A massive surge in the Macro Index Model

Key points:

- The Macro Index Model increased by over 18% on a month-over-month basis

- After similar surges, stocks showed a consistent upward bias

- A commodity index tends to rally, gold falters, and the 10-year yield is mixed

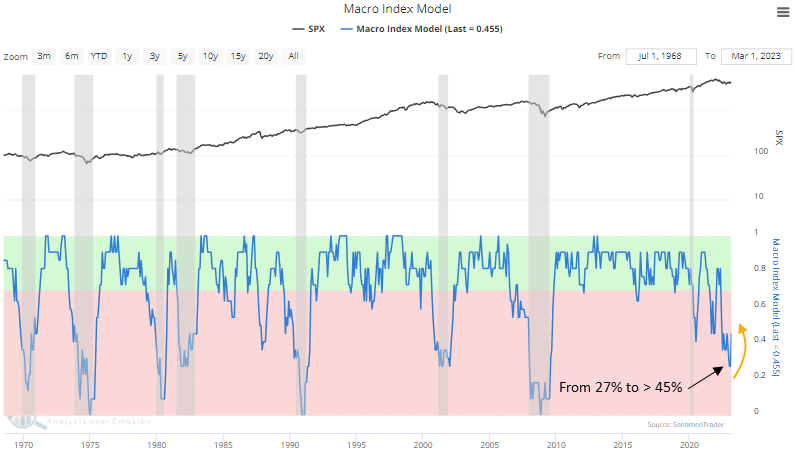

A diverse macroeconomic composite jumps by a significant amount

After falling to the lowest level in over a decade, the Macro Index Model, a composite consisting of 11 diverse economic indicators to determine the state of the U.S. economy, surged by more than 18% month-over-month.

While the MIM remains well below the favorable threshold of 70%, significant month-over-month surges like now tend to ignite a turning point for economic conditions that benefit stocks.

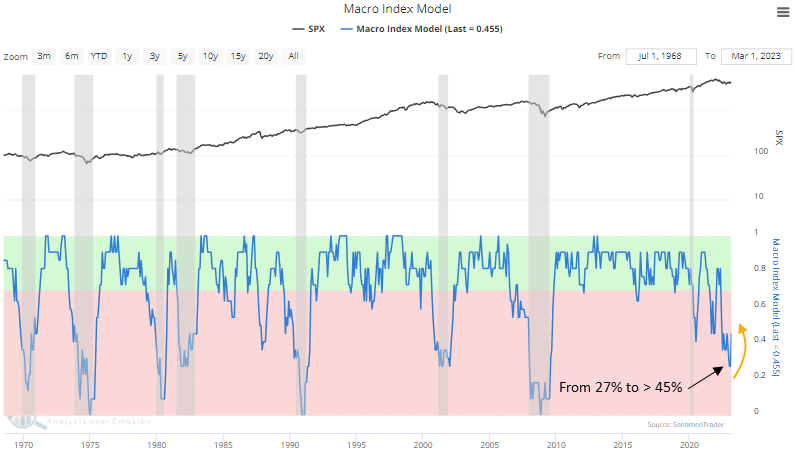

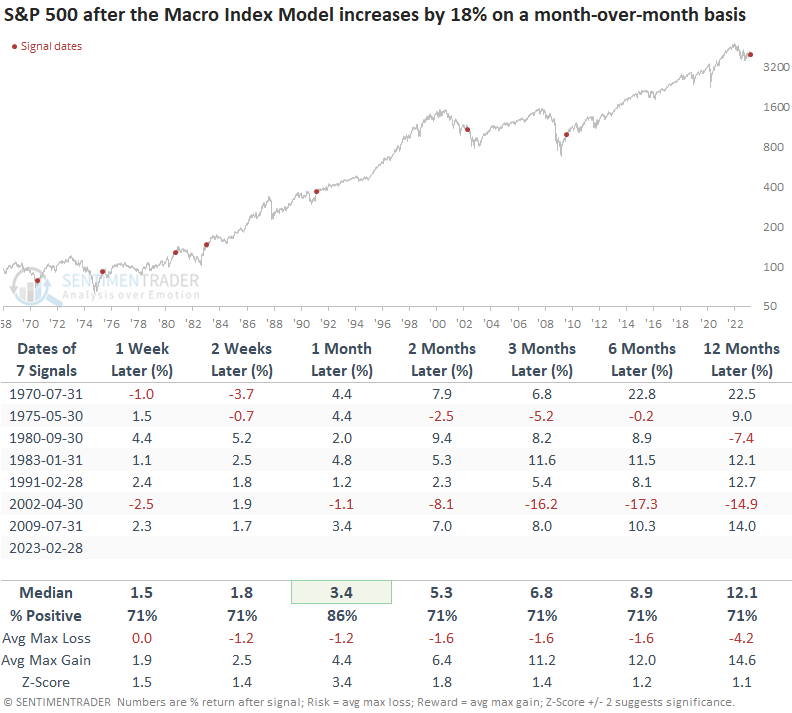

Most MIM month-over-month increases of 18% or more occurred when the S&P 500 turned up from a growth-scare correction or economic contraction.

Month-over-month surges in the Macro Index Model preceded positive results for stocks

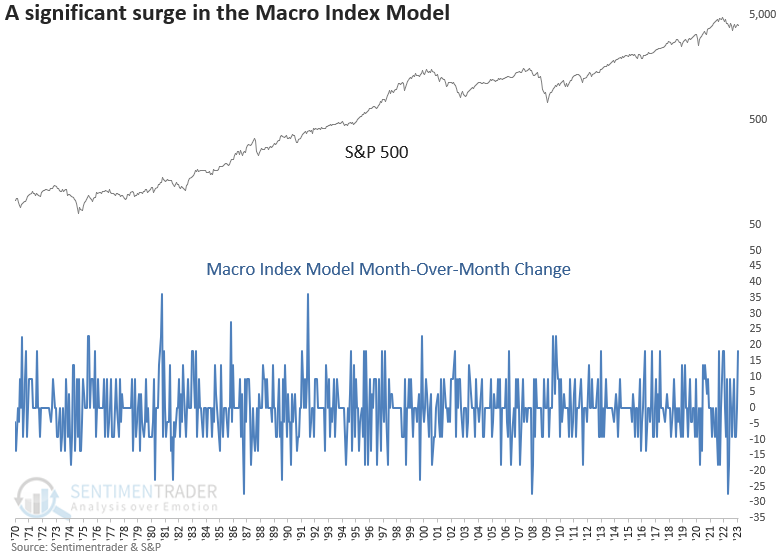

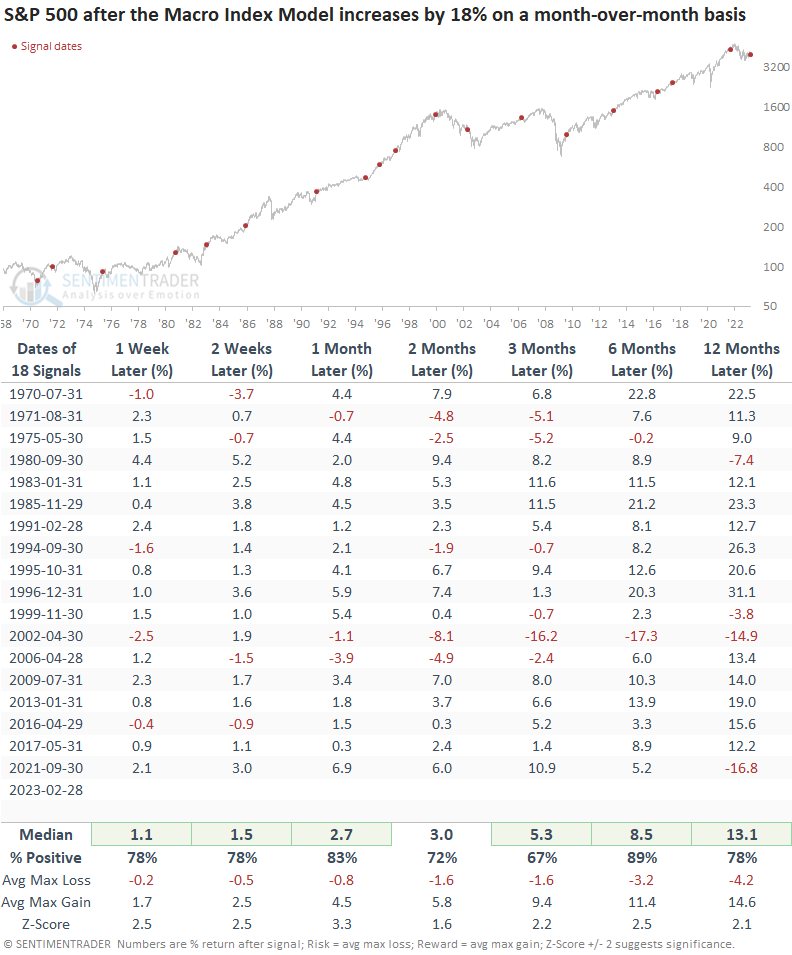

When the Macro Index Model increases on a month-over-month basis by 18% or more, the S&P 500 responds with a bullish outcome. Returns, win rates, and z-scores look excellent across all time frames.

The only significant failure occurred in 2002. Interestingly, the MIM continued to rise as stocks declined in the final leg lower of a multi-year bear market.

I screened out repeats by identifying the first signal in a year.

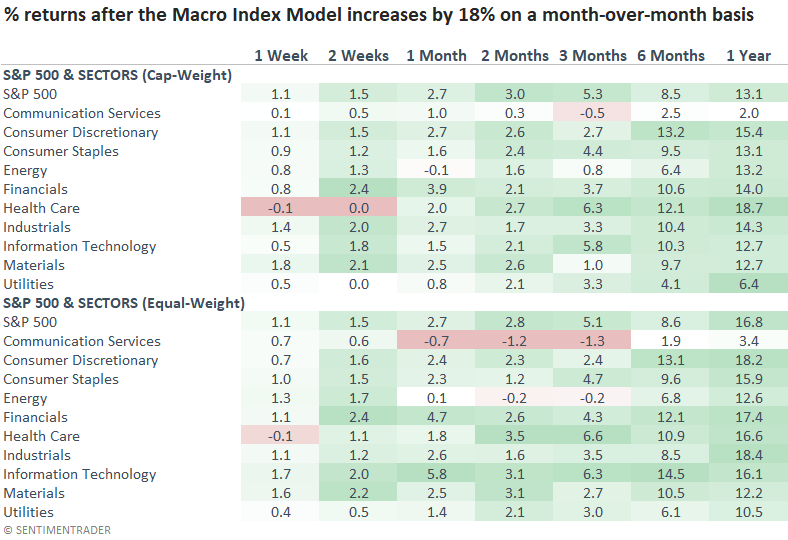

From a sector perspective, Consumer Discretionary and Industrials tend to perform well over the next year, which aligns with current relative strength trends.

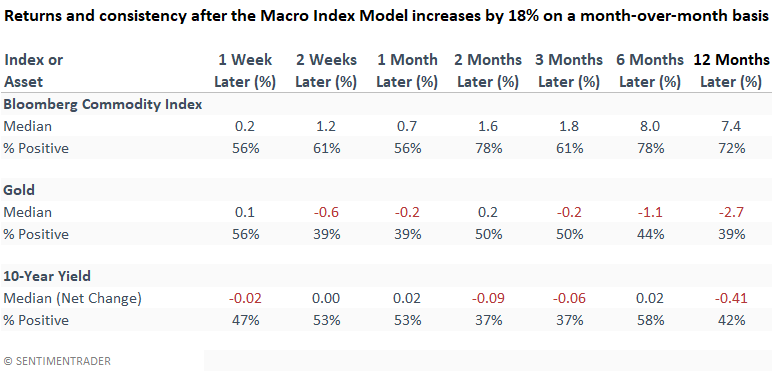

Other asset classes

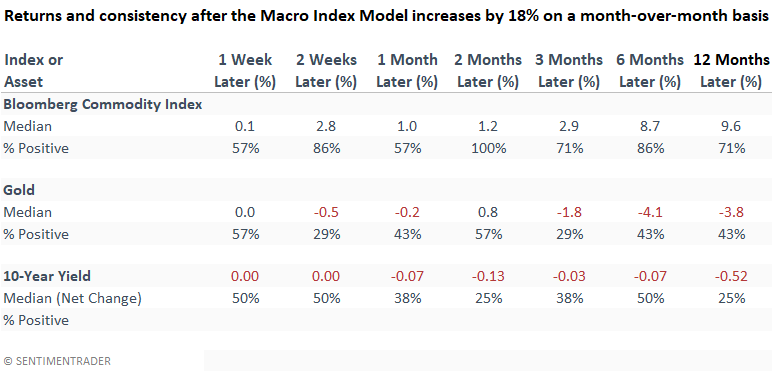

When I apply the signals to other asset classes, commodities, like stocks, tend to benefit from a jump in economic activity. However, the same can't be said for gold, as the metal is more likely to falter. The net change and win rates in the 10-year yield are a mixed bag.

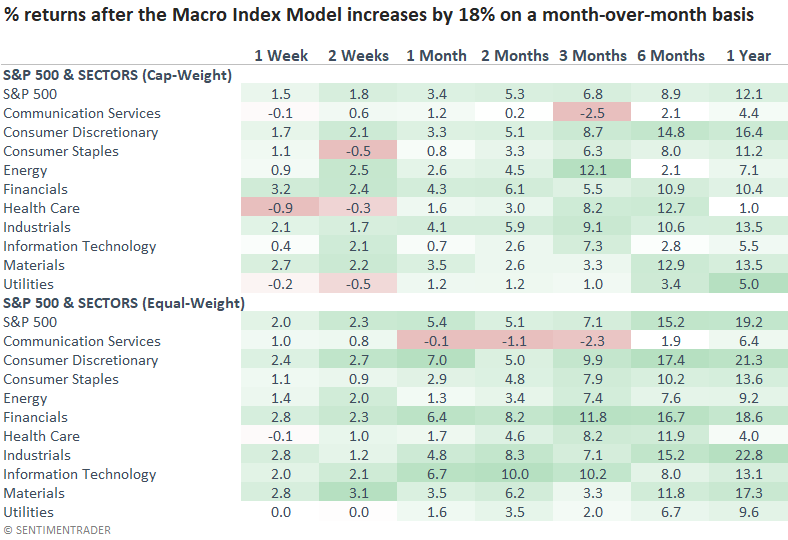

Significant month-over-month increases from a low starting point

Let's isolate when the month-over-month change in the Macro Index Model increases by 18% or more after the composite falls below 30%, which is the case now.

Significant surges from a starting point typically associated with an economic contraction provide bullish returns similar to the outlook for all signals. Win rates and z-scores are slightly less bullish but still impressive.

Not surprisingly, early cycle sectors like Consumer Discretionary and Industrials outperform, which is even more pronounced for equal-weighted index returns.

Other asset classes

Returns and consistency for the Bloomberg commodity index and gold look similar to the original study. However, after the Macro Index Model declined below 30%, the 10-year yield tended to ease.

What the research tells us...

The Macro Index Model surged on a month-over-month basis. Except for one instance in 2002, similar increases benefited stocks, especially cyclical sectors. While the renewed strength in economic activity is bullish for a basket of commodities, one can't say the same for a safe-haven asset like gold. With no meaningful edge in long-duration bonds, I would stick with a T-Bill yielding 5%.