Another Morning, Another Opening Loss

Another morning, another large opening loss.

The S&P 500 futures are indicated to open down more than 1.5% below Tuesday's close, marking the 5th opening gap of -1.5% or more in 12 days. In the history of S&P futures, only three time periods had this tight of a cluster of large negative opening gaps:

- Late October 1987 (aftermath of Black Monday)

- October-December 2008 (aftermath of the financial crisis)

- March 2009 (bottom of bear market)

There were several time periods that saw 4 gaps in 12 days, all medium-term bottoms:

- November 7, 1997

- September 21, 1998

- June 4, 2010

- August 19, 2011

- September 19, 2011

Clearly, an unusual situation. What's also notable about today's indicated open is that it is occurring when sentiment is already panicked.

Like recession indicators, we could pick and choose among hundreds of indicators to confirm whatever we want to suggest, but we always try to most heavily weight model-based readings. These are objective, not subject to cherry-picking and proven in real-time through market cycles.

As of Tuesday's close, the spread between the Smart Money Confidence and Dumb Money Confidence was +49%, down a bit from the previous day.

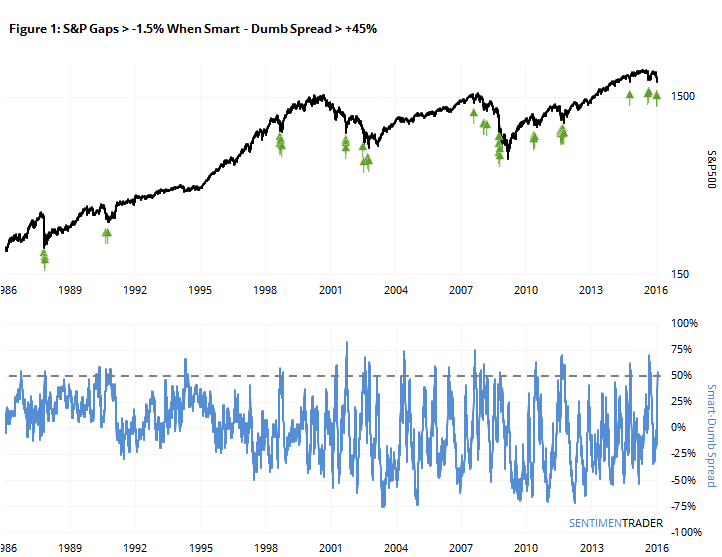

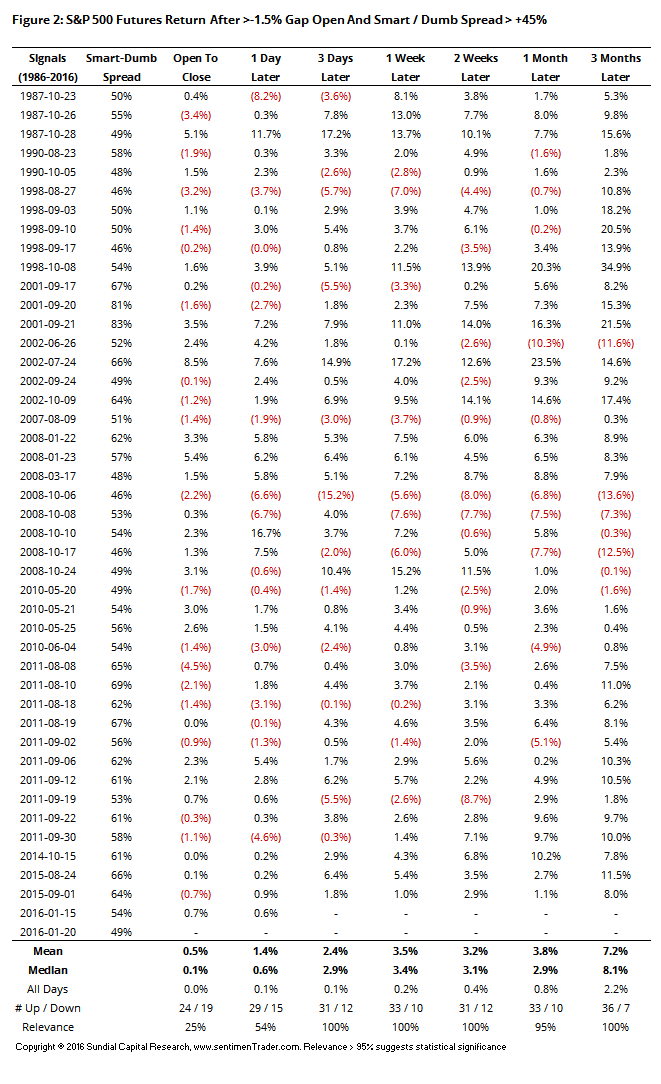

Figures 1 and 2 show the performance of the S&P futures from the opening print on any day that they opened down at least -1.5% and the Confidence Spread was +45% or greater.

Same-day performance was mixed, but improved dramatically as we moved out the time frame. The only real failures were in June 2002 and during the midst of the October 2008 collapse.

The highest-probability risk at the moment is if the major indexes, primarily the S&P 500, move below its August lows. That could trigger a round of stop-loss orders during the day and bleeding into the next 1-2 days. Margin call selling is a small possibility. A quick loss of an additional 5%+ would not be out of line in that case and if we saw anything like that, then there would be an exceptionally high probability of higher prices over the next several weeks to several months.

The safer bet in kinda-sorta panic situations like this would be to wait for the S&P to exceed the high from the previous day, about 1900 in our current case. That is not foolproof by any means, but it does tend to capture most of the upside of these rebounds while preventing one from buying into a possible collapse. The risk in those cases is that one is buying into rising prices in a downtrend, subject to reversal, so (wide) stop losses are recommended.