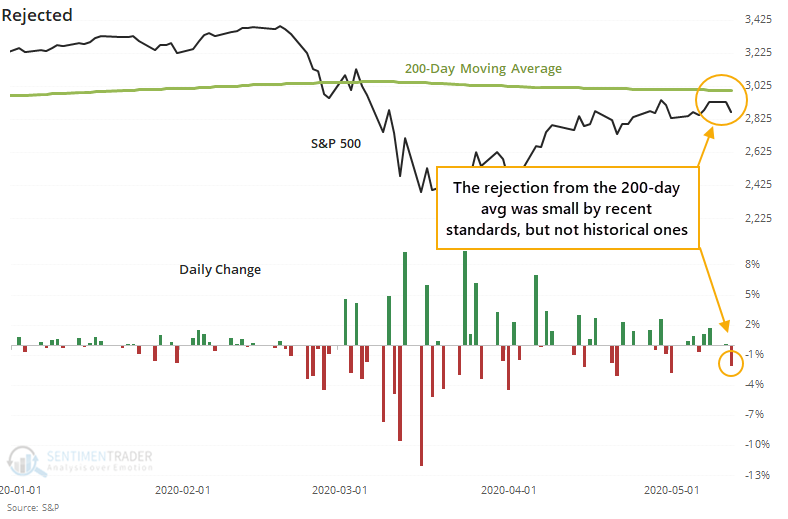

A technical rejection

Buyers have tried to push the most benchmarked index in the world above its most widely-watched moving average, and failed again. After nearing its 200-day average on Monday, selling pressure kicked in.

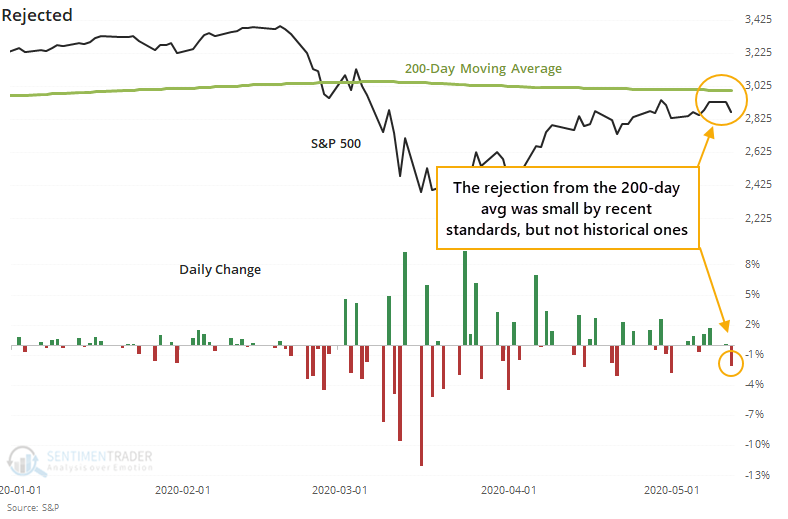

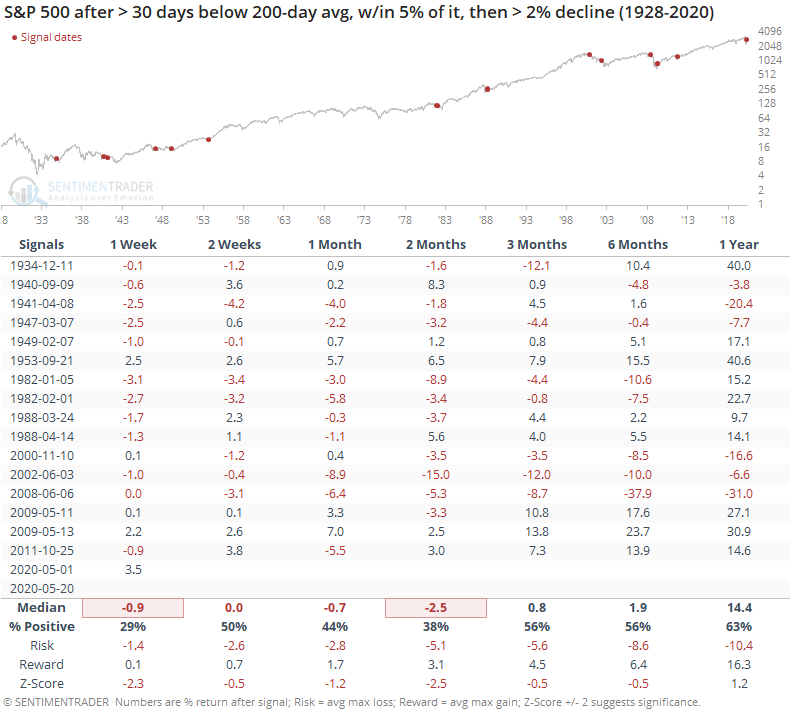

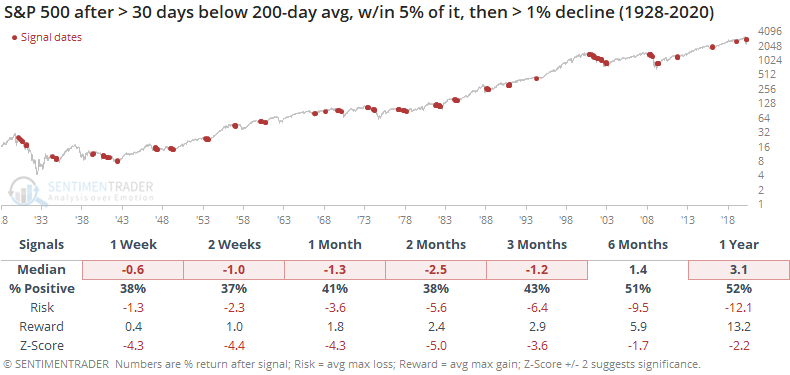

After being held below its 200-day average for more than two months, the S&P 500 climbed to within shouting distance of it, only to be slapped back on Tuesday. When we've seen big rejections while approaching from below the 200-day average, it has been a struggle for buyers to recover. All but three of them saw the S&P trade lower at some point over the next 1 to 12 weeks.

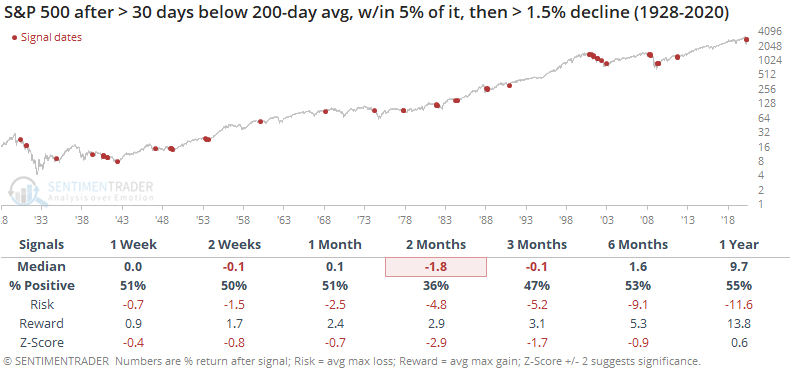

For a 1.5% decline, there were 56 signals. Of those, 82% of them saw a negative return anywhere from 1-12 weeks later.

For a 1% decline, there were 144 signals, of which 85% saw a negative return at some point between the next 1-12 weeks.

The breadth thrusts and impressive retracement of the decline that we spent so much time going over in late March and early April remain the most compelling reasons to expect a further recovery. This is the hardest part of that attempt, when pessimism has mostly been driven off, and investors have to decide whether it's too-much-too-fast. Most of the time, it is. A rejection like stocks saw on Tuesday is another knock against the recovery attempt, and buyers need to step in again soon.