A New Buy Signal in Housing

Some years ago, I created several housing market models. I love that housing has numerous macro data inputs that I can utilize in conjunction with my micro bottom-up factor, relative strength. Full disclosure, I had another reason for creating my housing models. My wife's family operates a fairly sizable homebuilding operation in the southeast.

In today's' note, I want to share one of the housing models as it triggered a new signal on 1/22/21.

Remember, Sentimentrader is not in the business of making specific recommendations. Our objective is to provide you with data and studies to help you with your research process.

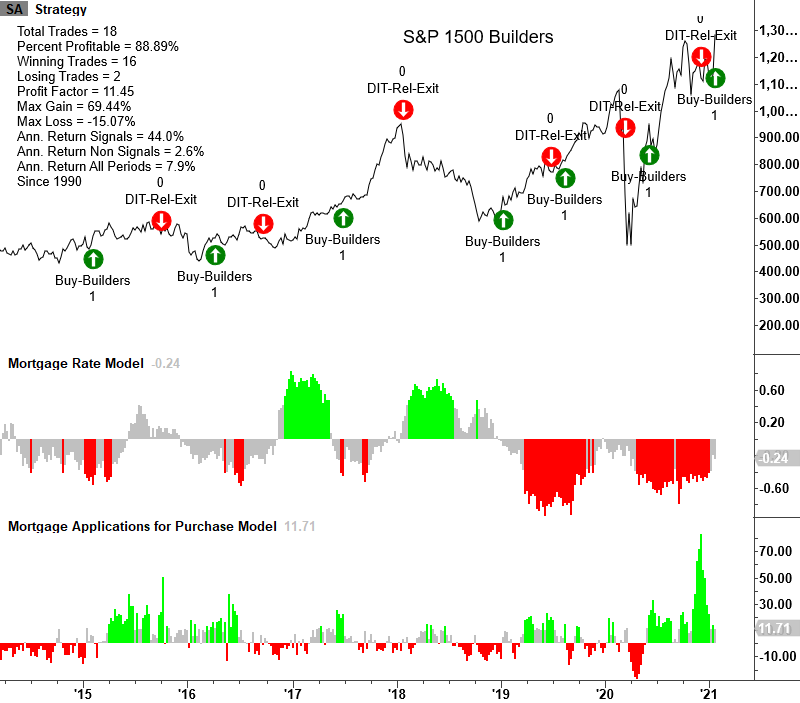

Housing Market Model

The housing market model is straightforward. It looks for favorable housing conditions as measured by mortgage rates and applications for purchase for single-family homes. i.e., rates are down, and applications are up. Once the housing data turns favorable, the model buys builders on a new relative high vs. the S&P 500. The model exits the trade when relative strength for the builders turns unfavorable.

Chart and Signal Example

Please note, it's not uncommon for the model to exit a trade and immediately reinitiate a buy signal like the most recent one.

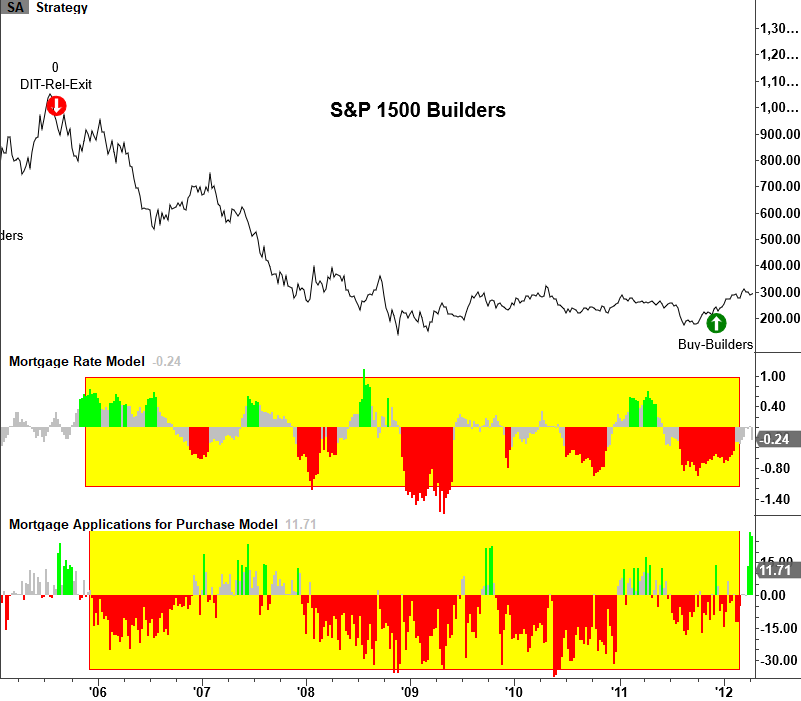

2005-2011 Example

I think it's important to share a chart of the model during the 2005-2011 period. As one can see in the highlighted area, the model had some favorable conditions when rates were down and applications up. However, the relative strength component did not trigger.

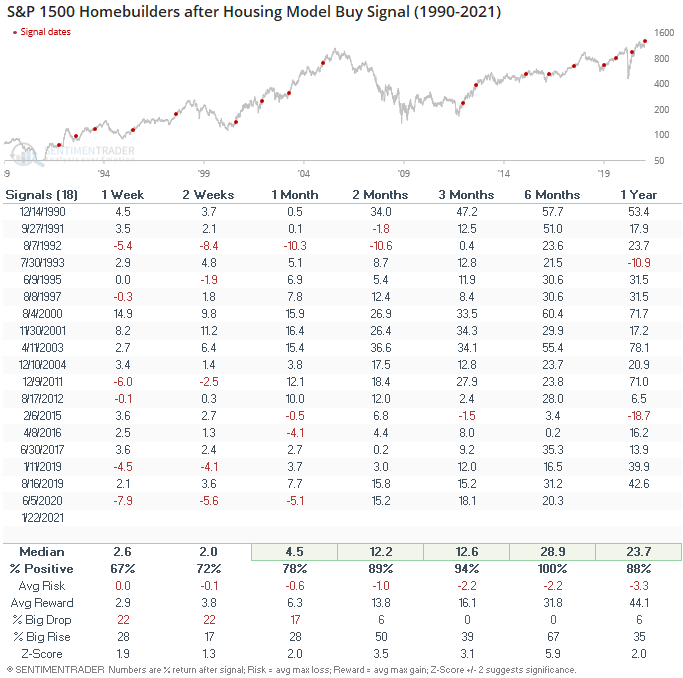

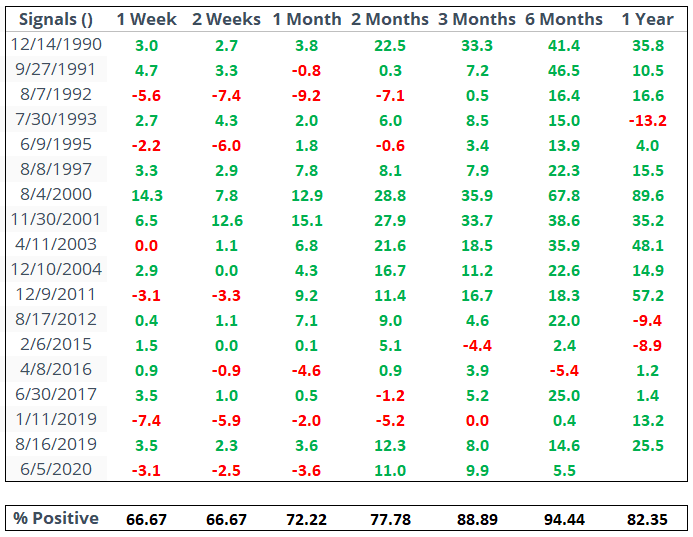

Housing Signal Performance

As the table below shows, the absolute performance for homebuilders is robust on all timeframes. Especially in the 2-12 period. It even performed well during the 2000-2002 recession/bear period.

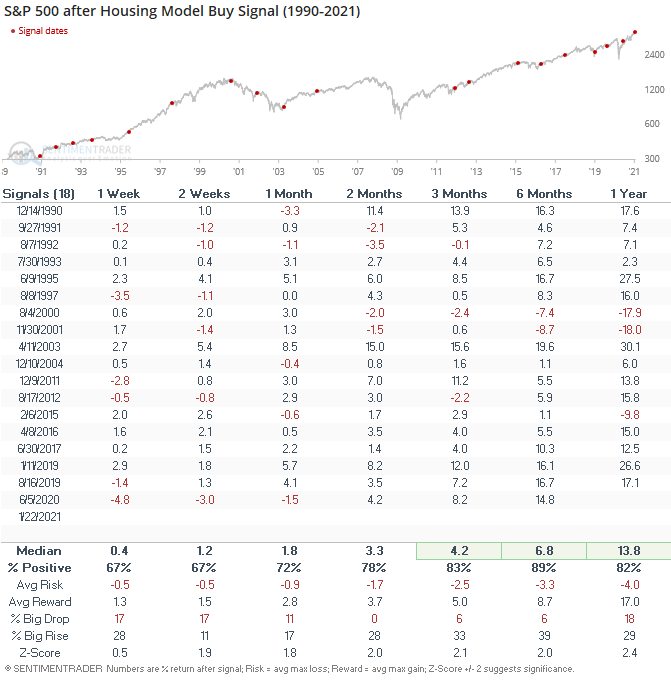

S&P 500 Performance

Given the homebuilders' strong performance, let's see how the S&P 500 performs when a housing model signal is triggered. Outside of the 2000 and 2001 recession/bear market signals, the numbers look good.

S&P 1500 Homebuilders Relative Performance vs. S&P 500

Of course, I always want to check relative performance when I'm examining a specific group. As one can see, relative performance versus the S&P 500 is robust.

Conclusion: A new buy signal in my housing market provides a favorable backdrop for builders and the broad market.