A reversal in optimism suggests investment-grade bonds could rally

Key points:

- The optimism index for the investment-grade bond ETF (LQD) reversed higher relative to its recent range

- The LQD ETF has rallied 75% of the time after other signals

Using the optimism index to identify bullish sentiment reversals

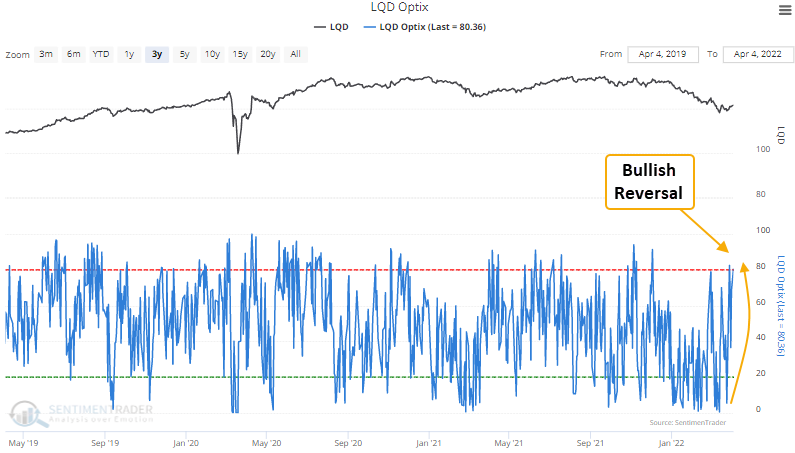

A trading model that uses the Optimism Index to pinpoint when sentiment reverses from a period of pessimism issued a buy signal for the investment-grade bond ETF (LQD) on 4/1/22.

A trading model that identifies a reversal in the optimism index

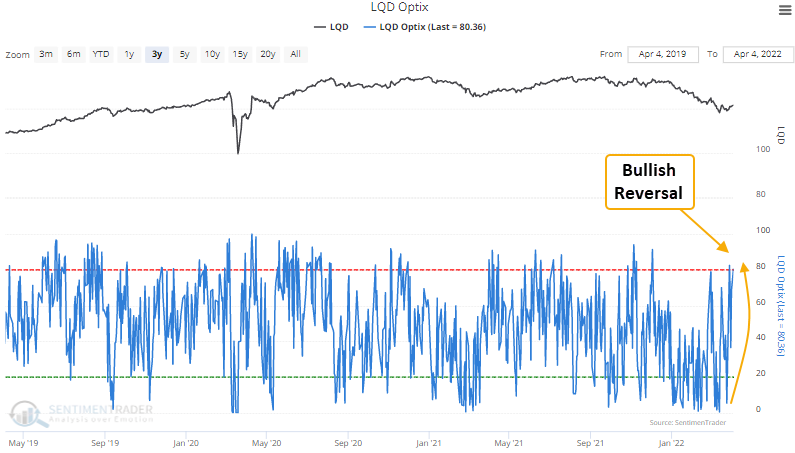

The model applies an 84-day range rank to the 6-day moving average of the Optimism Index for the LQD ETF. As a reminder, the range rank indicator measures the current value relative to all other values over a lookback period. 100 is the highest, and 0 is the lowest. The pessimistic reset condition occurs when the range rank for the Optix Index crosses below the 5th percentile. A new buy signal triggers when the range rank exceeds the 55th percentile and ETF momentum is positive within 5 days of the cross.

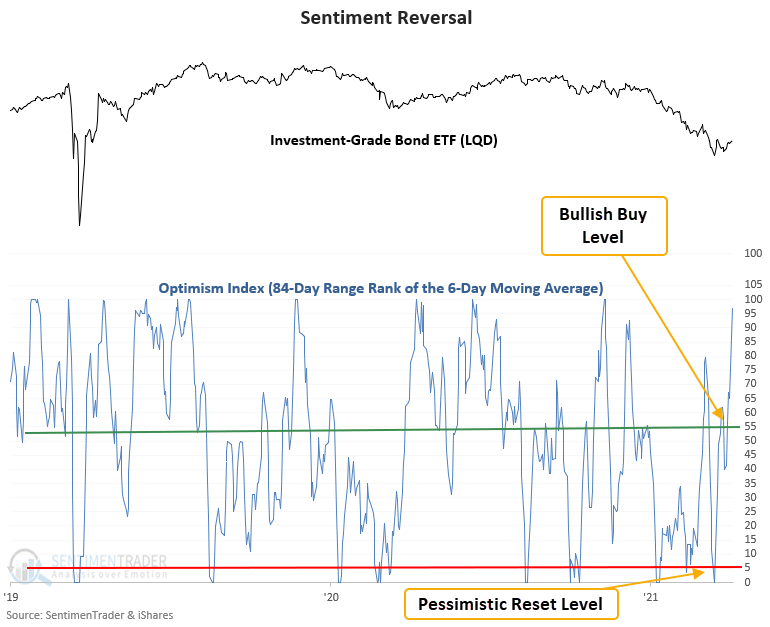

The Investment-Grade Bond ETF rallied 75% of the time after other signals

The trading model generated 12 other signals over the previous 18 years. After the others, the LQD ETF's future returns, win rates, and risk/reward profiles were solid across medium and long-term time frames. The 1-week window suggests the ETF could see some weakness before the bullish outlook takes hold. The LQD ETF is a relatively new instrument. Therefore, the sample size is small.

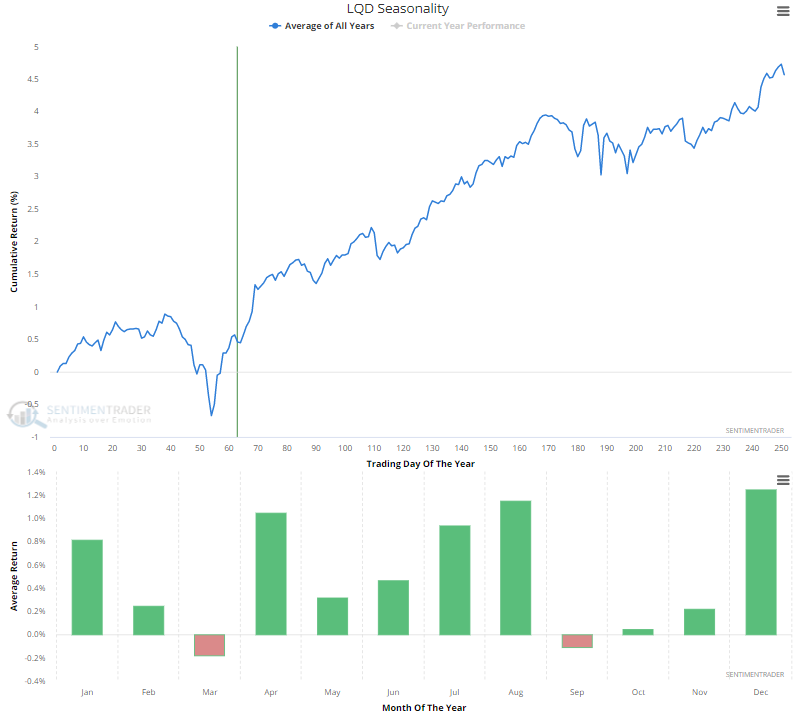

Seasonality looks favorable for investment-grade bonds

From a seasonality perspective, investment-grade bonds typically bottom in March and show healthy returns through the end of summer.

What the research tells us...

When the Optix index for the LQD ETF reverses from a pessimist level, it signals that traders have become more optimistic about the future direction of IG bond prices. Using the Optix index to measure that change in sentiment, similar setups to what we're seeing now have preceded rising bond prices. Seasonality trends suggest a favorable tailwind through the end of summer.