An overwhelming number of buy signals

According to a popular charting service, a huge number of stocks within the S&P 500 have flipped to buy signals.

The indicator measures how many stocks within the index are currently on buy signals. A buy signal is given when the Point & Figure chart is showing an uptrend.

According to Investopedia:

Contrary to some other types of charts, like candlesticks, which mark the degree of an asset's movement over set time periods, P&F charts utilize columns consisting of stacked Xs or Os, each of which represents a set amount of price movement. The Xs illustrate rising prices, while Os represent a falling price.

Technicians use P&F charts in various ways, from simple reversals to trendline analysis to pattern recognition. For example, the P&F pattern carved out in recent months is very close to what happened from January through June 2009.

The reason this is getting attention now is because almost all stocks within the S&P 500 were on sell signals in March, and in recent sessions most of them have flipped to buy signals, as noted by StockCharts.

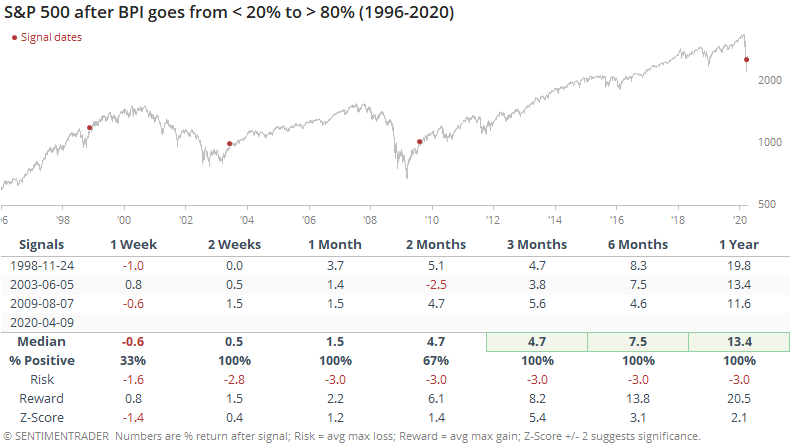

To say this is unusual is an understatement. Going back to 1996, it's only occurred 3 other times, and their implications were consistent.

While all of them saw a period of consolidation after the surge in P&F buy signals, at least over the next week or two, they all resumed their march higher in the months ahead.

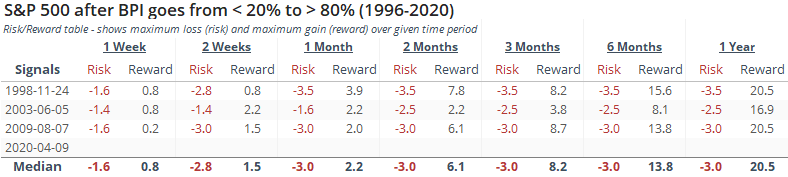

The risk/reward table was impressive as well.

Even though these signals triggered during (or more accurately, after) a few of the most volatile stretches in 25 years, maximum losses over the next year were limited to -3.5%, while maximum gains were all in the double digits.

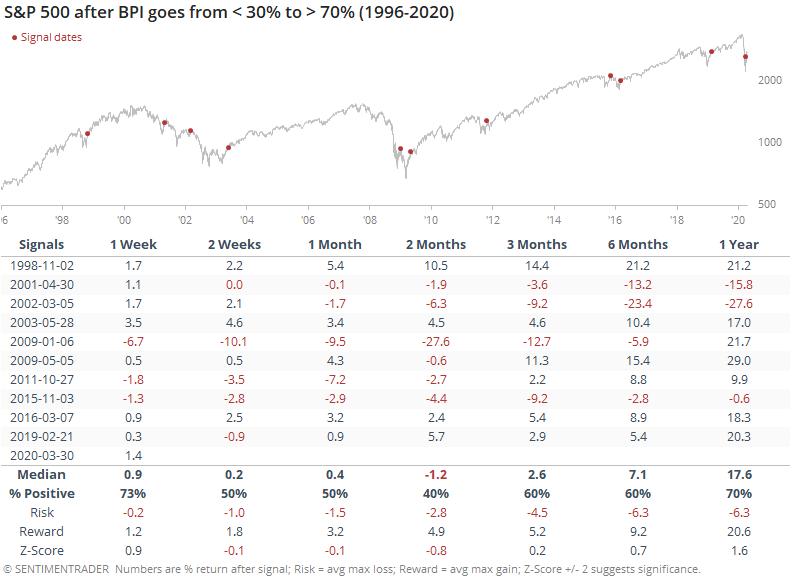

If we relax the parameters to get a larger sample size, the returns were not robust. The table was filled with at least temporary failures as these lesser extremes led to a quick resumption of the downtrend.

So the big question is whether we can rely on the tiny sample size based off an obscure indicator. Not really - we certainly wouldn't put a lot of weight on it.

But it's at least interesting to note that an overwhelming percentage of stocks have reversed enough on a percentage basis to trigger these buy signals, and every time it's cycled from so many sell signals to so many buys, it has coincided with important inflection points.