A reversal in optimism suggests the metals and mining industry group continues higher

Key points:

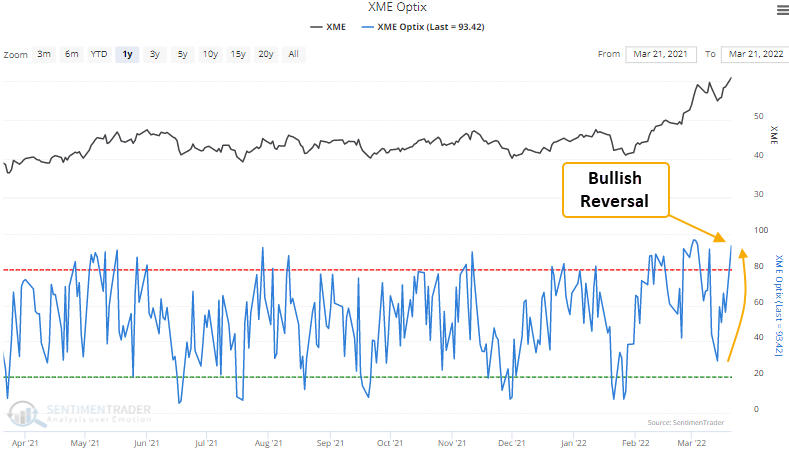

- The optimism index for the metals and mining industry reversed higher relative to its recent range

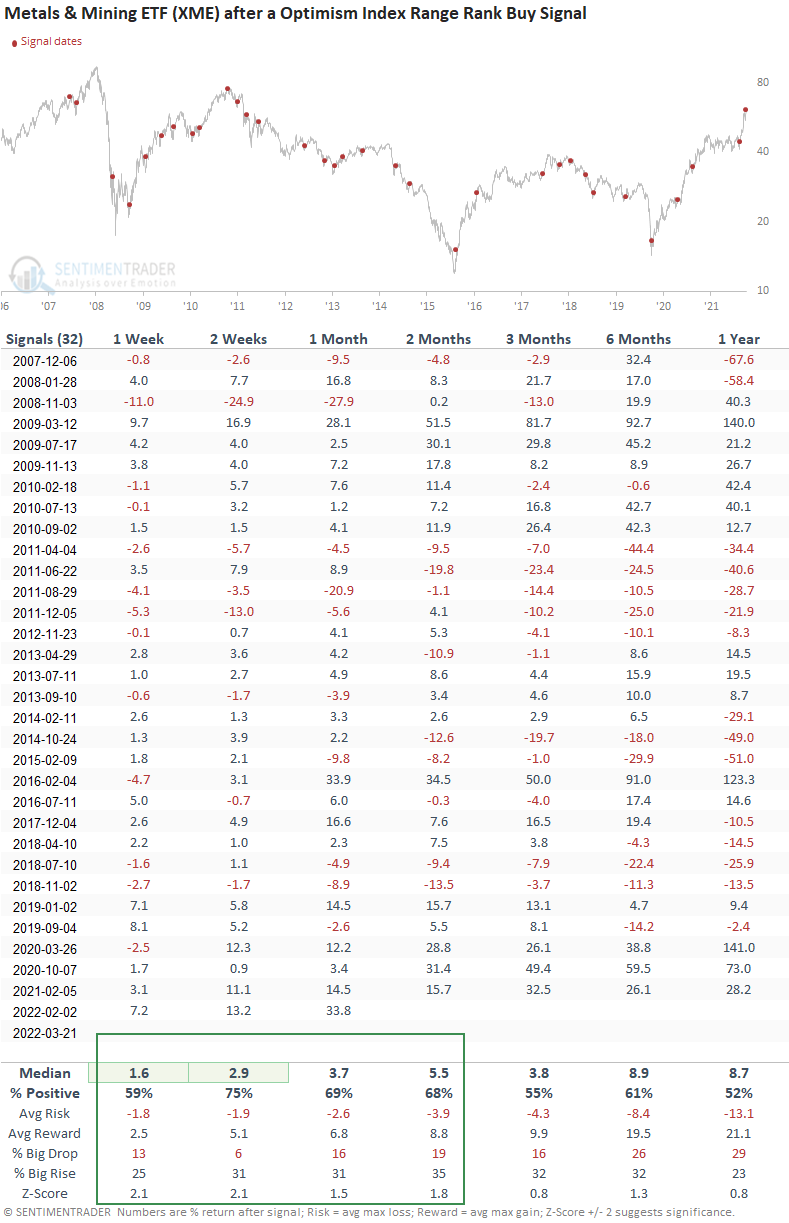

- The Metals & Mining ETF (XME) has rallied 75% of the time over the next 2 weeks after other signals

Using the optimism index as a way to identify bullish sentiment reversals

A trading model that uses the Optix Index to identify when sentiment reverses from a period of pessimism issued a buy signal for the metals and mining industry on 3/21/22.

A trading model that identifies a reversal in the optimism index

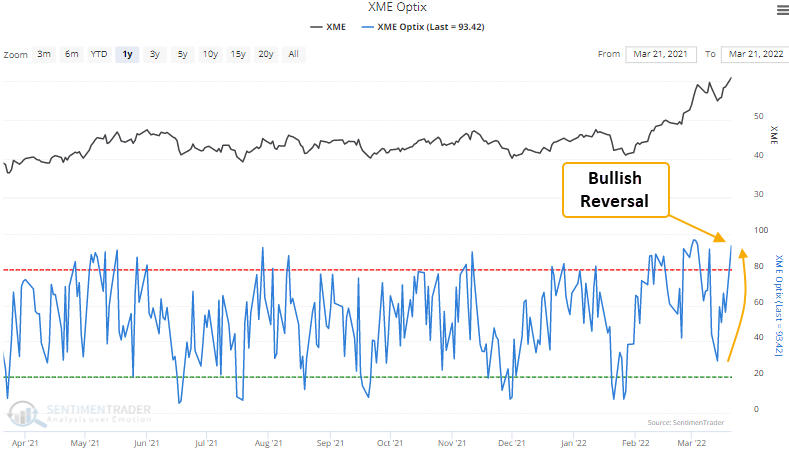

The model applies an 84-day range rank to the 6-day moving average of the Optimism Index for the XME ETF. The range rank indicator measures the current value relative to all other values over a lookback period. 100 is the highest, and 0 is the lowest. The pessimistic reset condition occurs when the range rank for the Optix Index crosses below the 5th percentile. A new buy signal triggers when the range rank exceeds the 53rd percentile, and ETF momentum turns positive within 5 days of the cross. The 5-day rate of change for the XME ETF must be >= 2.5%.

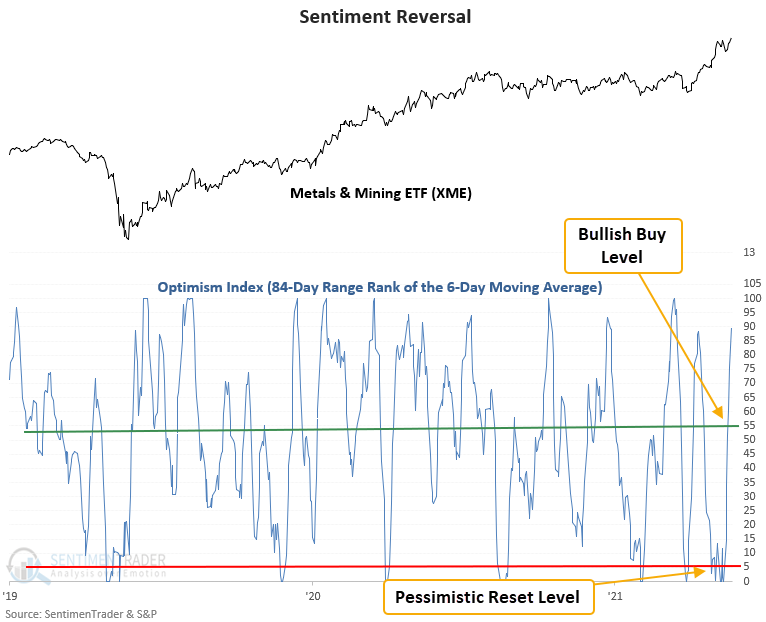

The metals and mining ETF rallied 75% of the time after other signals

This signal has triggered 32 other times over the past 15 years. After the others, the XME ETF future returns, win rates, and risk/reward profiles were solid across the 1-8 week time frames, especially the 2-week window. The near-term results are even more impressive considering the problematic long-term backdrop since the peak in 2008. Unfortunately, the ETF's history is limited. It would have been interesting to see how the signal performed across the 2002-08 natural resource/value-driven bull market.

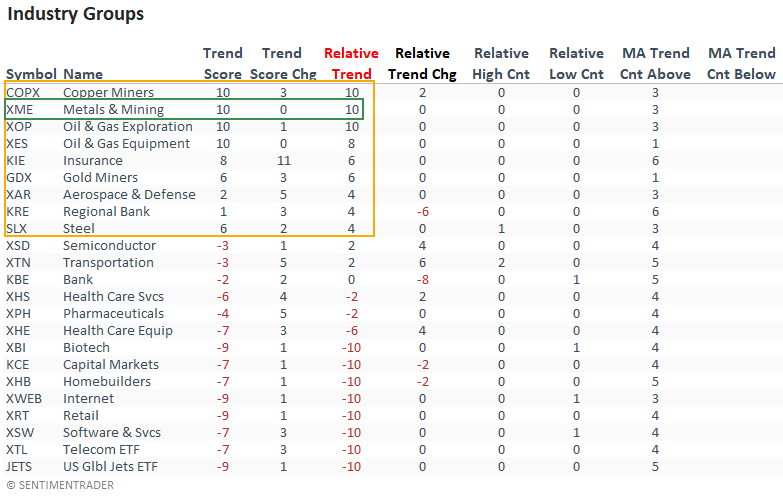

The absolute and relative trends for the metals and mining industry look solid

The metals and mining industry has been one of the top industry groups in my trend score tables for some time now. The rankings skew toward natural resource and value groups. I'm a momentum type of investor. So, I like to buy oversold reversals in the most robust groups. Rinse and repeat.

The seasonality chart looks compelling

Seasonality for the Metals and Mining ETF (XME) is about to turn favorable. The month of April is noteworthy.

What the research tells us...

When the optimism index for the metals and mining industry reverses from a pessimist level, it signals that traders have become more optimistic about the industry's future direction. Using the Optix index to measure that change in sentiment, similar setups to what we're seeing now have preceded rising metals and mining stock prices, especially in the 2-week window.