A Plunge in Global Stock Market Trends

Fewer countries are in medium-term uptrends, and that's a warning shot for stocks.

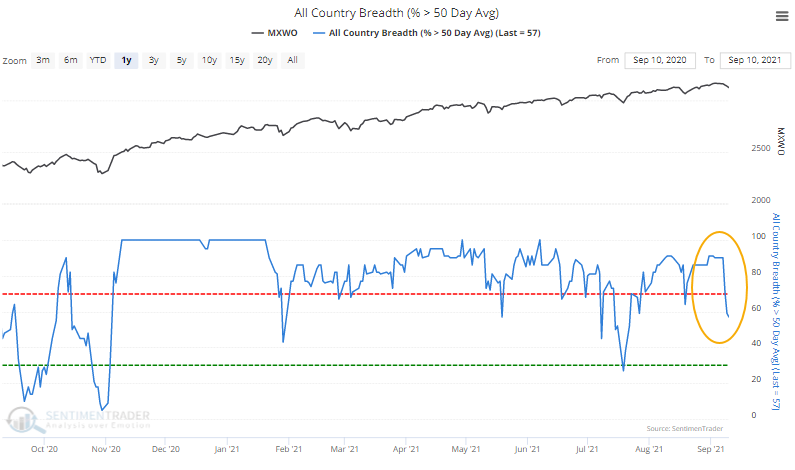

The percentage of country equity indexes trading above their 50-day moving average registered a sharp reversal lower over only a couple of sessions late last week. According to our calculations, positive trends plunged from 90% to below 60%.

Over the past 30+ years, there have been 17 other times when the percentage of countries trading above their 50-day average goes from >= 90% to <=60% in two days or less.

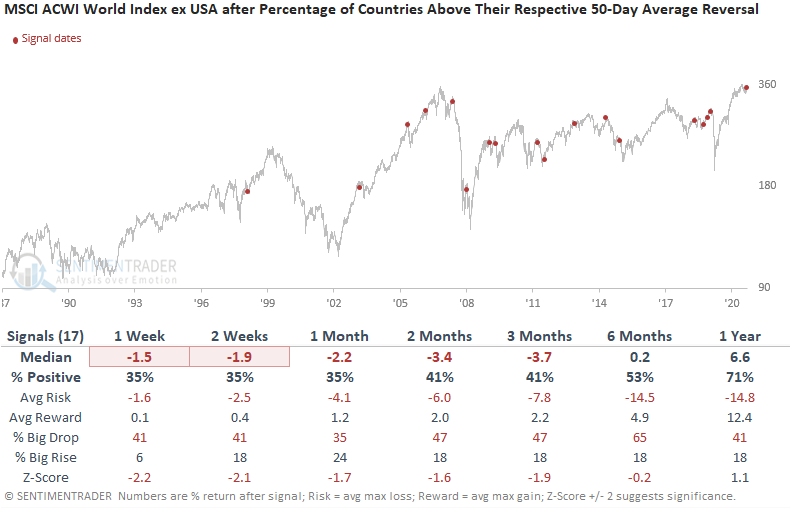

For the MSCI ACWI World Index ex USA index, future returns were weak on a short to intermediate-term basis, especially over the next 1-2 weeks.

Results look weak on a short to intermediate-term basis for the S&P 500, too, highlighting the interconnectedness of international stock markets. Interestingly, the 1-year performance is good, which would suggest the signal is more than likely to identify a correction within an ongoing bull market.

What else we're looking at

- Full details on returns in the MSCI World Index and the S&P 500 after trend reversal signals

- Why it pays to keep an eye on economic surprise indexes

| Stat box The SPY fund, which tracks the S&P 500 index, declined for 5 consecutive days with a total loss of less than 2%. In the fund's history, it has suffered such a persistent - but small - loss only 6 other times. |

Etcetera

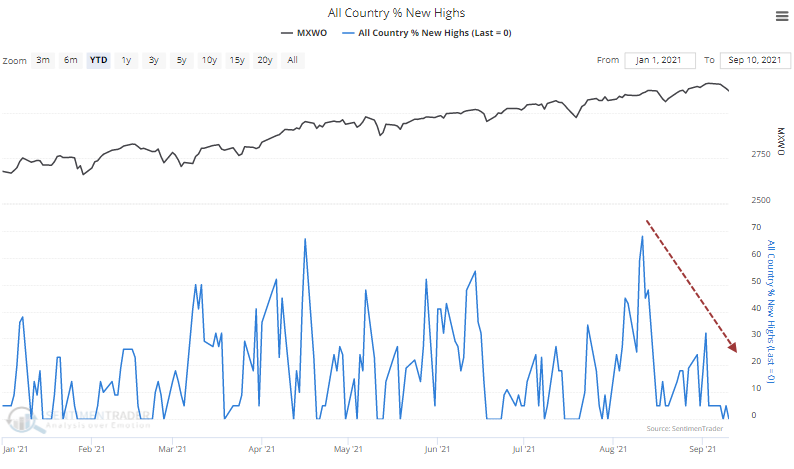

Fewer highs. In addition to fewer medium-term trends among global stock markets, fewer of them were hitting 52-week highs during the last push higher.

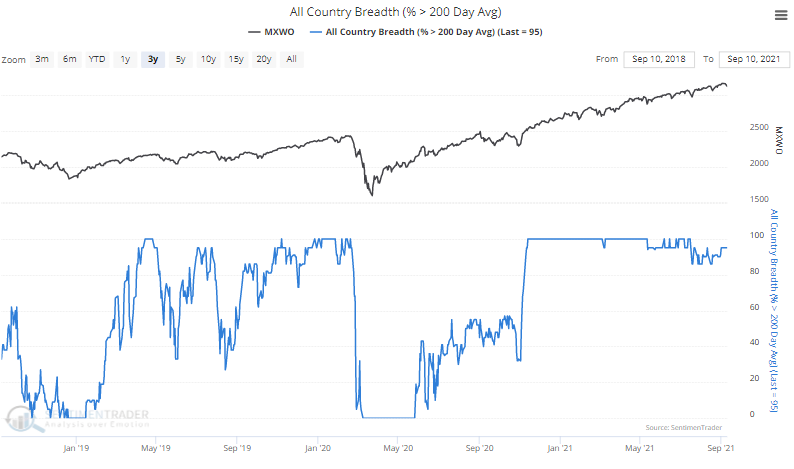

Long-term trends still strong. Even with deteriorating medium-term trends, the bigger picture is still quite positive with 95% of markets still trading above their 200-day moving averages.

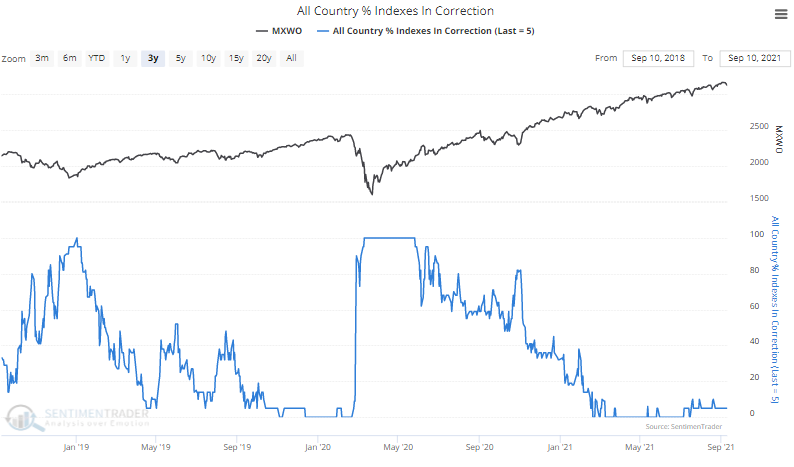

Hardly any corrections. Few countries are in correction mode as well. Unhealthy markets typically see this figure above 40%.