A favorable combination of price patterns emerges

Key points

- The S&P 500 will close July 2023 with a gain; this would mark the 5th consecutive up month

- During this time, April, May, and June all closed higher, completing a "2nd Quarter Trifecta"

- Following previous occurrences of these price patterns during the past 70+ years, the stock market has shown a persistent favorable bias in the months ahead

Five up months for the S&P 500 Index is rare - and bullish

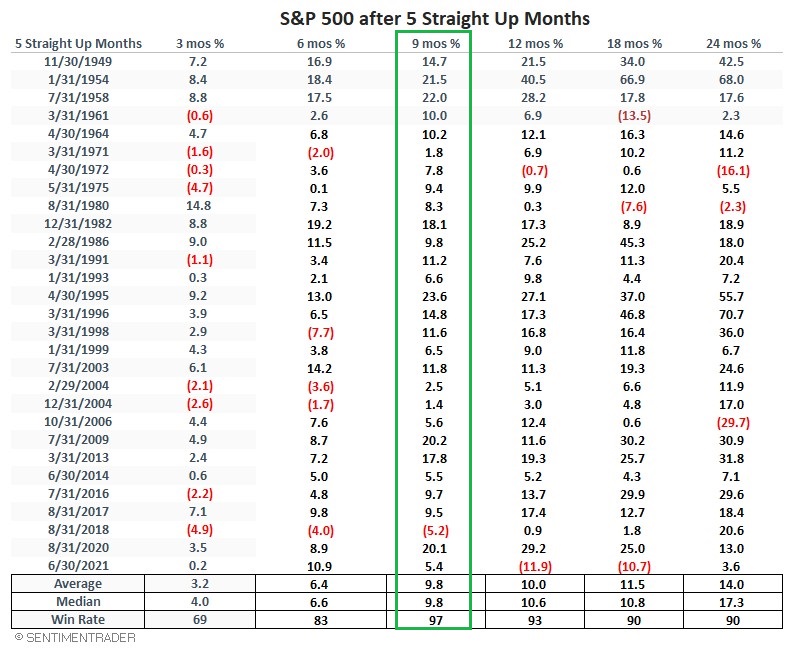

As discussed in detail in this piece, since 1949, there have been only 29 times when the S&P 500 Index showed a calendar monthly gain for five consecutive months. This has tended to be followed by favorable stock market action over the ensuing nine months. As a quick review, the table and chart below are reprinted from the previous article.

The table below displays the dates and subsequent S&P 500 performance for each of the previous instances.

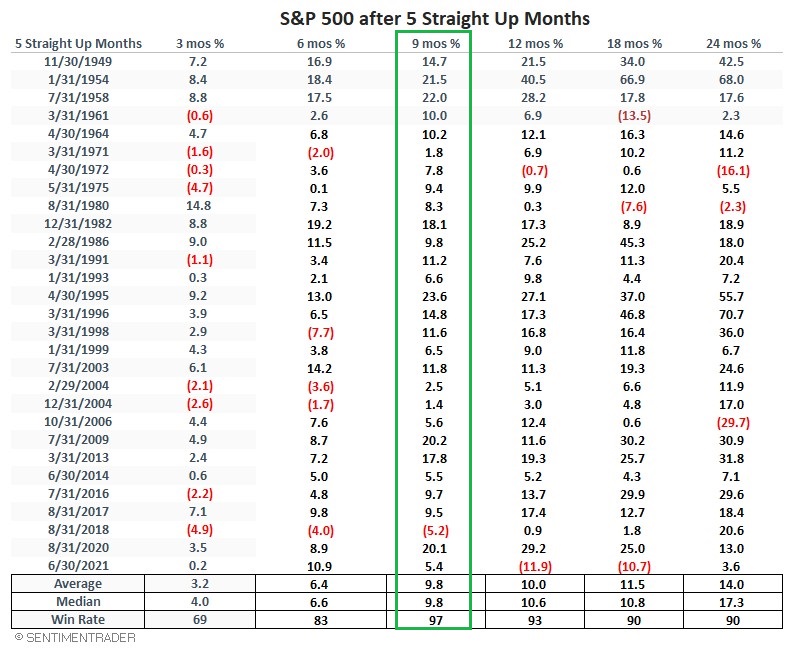

The chart below displays the growth of $1 invested in the S&P 500 (on a logarithmic scale, i.e., the distance between $1 and $10 is the same as the distance between $10 and $100) only during the nine months following the dates listed in the table above.

The 2nd Quarter Trifecta (2QT)

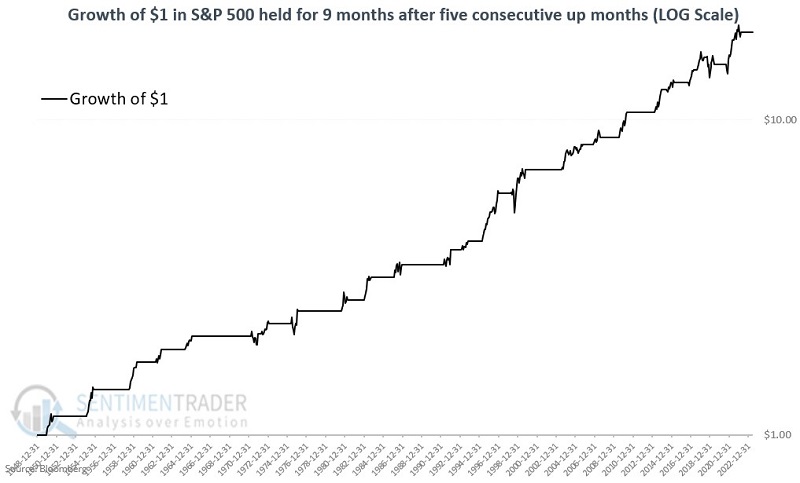

A 2nd Quarter Trifecta occurs when the S&P 500 shows a monthly gain for April, May, and June during the same year. This tends to be a favorable sign for stocks over the next nine months (i.e., through March of the following year). The table below displays the dates of previous occurrences and subsequent S&P 500 performance over the next nine months.

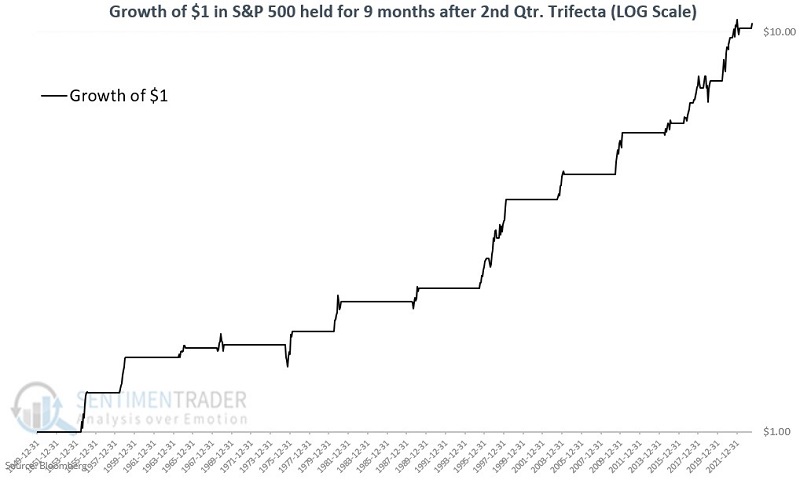

The chart below displays the growth of $1 invested in the S&P 500 (on a logarithmic scale) only during the nine-month periods listed in the table above (including July 2023, which showed the S&P 500 with a gain of +2.8% through July 28th).

Combining the two price patterns reveals a favorable tendency

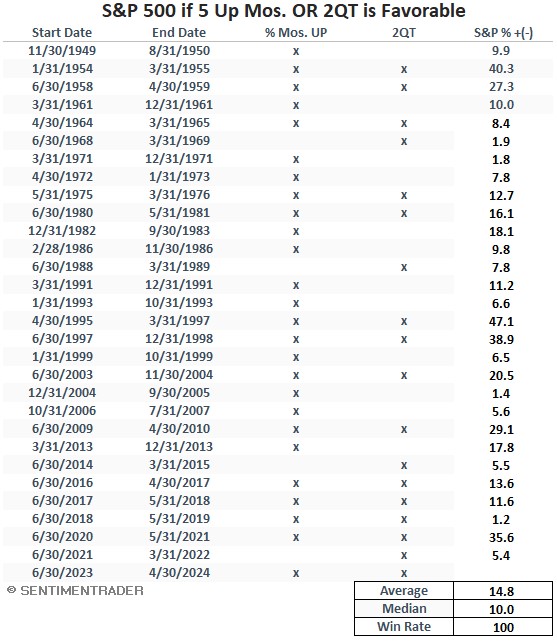

Next, we will combine the two price patterns above and consider all periods when either pattern is in a favorable nine-month period.

The table below displays all periods when at least one - or both - of the price patterns was favorable (i.e., the nine months after the 5th consecutive up months for the S&P 500 and/or the nine months after April, May, and June all see the S&P 500 close higher).

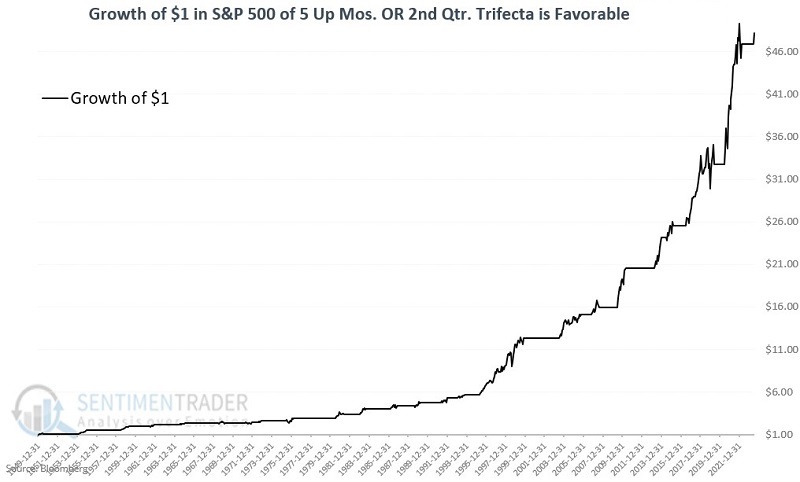

The chart below displays the growth of $1 invested in the S&P 500 only during the favorable periods listed in the table above.

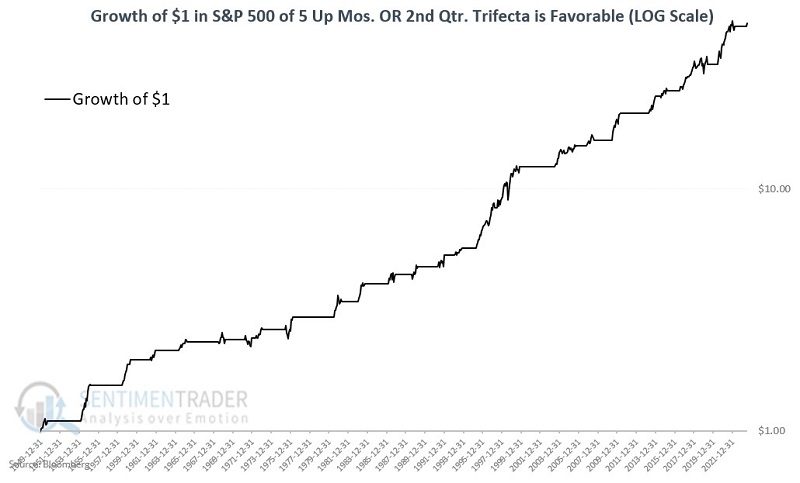

The chart below displays the same results as the previous chart but on a logarithmic scale.

What the research tells us…

Momentum can be a powerful force in the stock market. The results highlighted above represent a clear case in point. Nevertheless, it is essential to remember that there are no sure things in the financial markets. It would be a mistake for any investor to assume that the stock market is guaranteed to advance between now and April 2024. The primary lesson from the data above is one of being willing to give the bullish case the benefit of the doubt until price action gives some reason to think otherwise.