Almost all Tech stocks are now in uptrends

Key points:

- More than 93% of Technology stocks were recently above their 50- and 200-day moving averages

- This is the most in years and ranks among the best trends in 70 years

- When this many stocks are in uptrends, the sector has a strong record of showing more gains

Almost all Technology stocks are now in uptrends

It's no secret that Technology stocks have roared higher this year, though many seem to attribute it solely to the Magnificent Seven. Those stocks have been a large part of the gains in major indexes but also steal the limelight from what has been good performance under the surface.

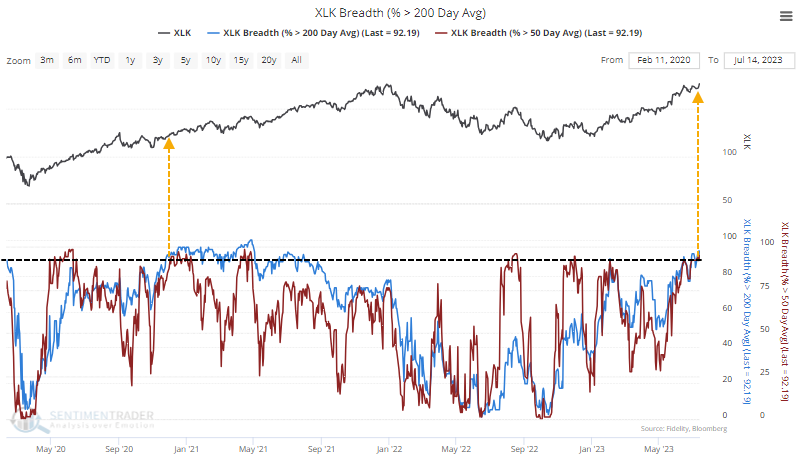

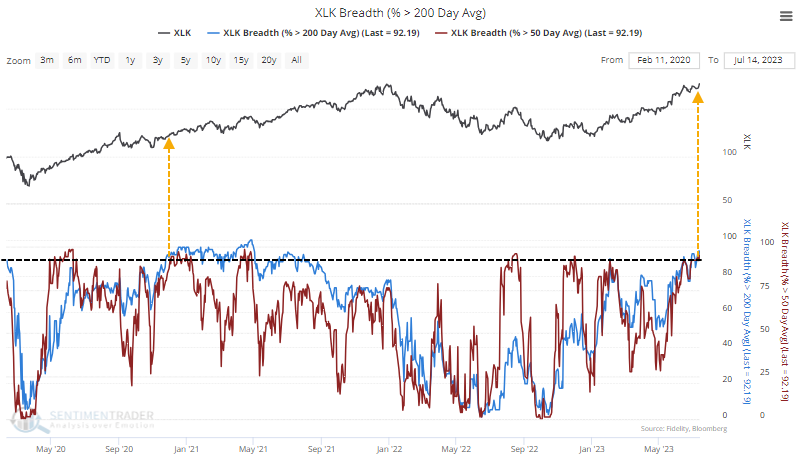

More than 93% of these stocks have climbed above their 50-day- and 200-day moving averages for the first time in years. The last time it occurred after a long dry stretch was in late 2020, as we emerged from the pandemic panic.

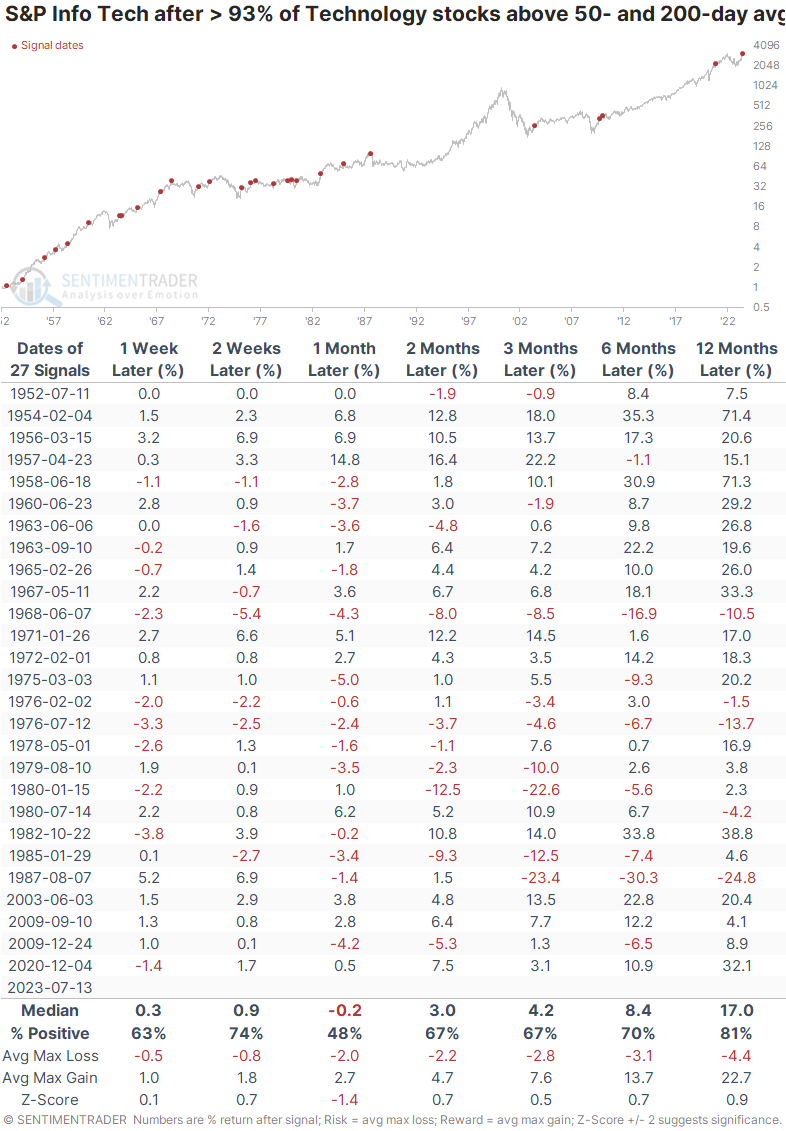

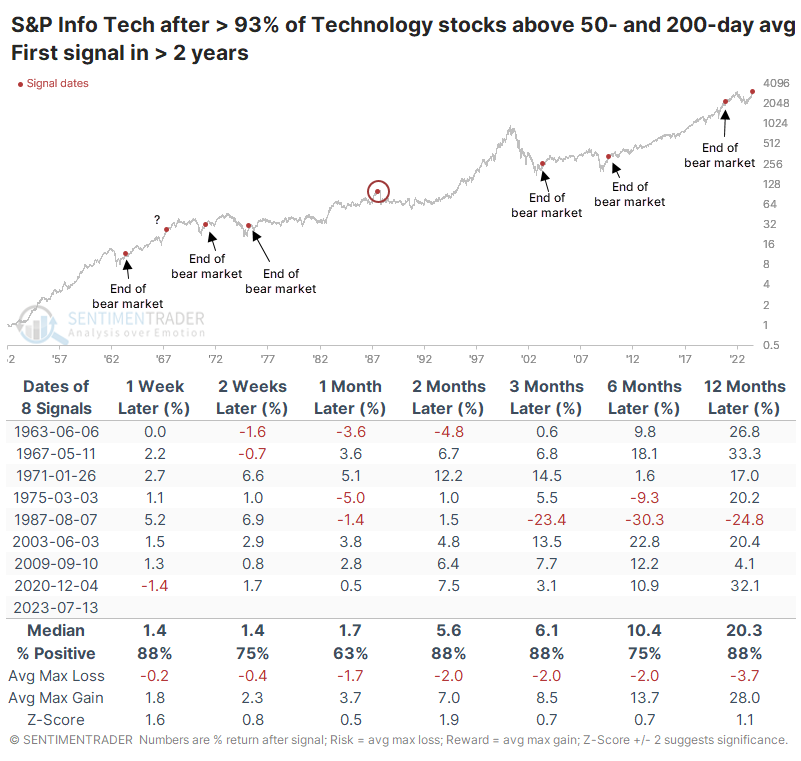

When this many Technology stocks climbed above both moving averages for the first time in at least three months, it preceded mostly positive returns across time frames, but nothing compelling. The last three signals showed that bear markets were over, even if those forward returns weren't inspiring.

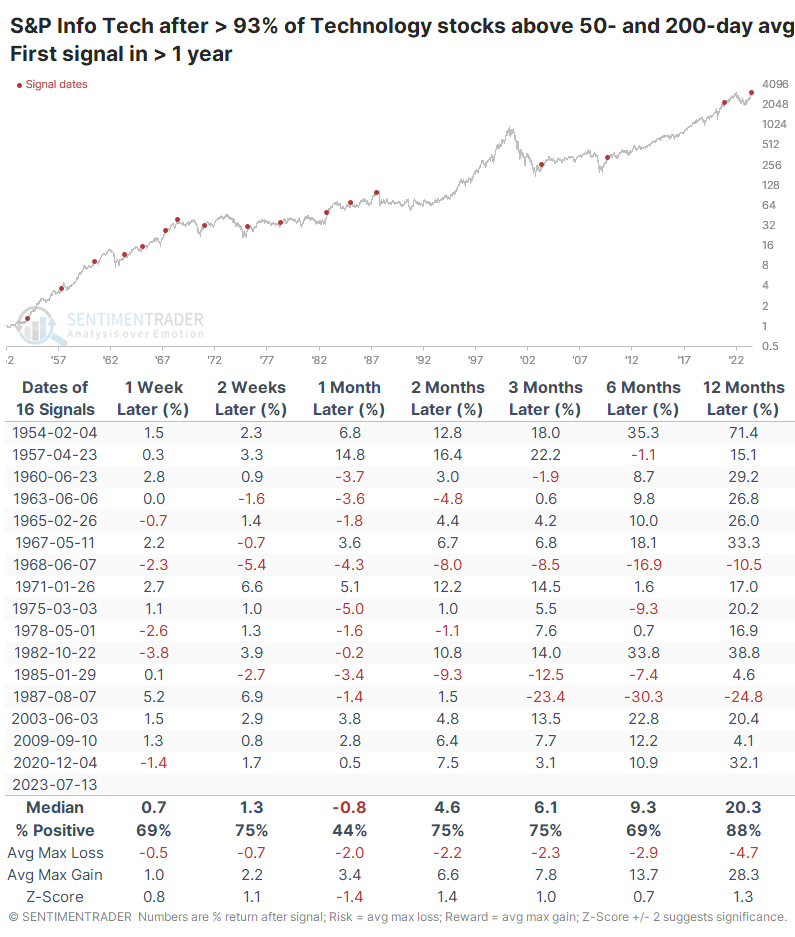

The current signal is more interesting because it has been so long since so many stocks were simultaneously in medium- and long-term uptrends. When we stretch the period between signals from three months to one year, future returns in the sector tend to improve. The following month was sketchy, with only a 44% win rate, but over the next year, the sector showed a median gain of 20.3% and a phenomenal risk/reward ratio.

If we look at even more significant signals, those that were at least two years between instances, the win rate improves even more. There was only one that was indeed a false signal - in 1987, this triggered right before the Black Monday crash. But that was also one of the few signals that didn't occur after a prolonged bear market. The ones that did all led to excellent long-term gains.

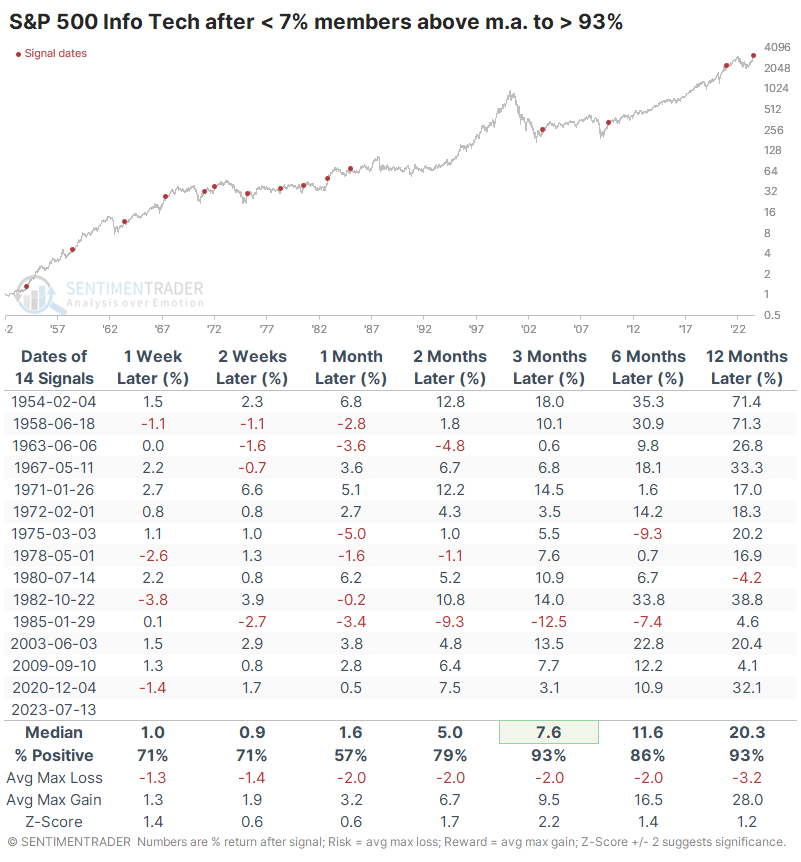

A preferred way of looking at data like this is through cycles. More than 93% of Technology stocks are above their 50- and 200-day averages for the first time since fewer than 7% of the stocks were above those averages. Similar cycles preceded even better medium-term returns for the sector.

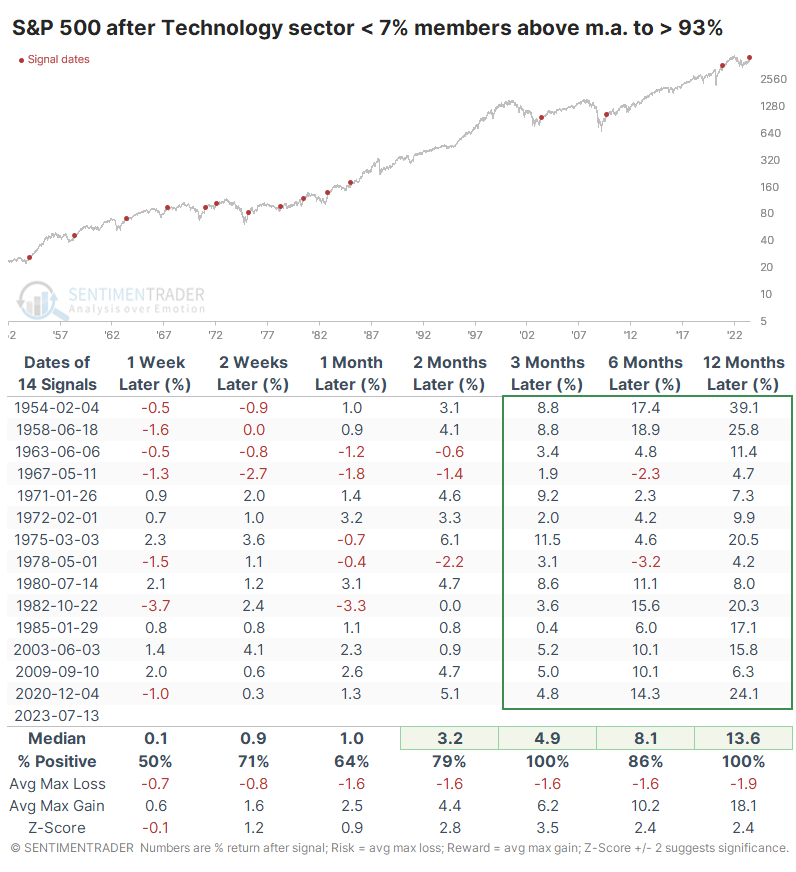

It was a fantastic sign for the broader S&P 500 index as well. Over the next three and twelve months, the index rose every time.

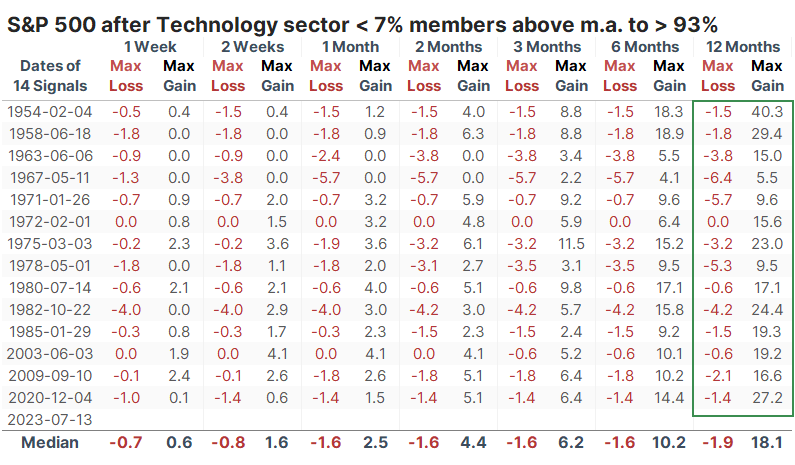

The most impressive aspect of these signals was the minimal drawdown over the next year. At no point within the following year did the S&P decline more than -6.4% across any of the signals.

What the research tells us...

It's always difficult for investors - especially those with a contrarian bent - to buy into a market that has rallied strongly and is at or near 52-week highs. We've seen with many studies in recent weeks, even months, that the type of internal momentum we've witnessed in the broader market and across sectors tends to continue. Even the excessive optimism we're seeing now isn't necessarily a bad sign since it's coming off a prolonged period of depression. The recovery of so many Technology stocks is further evidence that momentum this broad has a strong track record of continuing.