Another Jump In New Lows

The oddities continue to pile up.

In the Report on Wednesday, we looked at times when declining volume outpaced advancing volume for almost two weeks, while stocks gained during that time. Very rare.

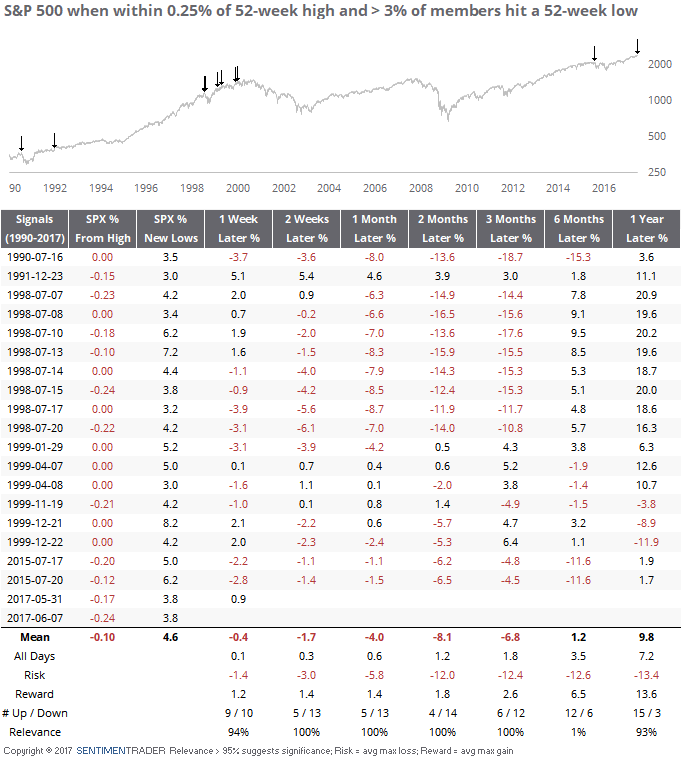

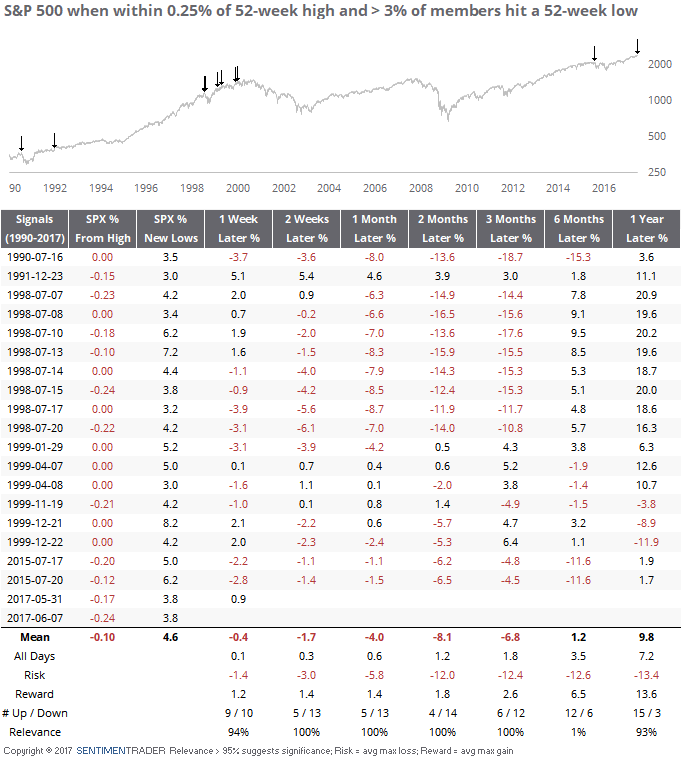

In late May, we looked at times when many stocks within the S&P 500 index reached a 52-week high, and there was also an abnormally large number of stocks hitting a 52-week low.

It happened again on Wednesday. Despite the S&P being within 0.25% of its high, more than 3% of its members reached a 52-week low. Almost all of them are oil & gas or retail companies, so perhaps that's a valid reason to excuse the issue, but almost all "issues" start with one sector and spread to others. Note that in July 2015, it was energy and mining companies that dominated the 52-week low list.

It's at least worth looking at the few other times we've seen this kind of a split with stocks so close to their high. It wasn't pretty, with one of the most skewed risk/reward ratios we've ever seen (due in large part to a cluster of dates in 1998).

The only date that managed a positive return across all time frames was in December 1991, and even those shorter-term gains were mostly given back in the months ahead.