A market regime indicator reversed from risk-on to risk-off

Key points:

- The S&P 500 closed at a 40-day low

- At the same time, fewer than 56% of S&P 500 members > their respective 200-day average

- The simultaneous condition of both events flipped a market regime indicator to risk-off

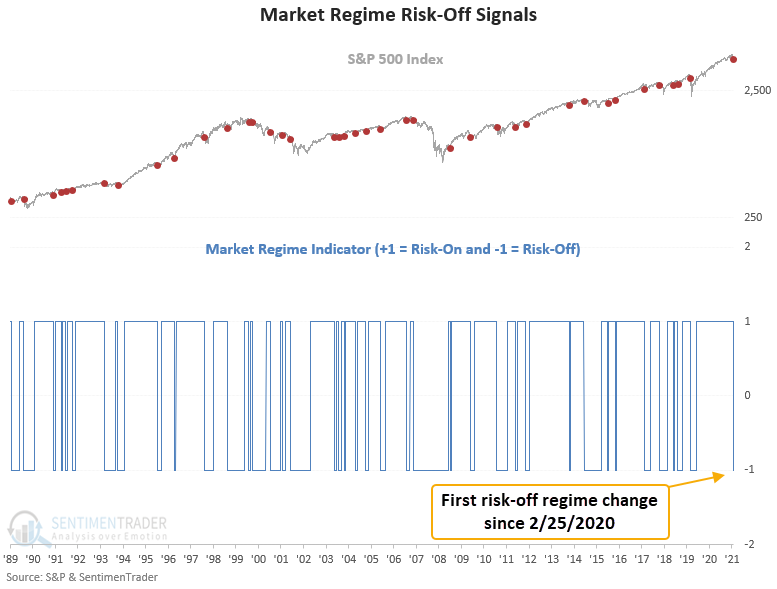

A market regime indicator that combines internal and external trend indicators

A new signal from a market regime indicator registered a risk-off alert on Thursday. Based on the following events, the market regime indicator will switch from one condition to another.

Risk-on conditions:

- The S&P 500 closes at a 40-day high

- The percentage of S&P 500 members above their 200-day average > 56%

Risk-off conditions:

- The S&P 500 closes at a 40-day low

- The percentage of S&P 500 members above their 200-day average < 56%

A backtesting process determined the optimal threshold levels for the system. The optimization parameters were 20-42 days in 2-day increments for the high-low breakout condition and 30-60% in 1% increments for the percent above 200-day condition. So, a 40-day breakout provides an intermediate-term external assessment of the index price trend. In contrast, the percent above the 200-day provides an internal evaluation of long-term member trends.

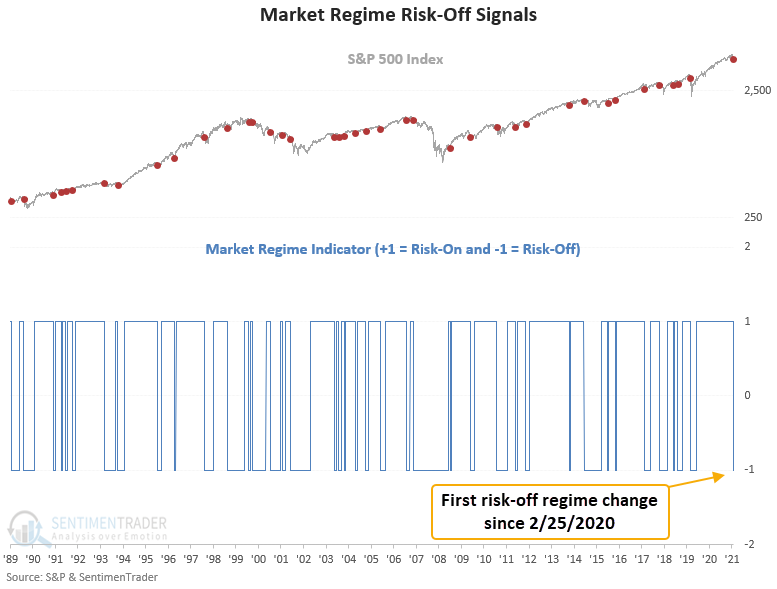

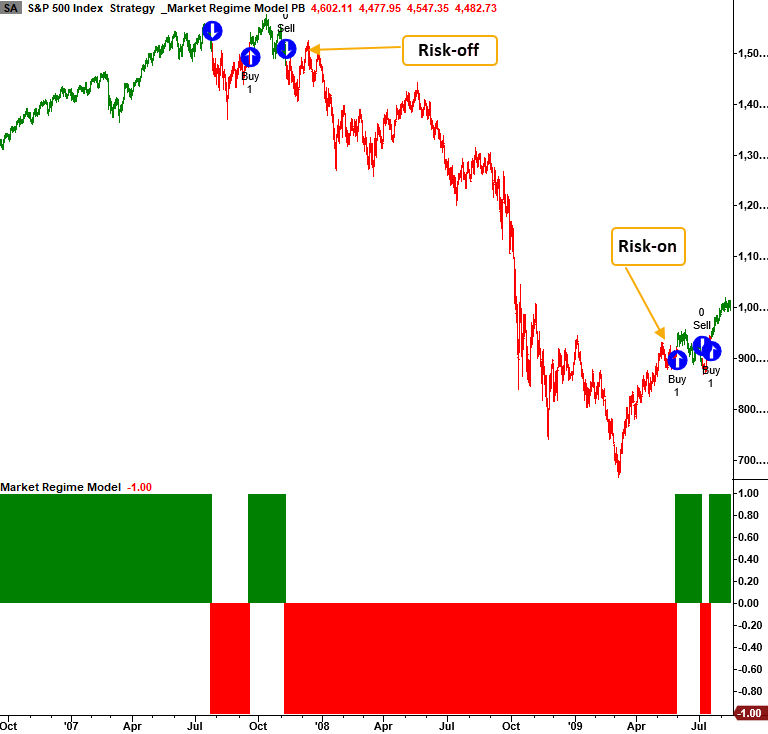

Annualized returns based on the market regime

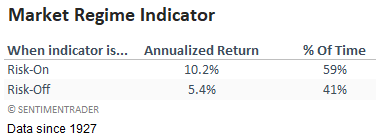

Market regime indicators rarely show overwhelmingly bullish or bearish annualized return scenarios, especially ones with a start date in 1927. Risk-on numbers tend to look slightly better than long-term averages. And, risk-off returns are not as negative due to whipsaw signals and the inability to quickly flip back bullish after severe bear markets. For example, the S&P 500 rallied 40% in 3 months after the 2009 low before the market regime indicator reversed back to risk-on. That type of surge creates an upward bias at the tail end of a devasting period.

This is what we seek to avoid with a market regime indicator.

However, this is what we can get in a choppy trend environment.

What happens when a risk-off signal occurs after a long risk-on period

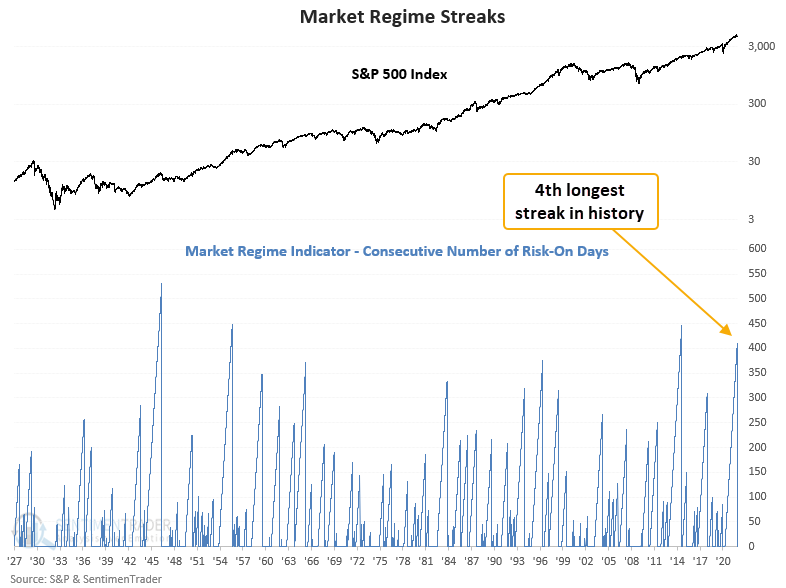

After 410 trading sessions in the risk-on regime, the indicator flipped to risk-off, ending the 4th longest streak since 1927. Let's conduct a study to assess the outlook for the S&P 500 when the market regime indicator flips to risk-off after a risk-on signal that lasts for 300 days or more.

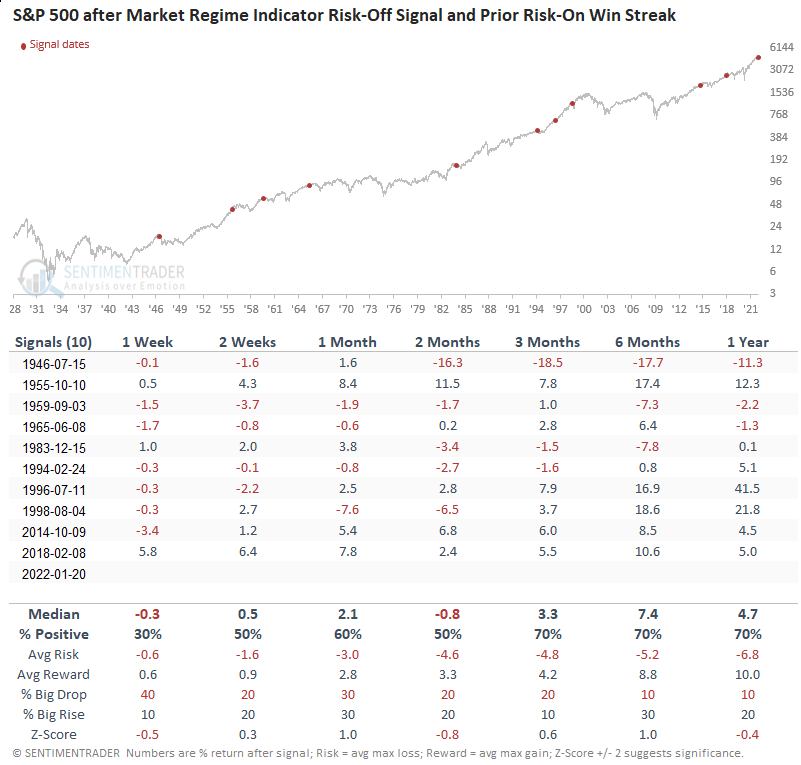

Similar signals preceded slightly weak to flat returns

Similar signals preceded slightly weak to flat returns

This signal triggered 10 other times over the past 76 years. After the others, S&P 500 future returns and win rates were slightly weak to flat in the 1-8 week timeframes. The signal in 1946 is the only time that one of the risk-off regime changes coincided with a bear market top.

Some thoughts on this indicator

- While the market regime indicator can avoid devasting drawdowns like 2007-08, it can also produce whipsaw signals. I would never use it as a stand-alone method.

- I designed this indicator with my risk tolerance and investing/trading style in mind. Suppose you're a long-term buy-and-hold investor with a taxable account. In that case, you might want to use a method with more long-duration indicators. For instance, you could replace the 40-day breakout condition with the slope of the 200-day moving average.

What the research tells us...

When the S&P 500 closes at a 40-day low, and fewer than 56% of S&P 500 members are above their 200-day average, a risk-off regime environment can lead to lower than average market returns. Furthermore, after long market regime risk-on streaks end, future returns and win rates look slightly weak to flat on a short and medium-term basis.