An overbought condition with bullish implications for the stock market

Key points:

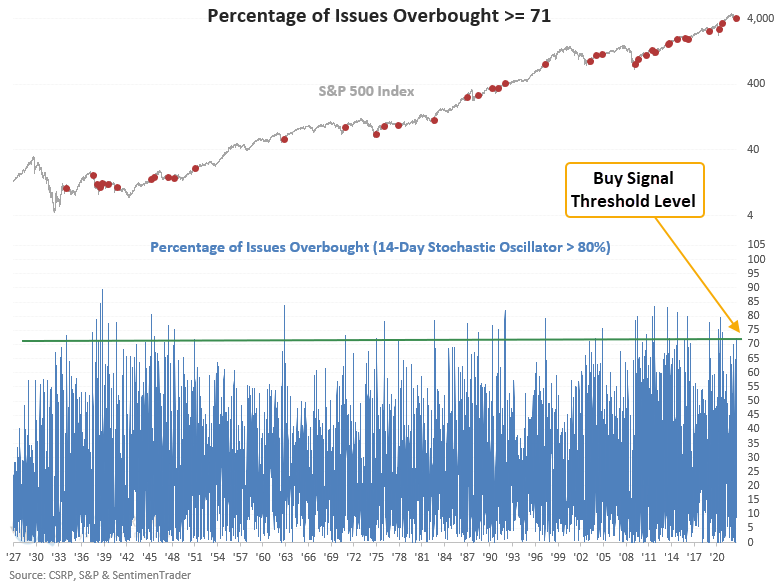

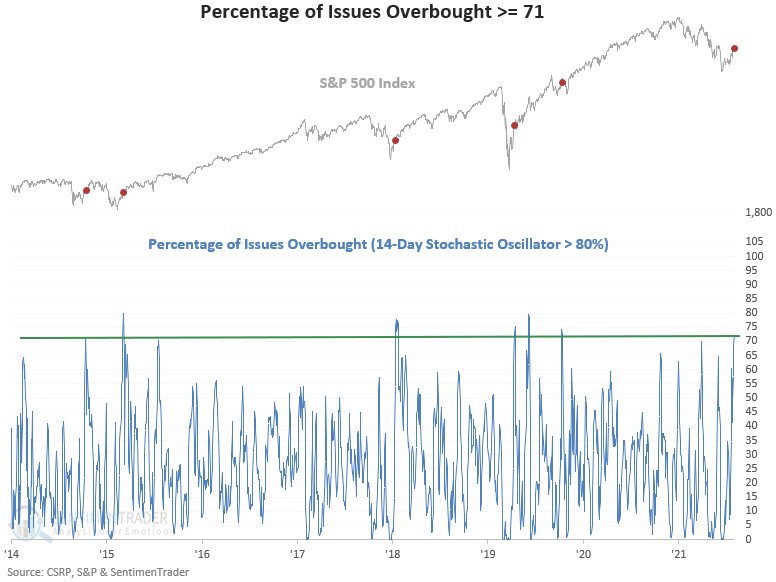

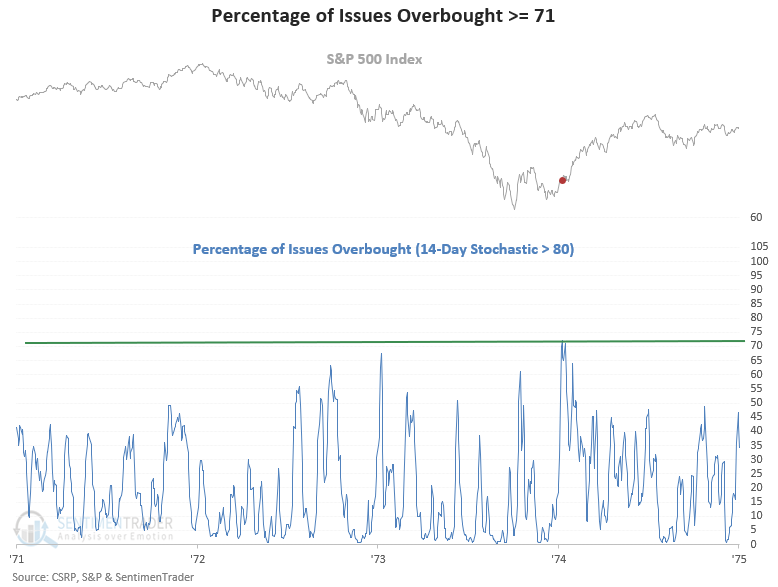

- The percentage of S&P 500 issues with a 14-day stochastic oscillator above 80% surged to 71

- The surge in participation triggered a new TCTM composite thrust model signal

- After other signals, the S&P 500 rallied 80% of the time over the next 12 months

- If I isolate bear market instances, the S&P 500 rallied 75% of the time over the next 12 months

A good overbought condition represents market momentum with bullish implications

A new signal from a voting member in the TCTM Composite Thrust Model issued an alert at the close of trading on Monday. The component is called the percentage of issues overbought model.

The model uses the stochastic oscillator, a technical indicator that measures momentum by comparing the current closing price to the high and low price over a lookback period. The standard setting is 14 days, and the oscillator ranges from 0% lowest to 100% highest.

The algorithm identifies when the percentage of S&P 500 issues with a 14-day stochastic oscillator above 80% reaches 71. I screened out repeats by pinpointing the first occurrence in 42 days and with a reset that requires the value to fall below 20.

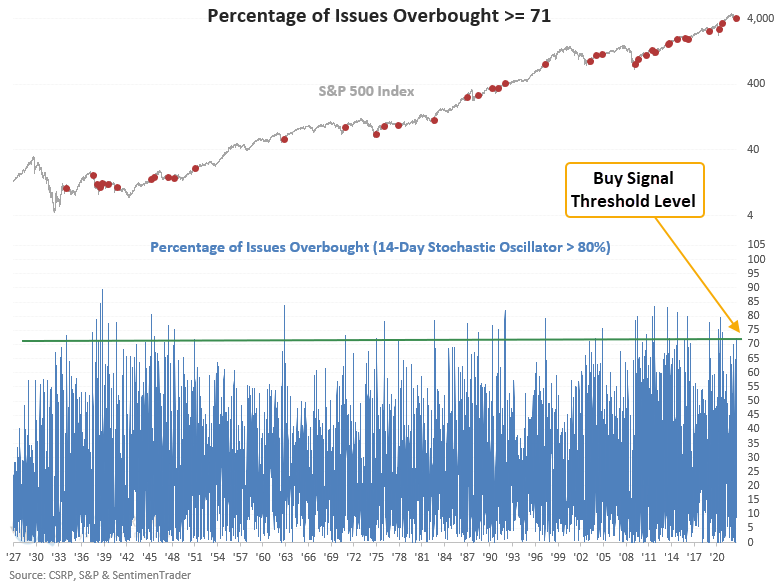

Similar signals preceded gains 80% of the time a year later

This model generated a signal 40 other times over the past 88 years. After the others, S&P 500 future returns, win rates, and z-scores were excellent across almost all time frames. The signal shows a gain at some point in the first 2 months in 37 out of 40 instances.

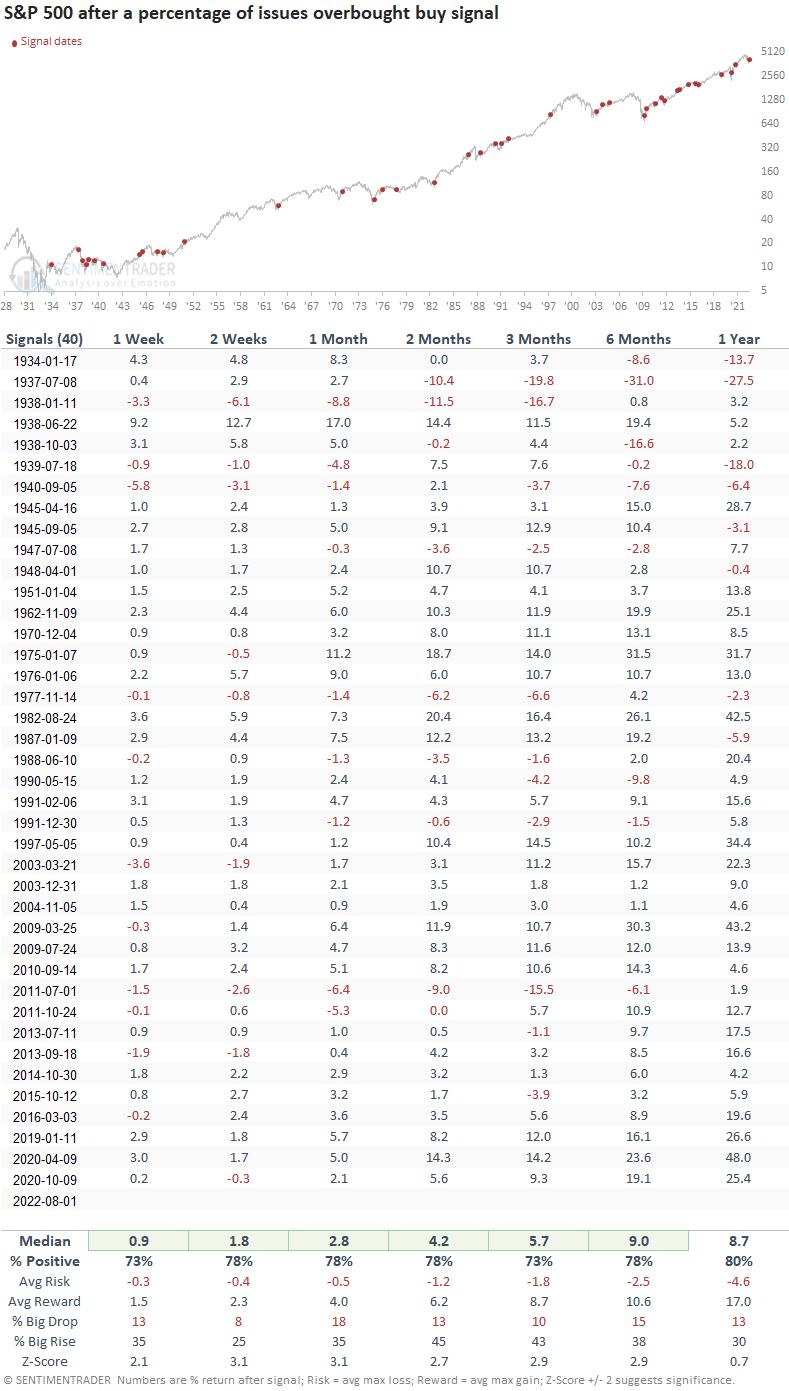

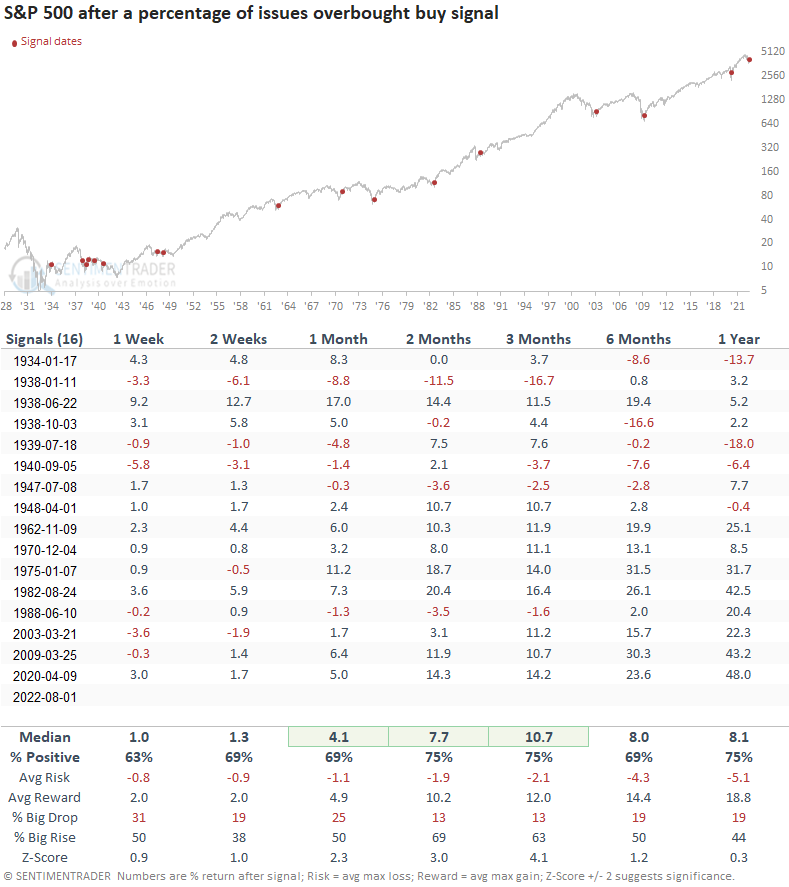

Signals associated with a bear market

If I isolate instances after the S&P 500 closed down 20%, the model generated a signal 16 other times in the last 88 years. After the others, S&P 500 future returns, win rates, and z-scores were solid across almost all time frames. Since 1950, the alert shows a perfect record 6 and 12 months later.

Let's zoom in and review some of the signals/charts since 1973.

Current day chart example

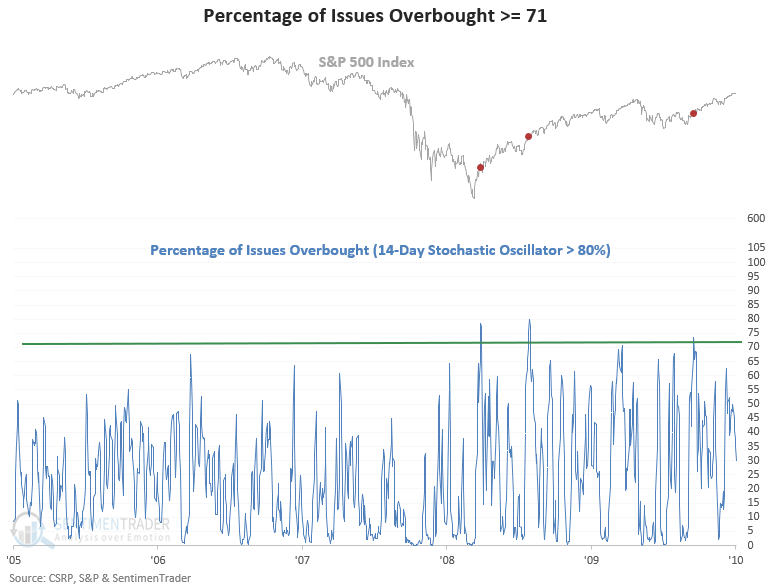

2007-08 chart example

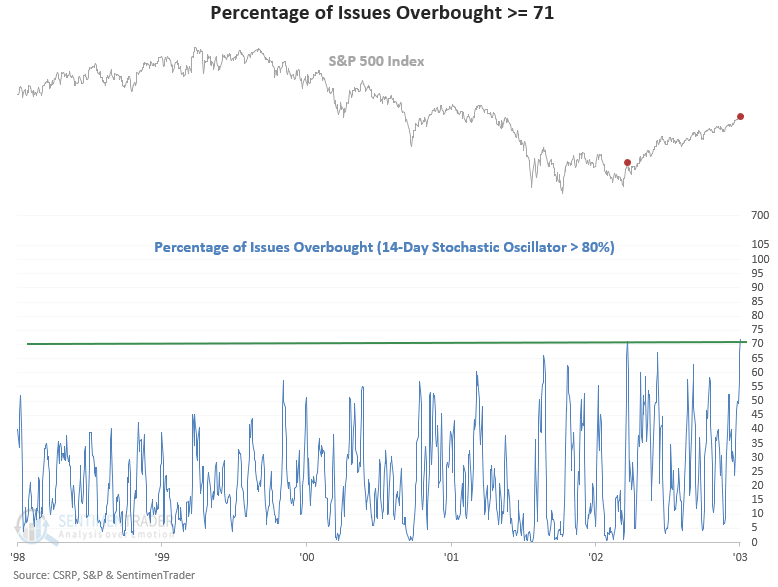

2000-02 chart example

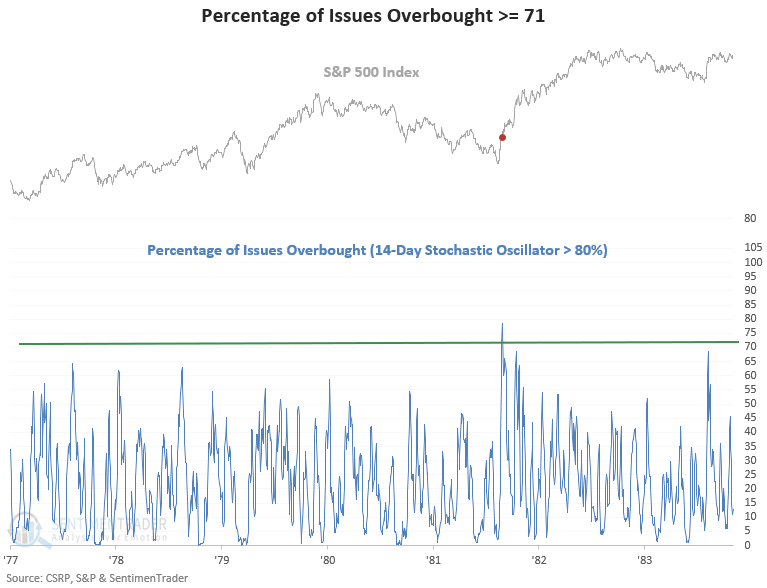

1980-82 chart example

1973-74 chart example

What the research tells us...

When the percentage of issues with an overbought stochastic oscillator surges to 71, the burst in participation amongst index members typically leads to further positive price momentum for the S&P 500. Similar setups to what we're seeing now have preceded solid returns, win rates, and z-scores across almost all time frames.