An example trade using options on BABA

Key Points

- Alibaba Group Holding Limited (BABA) has (at least for the moment) established a support level just south of $109 a share

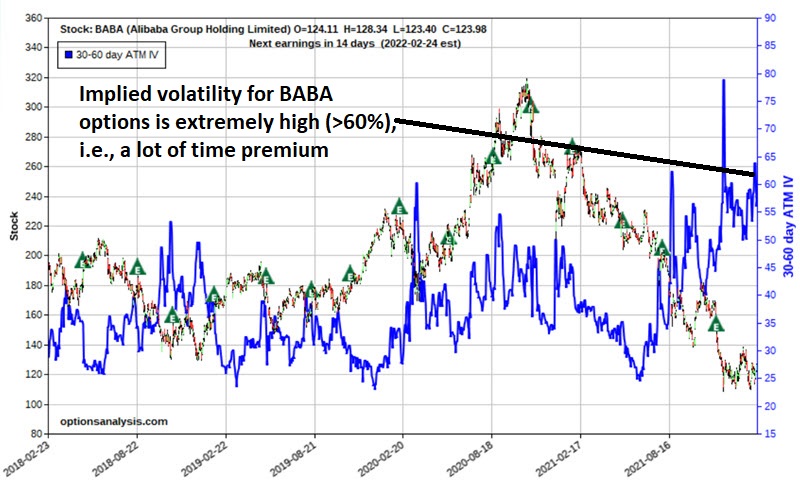

- Implied volatility on BABA options is close to the high end of its historical range (meaning there is a lot of time premium built into the price of its options)

- This type of confluence may be a good setup for a bull put credit spread for options traders who understand the risks and potential rewards

One approach to trading BABA

The chart below (courtesy of StockCharts) displays price action for Alibaba (BABA). We see a long, steady decline followed by an attempted bottoming out/consolidation period, with a low of $108.70 on December 3rd, 2021.

The chart below (courtesy of Optionsanalysis) displays the last 1000 days of trading for BABA along with the implied volatility % (blue line) for 30-60 options on BABA. The key thing to note is that IV is at the high end of the historical range. High implied volatility tells us that there is an above-average amount of time premium built into the prices for BABA options. This can make selling premium an attractive strategy.

Factors/Assumptions

The example trade that we will highlight below is based on the following factors/assumptions (A trader must believe the assumptions to be true and must be willing to assume the risks entailed to consider taking the trade).

- Implied volatility for 30-60 day options on BABA is extremely high (offering the potential to take in a great deal of premium by selling options)

- BABA registered a low of $108.70 in early December. That low has twice been tested successfully since

- You believe that the December 2021 low of $108.70 will not be penetrated to the downside before March 2022 options expiration on March 18th

- The objective for our example trade is to take advantage of high option volatility by selling premium, with the belief that the December 2022 low of $108.70 will hold for the next 36 days.

The example bull put credit spread trade

To create a complete example, we will assume that a trader has a $50K trading account and is willing to commit 5% ($2,500) to a trade.

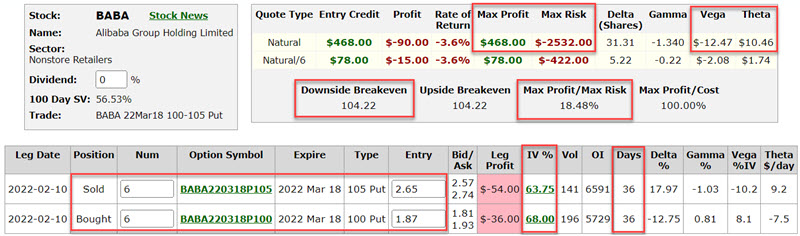

Our example BABA trade would be entered as follows:

- Sell 6 BABA March18 2022 105 puts @ $2.65

- Buy 6 BABA March18 2022 100 puts @ $1.87

The particulars for this trade appear in the figure below (courtesy of Optionsanalysis).

The risk curves - which display the expected $ profit or loss as of a given price for BABA on four different dates leading up to March expiration - appear in the chart below.

Things to note:

- The trader would be required to have $2,532 in their account to enter the trade.

- Maximum profit potential is $468 ($2,65 - $1.87 x 600 shares). This would represent a profit of 18.5% on risked capital in 36 calendar days if achieved.

- The maximum risk on this trade is -$2,532 and would be realized if the trade is held until expiration and BABA was below $100 a share at expiration. Barring a significant price gap, a trader should have plenty of opportunities to act well in advance to mitigate the risk of losing the full $2,532.

- The breakeven price for this trade is $104.22 (if the trade is held until expiration, the trade will show a profit if BABA is above this price and a loss if it is below this price).

- If BABA trades below $105 a share, the trader does face the risk of exercise on the $105 puts. This is important to understand. If the 105 puts were exercised against the bull put spread trader, they would find themselves short 600 shares of BABA stock and would be required to hold whatever maintenance margin is required for that position in their account. The bottom line is that our trader must be prepared to act to mitigate the risk of assignment if BABA stock does fall in price.

- As long as BABA stock holds above $105 a share for the next 36 days, there is not much for the trader to do except wait for time decay (and/or a sharp decline in implied volatility and/or an advance in the price of BABA stock) to cause a profit to accrue.

- However, If BABA stock does begin to fall, the trader MUST stand ready to take action (see thoughts on possible "Position Management" steps below) to mitigate the risk of assignment and/or significant loss.

Position Management

When to take a profit:

- The key decision here is whether to take an early profit - if available - or hold until expiration to capture the full $468 credit received. There are no right or wrong answers.

- Many traders target 50% to 80% of the maximum credit as a profit target. A 50% profit target would mean closing the trade if an open profit over $234 accrues. An 80% profit target would mean closing the trade if an open profit over $374 is available.

- If the price of BABA shares moves significantly higher, a trader may be more comfortable simply holding on until expiration. As long as BABA is above $105 at expiration, both options will expire worthless.

When to cut a loss:

The bad news is that the bear put spread is NOT a "set it and forget it" type of trade. It requires at least daily monitoring. For our example trade, if BABA stock declines in price, there are two key levels to watch:

$108.70: This was the December 2021 low and serves as "support." The catalyst for this trade was believing that BABA would not drop below $108.70 before expiration. A trader could consider exiting if this price is taken out. HOWEVER, the fact remains that the trade could still be profitable as long as BABA does not fall below the breakeven price of $104.22.

$105: As discussed above, if BABA shares drop below 105, then a trader holding a short 105 put runs the risk of being assigned a position holding short shares of BABA. Unless, for some reason, a trader truly wants to take on that position, then our example trade should be exited before BABA reaches $105.

If the trade is exited with BABA near $105 a share, the result on the trade (see the risk curves chart above) would likely be somewhere between a loss of -$851 (if BABA fell immediately to $105) and a profit of $468 (if BABA falls to $105 on expiration day).

What the research tells us...

An objective support level combined with exceptionally high implied options volatility is a prime setup for a bull put credit spread. The keys to success are a) a breakeven (or other stop-loss) point below recent support, and b) a position management plan designed to eliminate as much risk as possible while still giving the trade room to breath.