A Sentiment Reversal in SPY

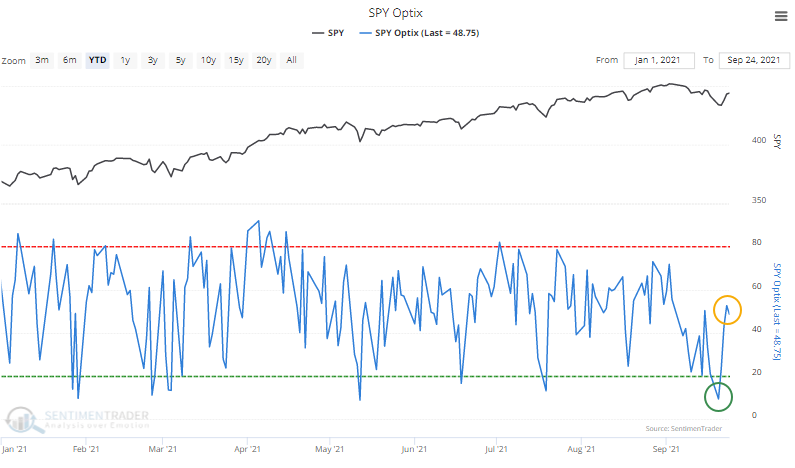

Last week, traders become pessimistic about prospects for the world's most important ETF. Then, suddenly, they calmed down.

Early in the week, our Optimism Index (Optix) for the S&P 500 ETF fell to a pessimistic level below 10%. The Optix Index then normalized, surging above 50% in only a few sessions.

Dean conducted a study to identify the outlook for the S&P 500 ETF when the Optix Index falls below ten and subsequently increases above fifty in three trading sessions or fewer.

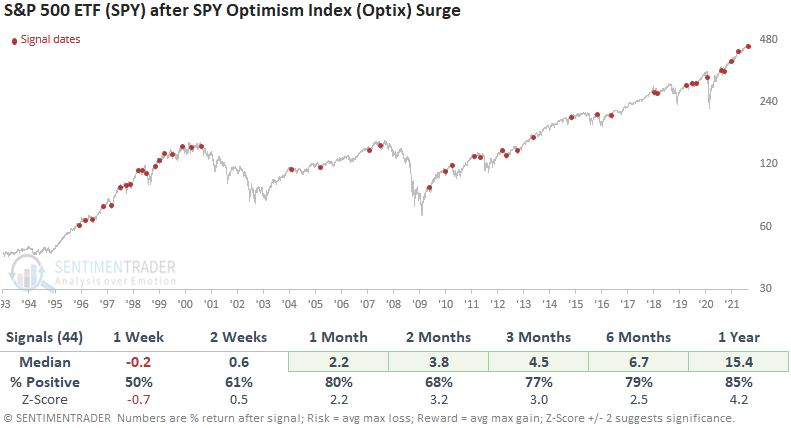

The results look good on an intermediate to long-term basis with several notable z-scores. As is the case with most mean reversion signals, the short-term performance can reflect choppy conditions associated with a bottoming process. And bear markets are unkind to short-term reversals.

Now, let's add a trend filter to find signals similar to last week. We'll include a condition that requires the SPY ETF to be trading above its respective 200-day moving average at the time of the sentiment reversal.

Except for the first two weeks, the results look excellent, with several notable z-scores. Context is always important.

What else we're looking at

- Full returns in SPY after short-term sentiment reversals

- A look at forward returns in China tech stock Tencent after a surge in corporate share buybacks

| Stat box According to Lipper, last week, investors pulled $6.7 billion from equity funds. That ended several weeks of inflows and was the largest single-week outflow since mid-July. It was the 4th-largest outflow of the year. |

Etcetera

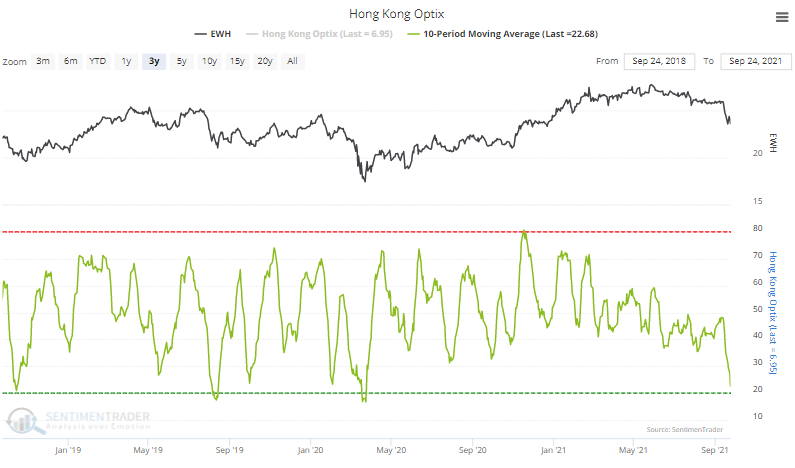

Hong Kong correction. A 10-day average of the Optimism Index for the Hang Seng has dropped to its lowest level since the pandemic crash. It's nearing one of the lowest levels of the past 3 years.

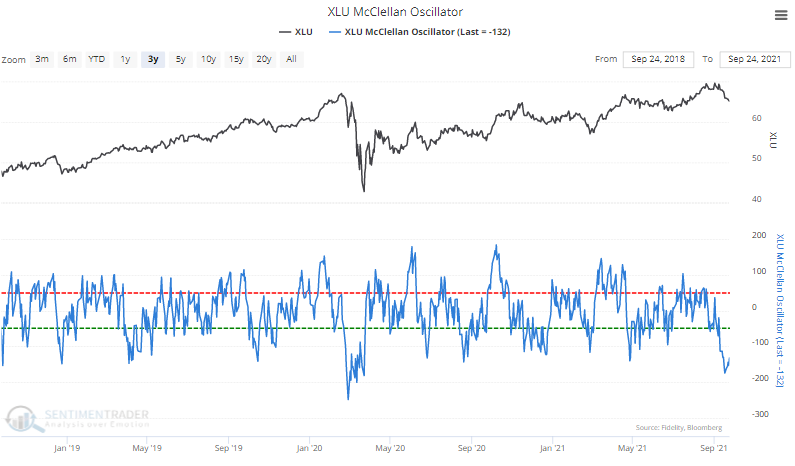

Lights out. The McClellan Oscillator, a sign of internal breadth momentum, has plunged for utility stocks. It's trying to recover from a reading below -150, the 2nd-lowest reading in the past 3 years.

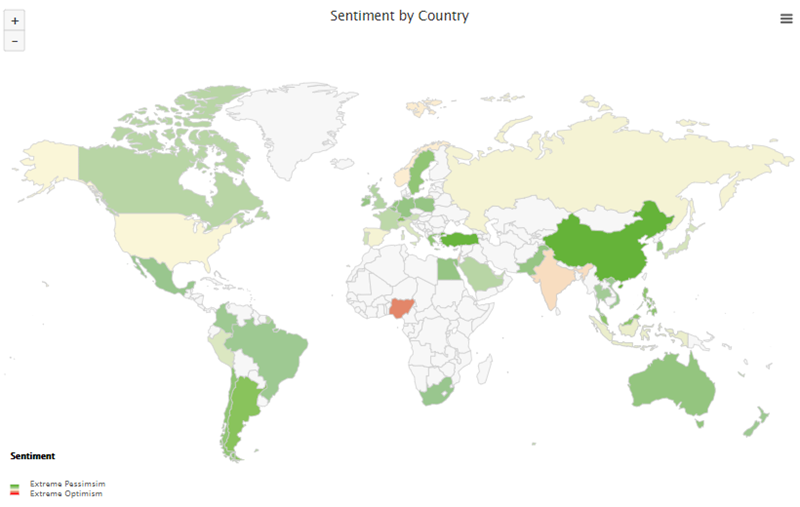

Is anyone optimistic? Our Optimism Index Geo-Map shows that pessimism is prevalent around the world. The only place with a hint of optimistic investors? Nigeria.