Apple just won't quit

There has been quite a bit of hand-wringing about the biggest stocks in the market becoming an undue influence over the major indexes. There is some evidence to support this concern, but that evidence has been, well, evident for months and yet here we are, even more extreme.

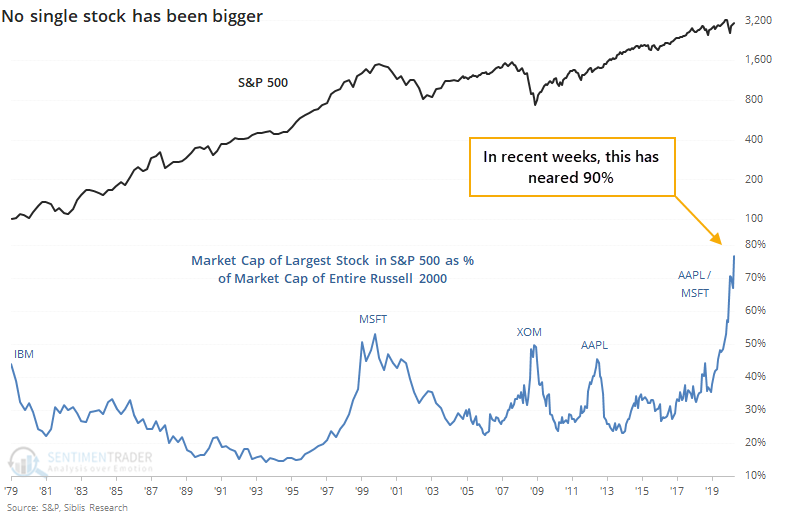

The biggest stock in the U.S. and nearly the world, Apple, keeps powering higher. At the end of June, the value of Apple alone was nearly 80% of the market capitalization of the entire Russell 2000 index. As of today, it's nearly 90%. This is astounding - in the past 40 years, no single stock has come close to dwarfing the value of so many other companies.

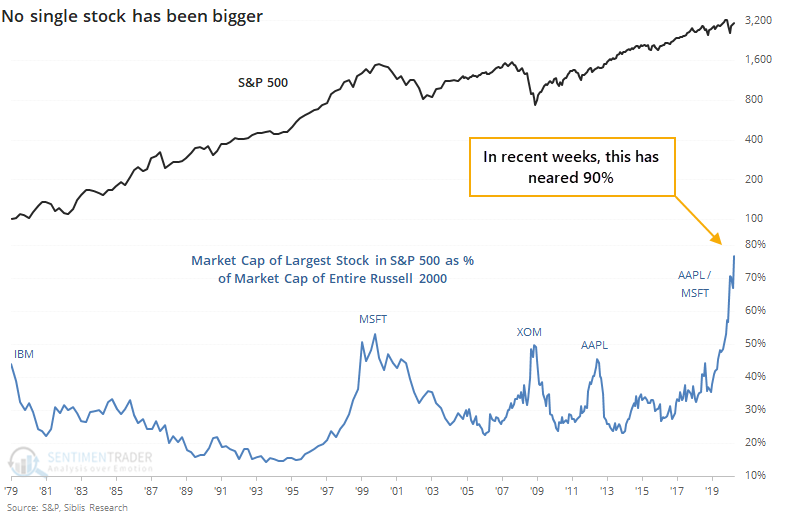

Prior to the past year, once a stock reached about 45% of the value of the entire Russell 2000, its influence started to wane. The ratio of that stock versus the rest of the S&P 500 had a tendency to drop dramatically over the next couple of years, as much as we can consider such a tiny sample size to show a tendency.

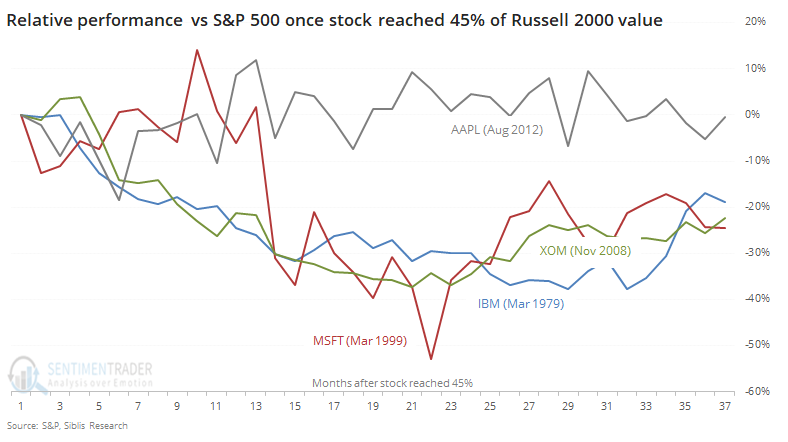

When Microsoft reached this 45% threshold last August, it didn't put much of a dent in its relative performance versus the index. Neither has Apple since it took over that crown last October.

When IBM and Exxon held this honor, their relative returns started to suffer pretty much immediately. In 1999, Microsoft managed to keep up its relative outperformance for about a year before cracking. In 2012, Apple did too, before it basically just traded in line with the index.

The historical precedent here is too small to generate any solid conclusion, and the current weight of these stocks is so absurd that there really is no true precedent, anyway. There might be a very slight suggestion that those piling into the largest stocks are betting against the "rules" of economics and market history, but those rules have been put on hold for months on end already.