A Perfect Technical Buy Signal

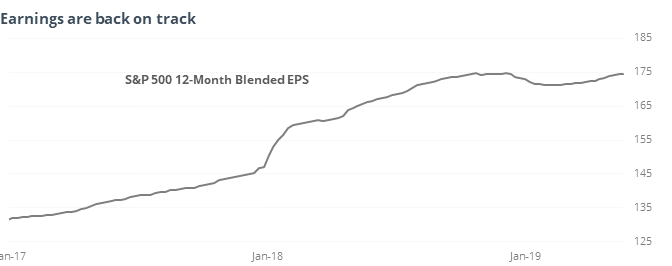

Earnings approach peak

Since last fall, earnings among S&P 500 companies have been in a pullback. A recent trend higher has nearly erased that and they’re closer to their peak than they’ve been in six months.

After other times earnings near their peak after several months, stocks performed well.

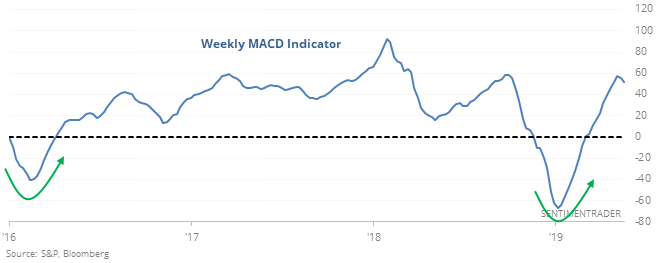

A technical buy signal

The MACD indicator isn’t as well-known as some, though it’s still popular among many technicians. On a weekly time frame, the indicator has cycled from persistent downside momentum to persistent upside momentum.

Every time it’s done that since 1950, stocks rose over the next 1-2 years. Prior to 1950, there were several losers out of the 7 signals, and while they may not be as comparable to more recent time periods, it’s a bit of a damper on what otherwise looks to be a decent sign.

More outflow

According to the ICI, investors have pulled more than $30 billion from domestic funds over the past four weeks. Excluding October 2008, the S&P was higher three months after all 14 of the other weeks.

Copper panned

Copper futures fell more than 1% to an 80-day low. Of the 216 other times it’s done so since 1988, it usually continued lower. Six months later it was higher 49% of the time with an average return of -0.3% But its impact on stocks was nil – the S&P was higher 70% of the time.

Few calls

On the ISE exchange, traders bought only 55 calls for every 100 puts. The Backtest Engine shows that when there were this few calls, three months later the S&P 500 gained after 39 of 43 days.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.