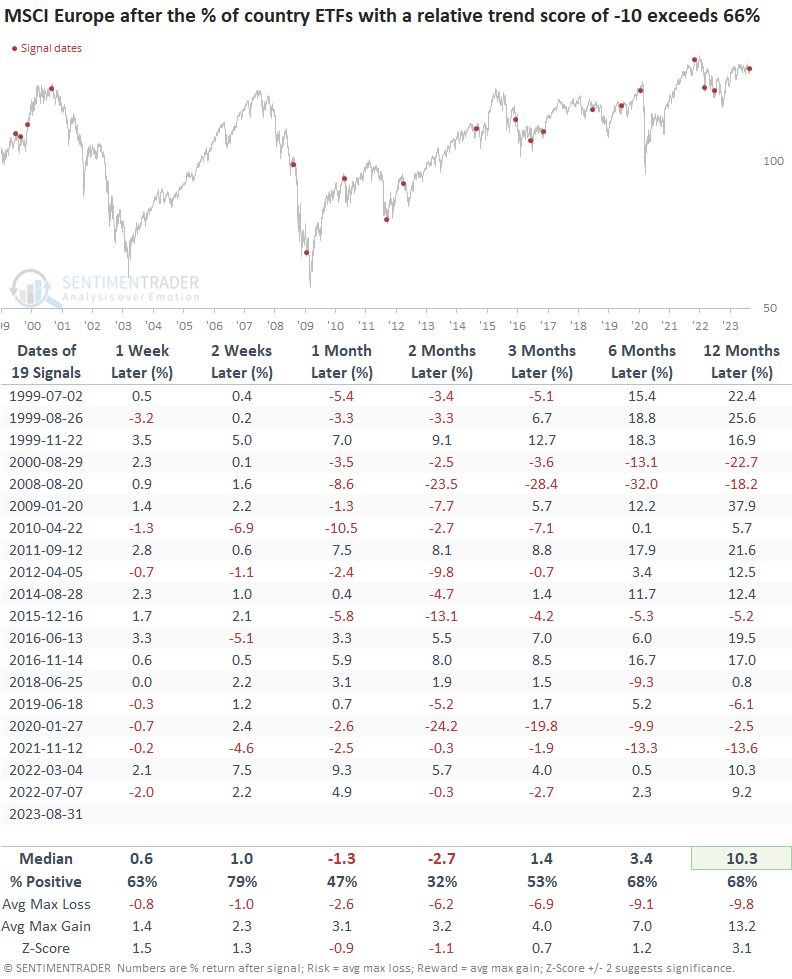

A negative shift in relative trends across Europe

Key points:

- The percentage of European country ETFs with the worst possible relative trend score surged higher

- Similar trend score conditions led to unfavorable returns for the MSCI Europe Index over the next few months

Trend scores for European country ETFs are losing ground relative to the S&P 500

Despite the persistent talk of a looming rotation from growth to value, my evidence-based market research approach doesn't lend strong support to this narrative, even as the value-oriented energy sector shows bullish internal dynamics.

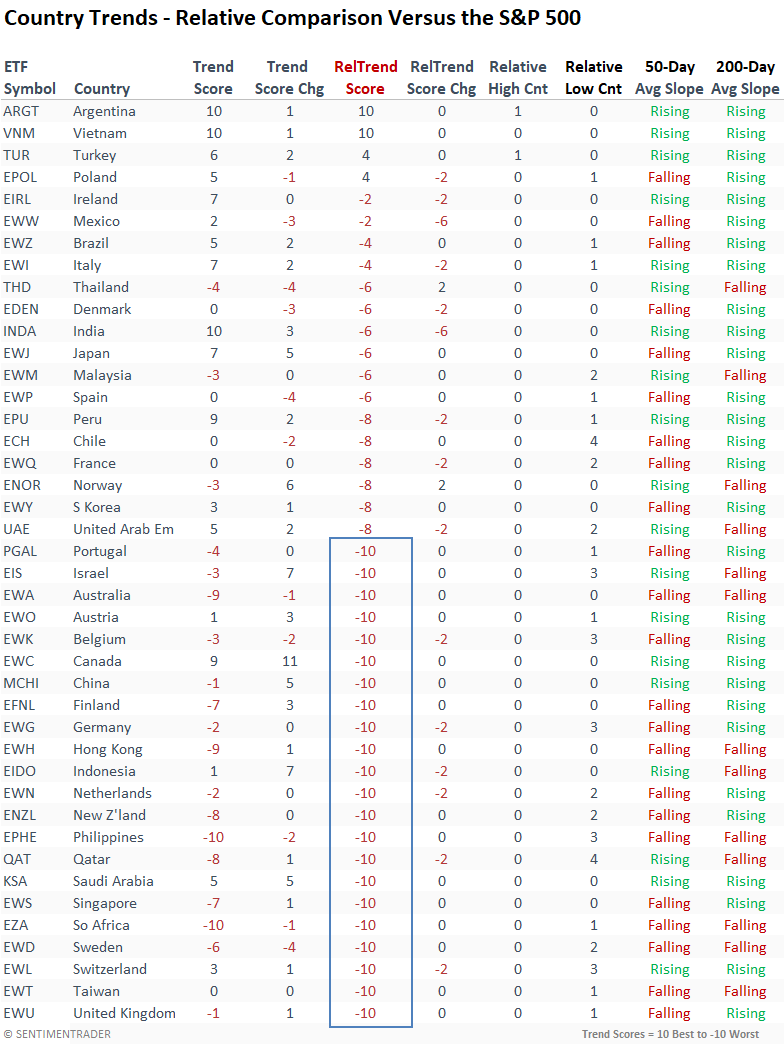

Nowhere do we see a more unambiguous indication of the case against an impending shift than in global indexes, which are tilted more toward value-oriented stocks. Among the 42 country ETFs I track, only four maintain a positive relative trend score when compared to the S&P 500.

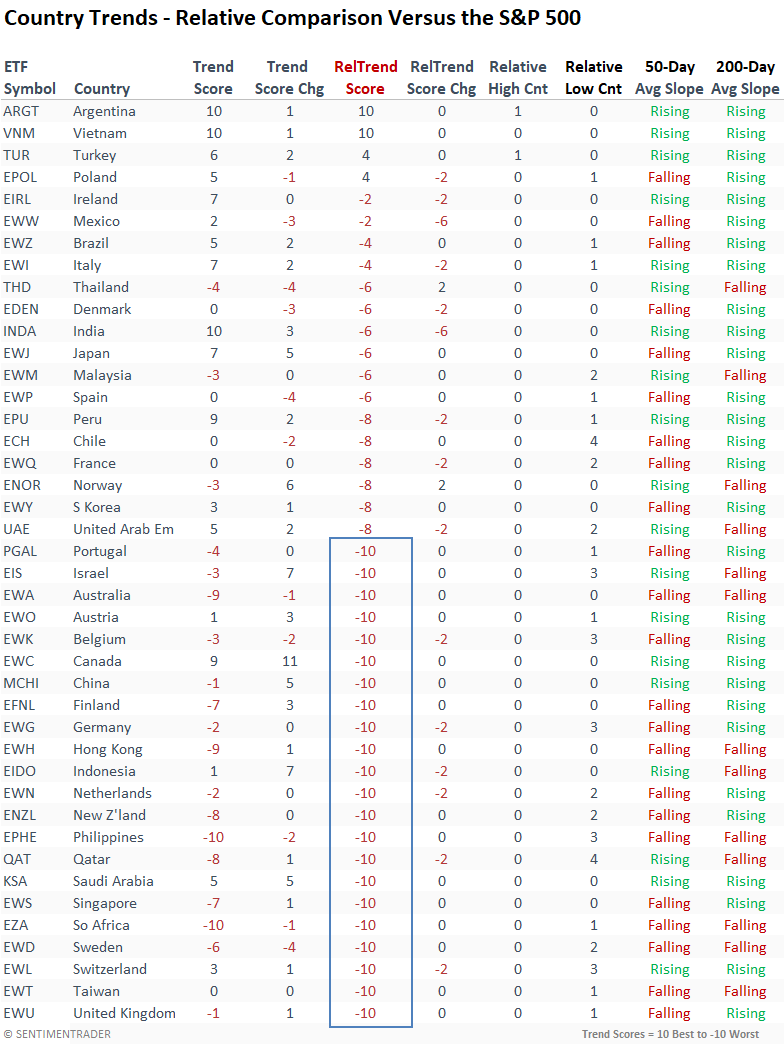

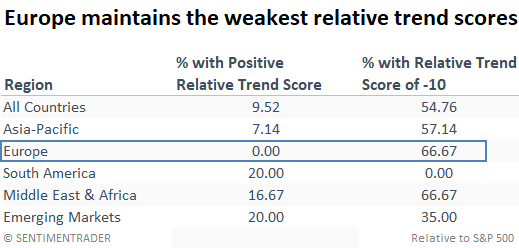

Regarding regions around the globe, Europe is a glaring weak spot. Astonishingly, no European country maintains a positive relative trend score versus the S&P 500. Even more concerning is the recent surge in countries achieving the lowest possible score, with a whopping two-thirds of European nations now residing at a dismal -10.

When aggregating the relative trend scores for regions globally, it's notable that no European country maintains a positive score compared to the S&P 500, and the percentage with the worst possible score, -10, has now increased to 66%.

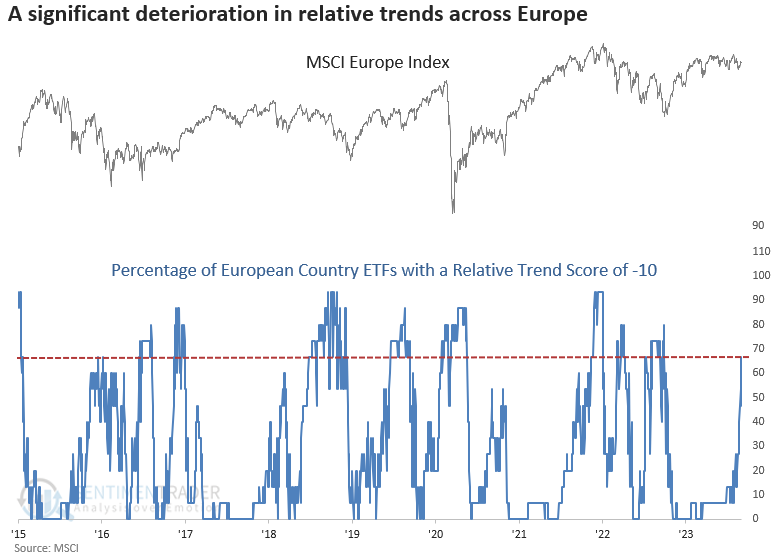

The percentage of European country ETFs with a relative trend score of -10 increased to the highest level since September 2022.

Similar relative trend score conditions suggest Europe could struggle

When the percentage of European country ETFs with a relative trend score of -10 cycles from less than 25% to greater than 66%, the MSCI Europe Index tends to bounce in the near term. However, after the relief rally, the index showed negative returns over the subsequent one and two-month periods.

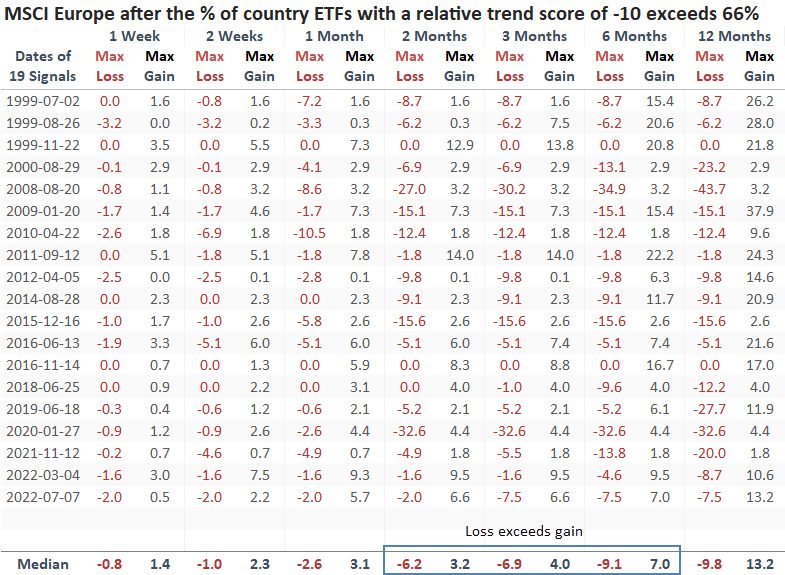

The median max loss exceeds the max gain from two to six months later.

What the research tells us...

Except for just a handful of nations, global relative trend scores exhibit weak conditions compared to the S&P 500. This discrepancy is glaring in Europe, where an astonishing two-thirds of countries presently hold the lowest attainable scores. Unfavorable relative trend score conditions, like now, tend to foreshadow poor absolute returns for the MSCI Europe Index over the subsequent one and two-month periods.