An Oil And Gas Trade

Oil and related stocks have had quite a run over the past few weeks. The oil and gas explorer ETF (XOP) has been up 12 days in a row for the first time ever. Even more established funds like XLE are on a near-record run after the sector got washed out on August 18 with more than half of the stocks plunging to a 52-week low.

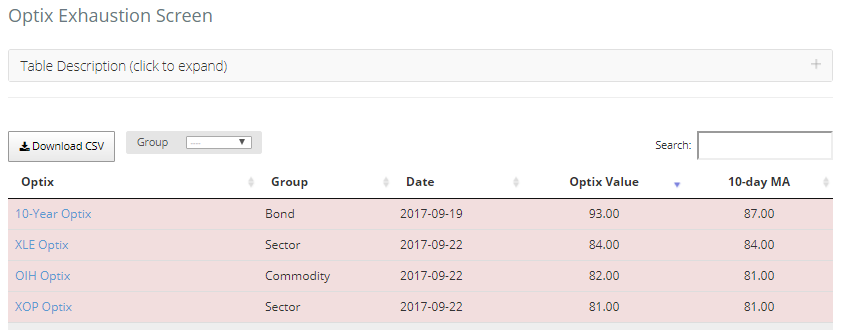

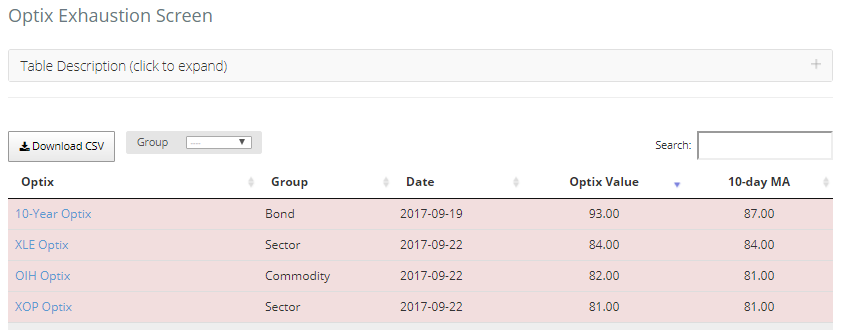

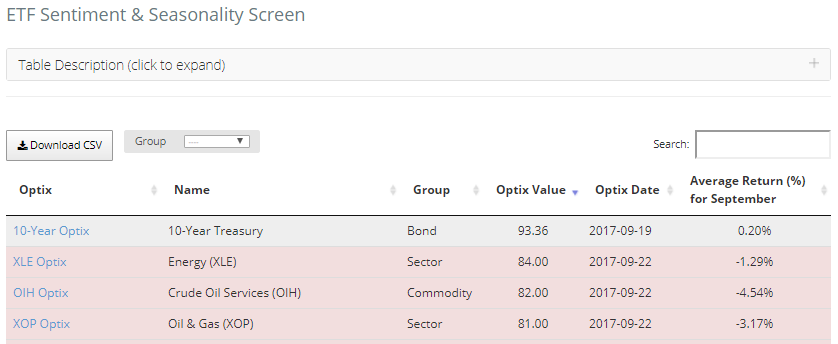

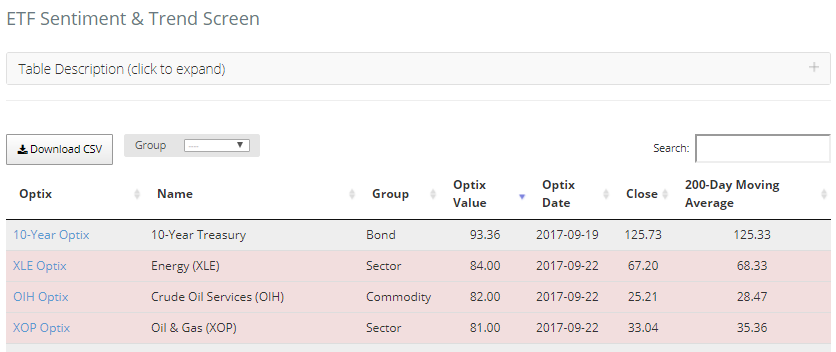

As a result of the run, energy ETFs keep showing up in our screens. XOP, for example, is being highlighted as having a negative bias in the seasonality, trend, and exhaustion screens. That means that the Optimism Index for the fund is extremely high given poor seasonality (for a little while) and an overall long-term downtrend. It's also showing an almost maxed-out daily reading on the Optimism Index when its 10-day average was already high (showing potential buying exhaustion). All of those tend to lead to below-average returns over the next several weeks.

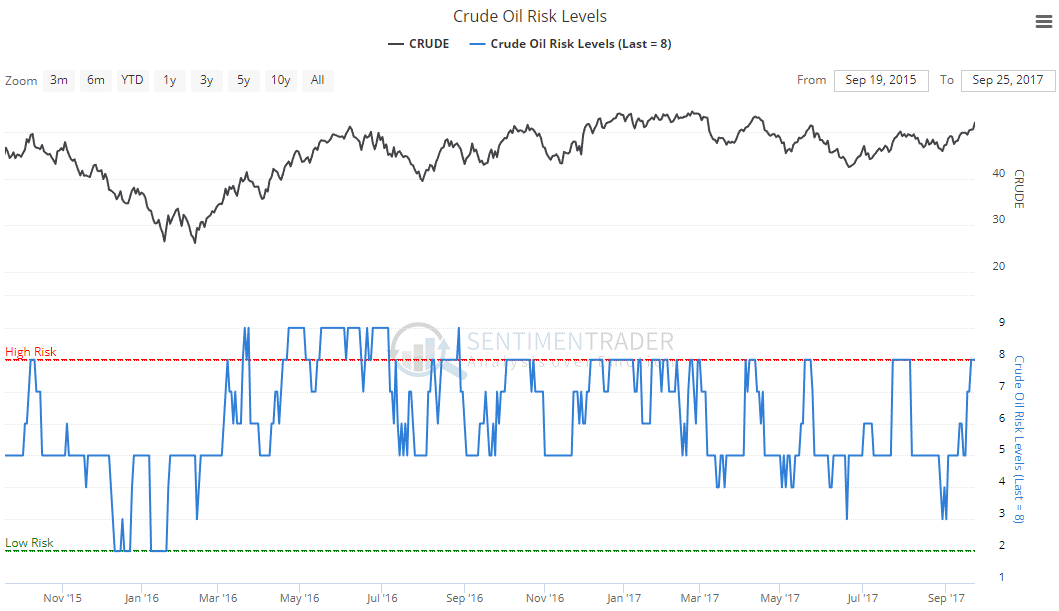

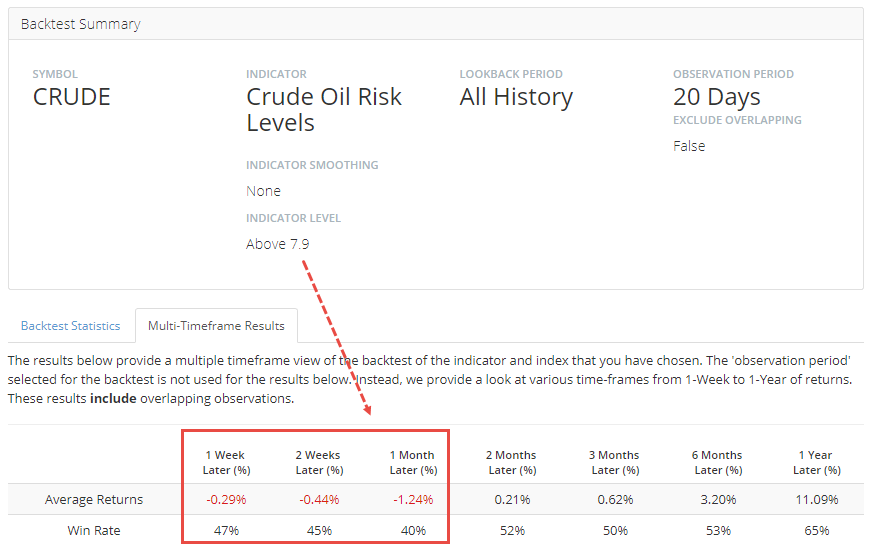

Also notable is that the Risk Level on crude oil is at an 8. Using the Backtest Engine, we can see that crude has had trouble maintaining upside momentum when the Risk Level was this high.

The oil stocks have a high positive correlation to crude, so if oil does stumble, the oil stocks will too.

So what to do? How to actually trade this? There is no right answer, since everyone has different risk tolerances, experience, etc. All I can do is show what I'm doing.

There are hundreds of ways to structure a trade to take advantage of an outlook that's neutral-to-bearish on an ETF. I could short it, buy a put, buy an inverse fund, sell calls, short crude futures, among others. Those are all relatively high risk, and more appropriate if one has an outright bearish outlook. I don't, since there seems to be a decent shot that oil and the oil stocks are embarking on a new sustained bull market. A major buying thrust like we're seeing now is often a harbinger of a larger tend change and I don't particularly feel like getting my face ripped off.

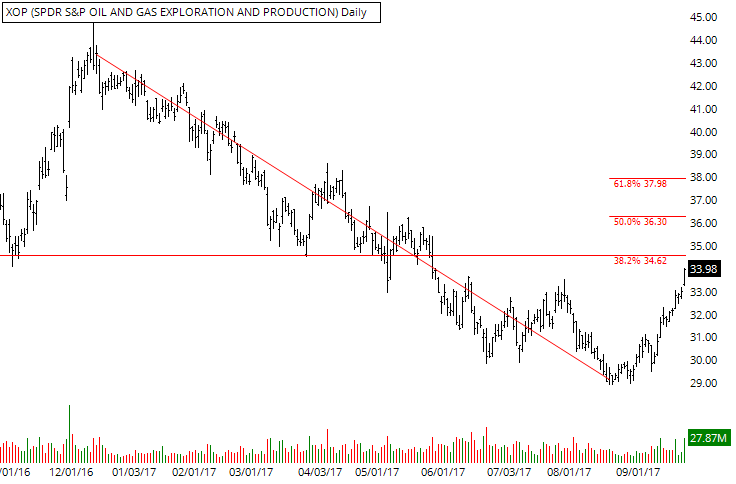

My outlook is more of a "due for a rest" one. Almost always when there is a push like this, there is some short-term back-and-forth that gives back some of the gain. And funds like XOP are now starting to push up against what some would consider resistance - former lows and a 38% retracement of the decline so far this year.

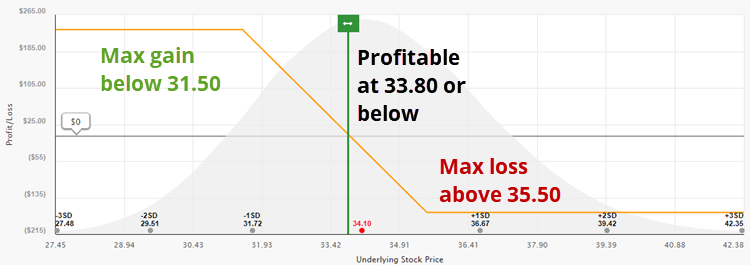

So the outlook would be that XOP won't get much above 34.50ish in the coming weeks, and is more likely to flatten out and give back some of its gains over the coming weeks. One of the better strategies to use for that outlook is selling call spreads or buying put spreads. I prefer to let time decay work for me instead of against me, so I'm going to short calls.

To be honest, I'm bad at structuring the ideal trade. I rely on option strategy screeners from Bloomberg and brokers like Fidelity, Schwab, and E-Trade to help find the strikes that are least likely to show large losses, and most likely to show a profit given a neutral-to-bearish outlook. Based on those, I'm looking to buy the October 35.50 strike and sell the 31.50. It's profitable if XOP stalls out and declines a bit over the next several weeks (would prefer to have a little more time but don't want to go out to November). I don't think the "max gain" of about $244 per net contract is in play, and the maximum risk of about -$155 would occur if XOP is above 35.50 at expiration.

As a reminder, some of this was already posted on the private Twitter feed, which you have access to as a Premium tier member. Just request to follow @SenTrader_Prem and let us know so we can approve your access.