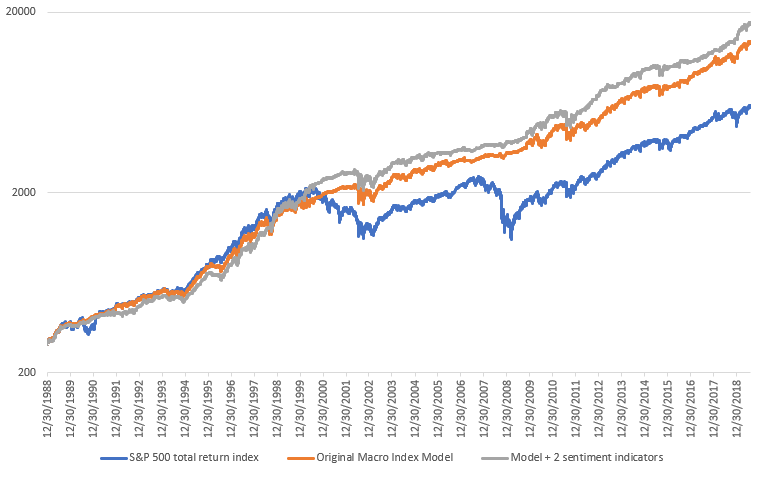

Macro Index Model + 2 sentiment indicators

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Macro Index Model has an average annual return of 11.65% per year

- Macro Index Model (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 12.99% per year

*These returns do not include the S&P 500's dividends reinvested. Including dividends reinvested, average annual returns would be higher.

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Macro Index Model has a Sharpe ratio of 0.69

- Simple Trading Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 0.87

*These Sharpe ratios are lower than what you might expect, since they do not include the S&P 500's dividends reinvested. Including dividends reinvested, Sharpe would be higher.

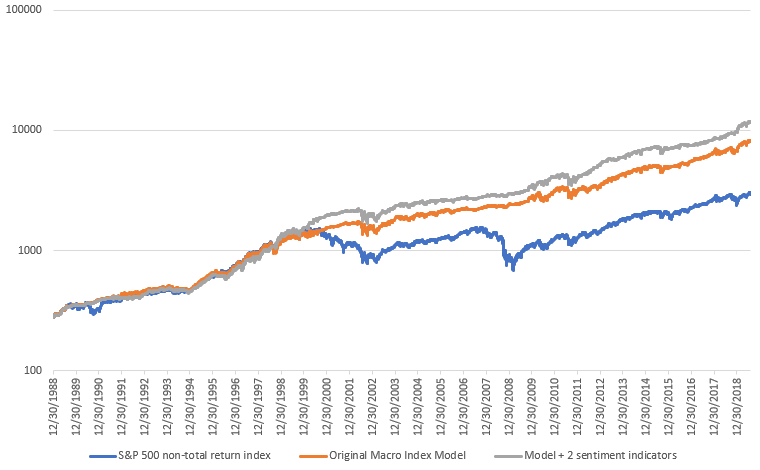

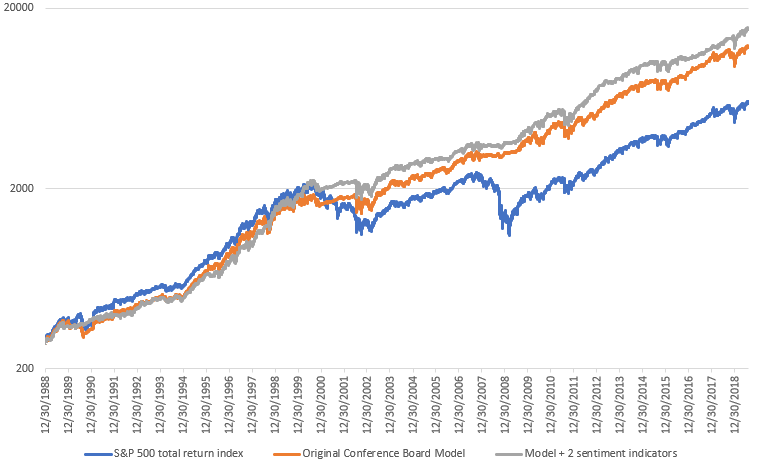

Conference Board LEI Model + 2 sentiment indicators

*This Conference Board LEI Model is a little different from what I described here. In the following version of the Conference Board LEI Model, the rules are as follows:

*Thank you to Daniel - one of our subscribers - who emailed me about this

- Buy and hold the S&P 500, unless...

- The Conference Board LEI's 6 month rate-of-change is negative, AND the S&P is below its 12 month moving average.

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Conference Board LEI Model has an average annual return of 10.99% per year

- Conference Board LEI Model (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 12.4% per year

*These returns do not include the S&P 500's dividends reinvested. Including dividends reinvested, average annual returns would be higher.

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Conference Board LEI Model has a Sharpe ratio of 0.6

- Conference Board LEI Model (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 0.77

*These Sharpe ratios are lower than what you might expect, since they do not include the S&P 500's dividends reinvested. Including dividends reinvested, Sharpe would be higher.

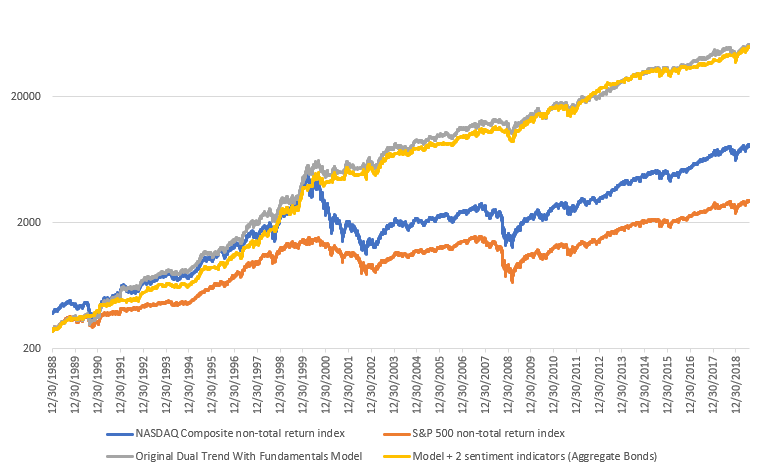

Dual Trend Model With Fundamentals + 2 sentiment indicators

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Dual Trend Model With Fundamentals has an average annual return of 18.53% per year

- Dual Trend Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 18.4% per year

*These returns do not include the S&P 500's dividends reinvested. Including dividends reinvested, average annual returns would be higher.

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Dual Trend Model With Fundamentals has a Sharpe ratio of 0.92

- Dual Trend Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 1.02

*These Sharpe ratios are lower than what you might expect, since they do not include the S&P 500's dividends reinvested. Including dividends reinvested, Sharpe would be higher.

Now what if we used the S&P 500's total return data?

Simple Trading Model With Fundamentals + 2 sentiment indicators

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Simple Trading Model With Fundamentals has an average annual return of 13.98% per year

- Simple Trading Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 14.97% per year

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Simple Trading Model With Fundamentals has a Sharpe ratio of 0.81

- Simple Trading Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 0.99

Macro Index Model + 2 sentiment indicators

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Macro Index Model has an average annual return of 13.38% per year

- Macro Index Model (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 14.28% per year

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Macro Index Model has a Sharpe ratio of 0.81

- Simple Trading Model With Fundamentals (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 0.97

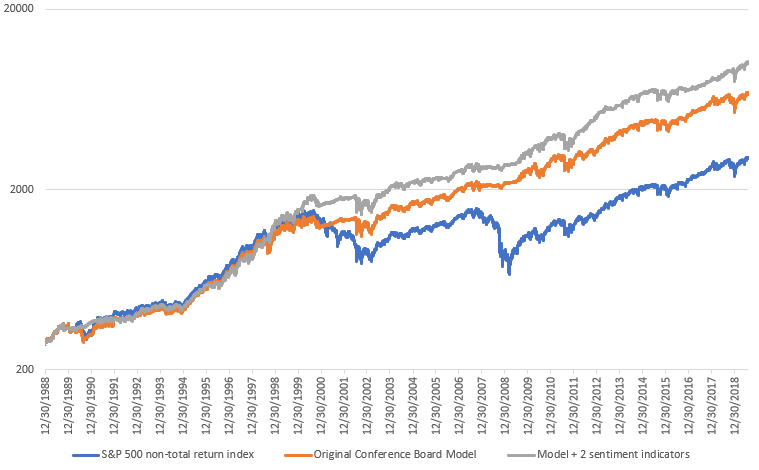

Conference Board LEI Model + 2 sentiment indicators

Average annual returns

From December 30, 1988 - August 1, 2019:

- The original Conference Board LEI Model has an average annual return of 13.11% per year

- Conference Board LEI Model (+Stock/Bond ratio and NYSE HiLo Logic Index) has an average annual return of 13.96% per year

Sharpe ratio

From December 30, 1988 - August 1, 2019:

- The original Conference Board LEI Model has a Sharpe ratio of 0.74

- Conference Board LEI Model (+Stock/Bond ratio and NYSE HiLo Logic Index) has a Sharpe ratio of 0.88

*I'm unable to backtest the Dual Trend Model With Fundamentals using total return data since the NASDAQ's total return data history is limited.

Conclusion

Incorporating the Stock/Bond ratio and NYSE HiLo Logic Index adds significant alpha to trading models and increases their Sharpe ratios. These aren't the only sentiment indicators that add alpha - this post seeks to demonstrate that combining several sentiment indicators to different models adds alpha and increases risk-adjusted returns, regardless of which model you apply these sentiment indicators to.