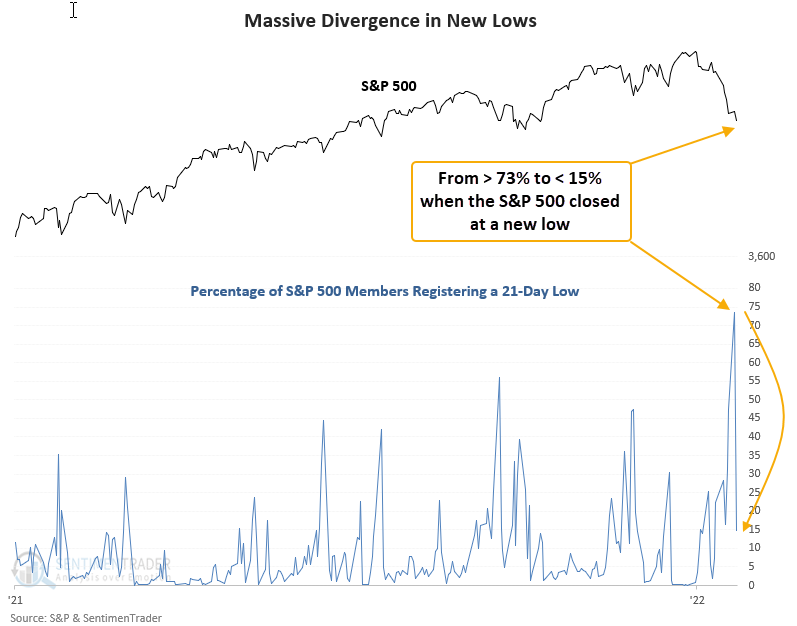

A divergence in new lows suggests a bounce

Key points:

- The number of S&P 500 members registering a 21-Day low surged above 73% on Monday

- On Tuesday, the S&P 500 index closed at a new low, but 21-day lows were less than 15%

- The S&P 500 has rallied 92% of the time after other signals

Measuring a divergence in new lows

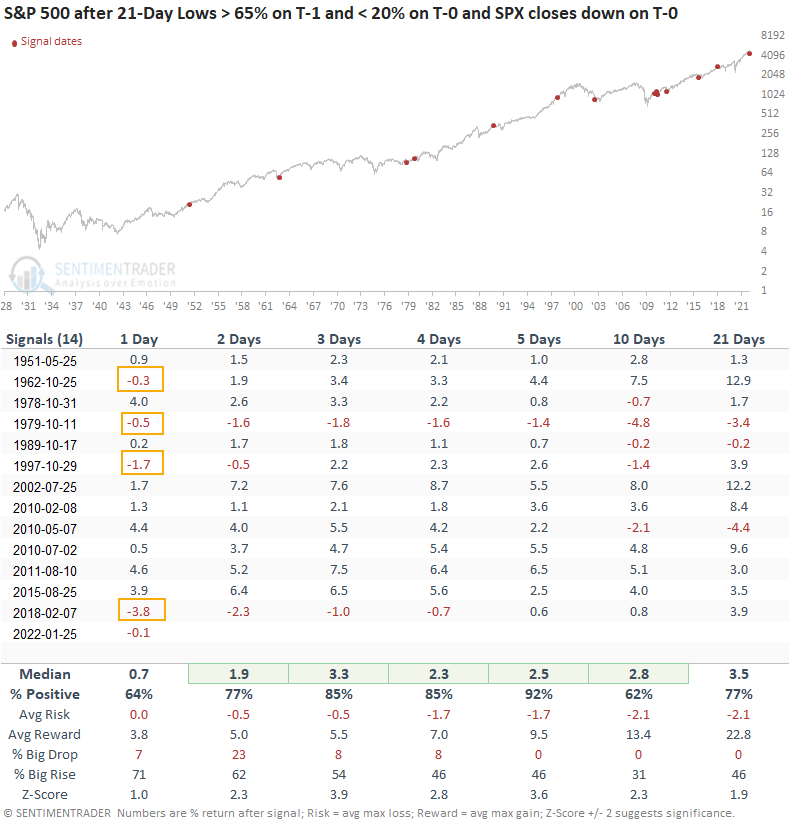

Let's assess the outlook for the S&P 500 index when the number of S&P 500 members registering a 21-day low >= 65% on T-1 and <= 20% on T-0. And, the S&P 500 index closes down on T-0. I adjusted the threshold levels to include more signals.

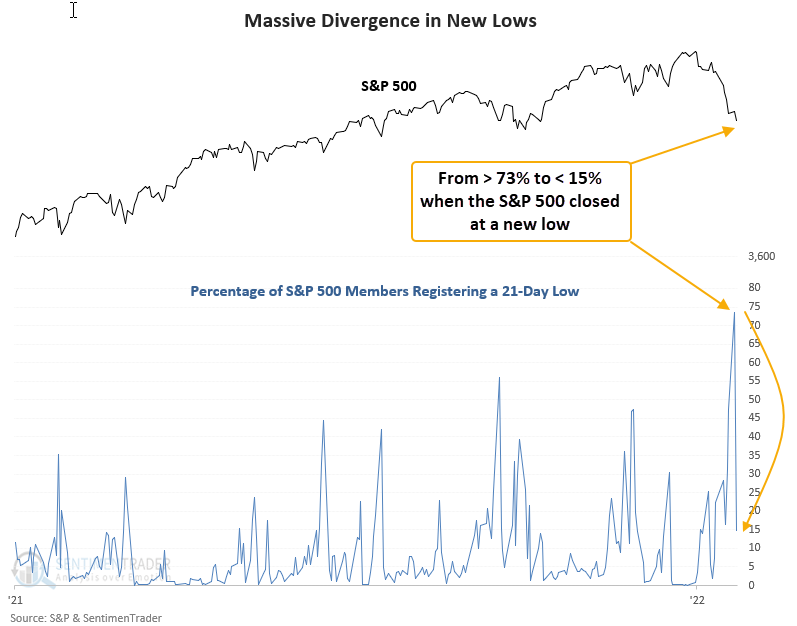

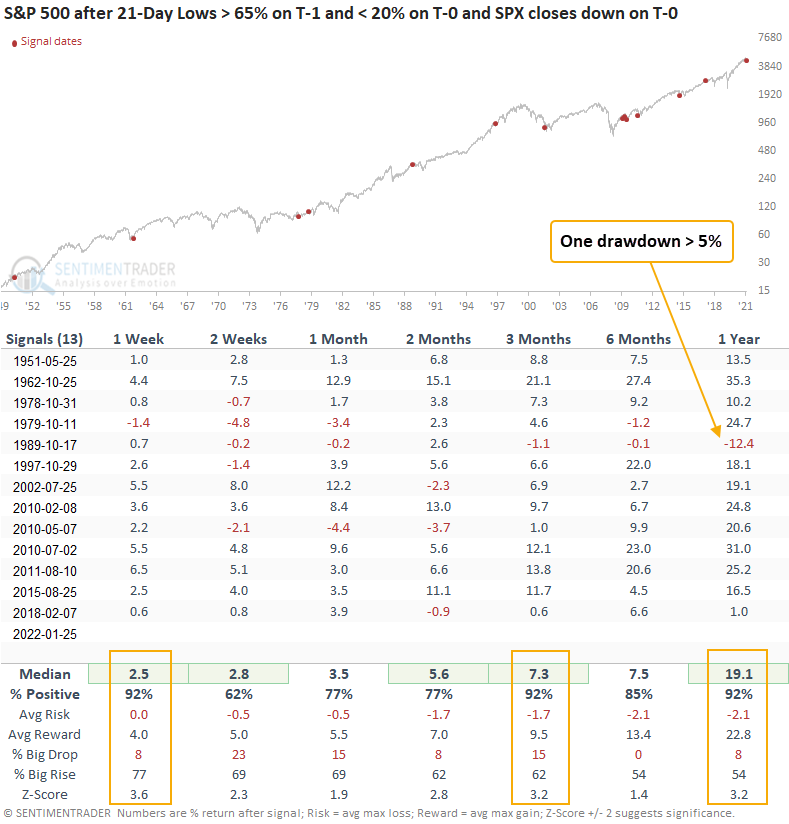

The S&P 500 rallied 92% of the time after other signals

This signal has triggered 13 other times over the past 71 years. After the others, S&P 500 future returns, win rates, and z-scores look excellent across all time frames. The study shows only 1 drawdown greater than 5% across all time frames.

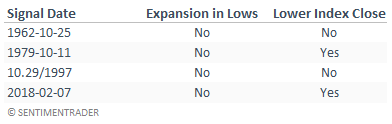

What happens when the S&P 500 closes down on the day after the signal

The short-term table shows 4 other instances with a negative return 1-day post the divergence signal. In all 4 cases, new lows did not expand above the maximum level achieved during the entire drawdown period. However, 2 of the instances show that the S&P 500 closed below the lowest close during the drawdown period. In 1979 and 2018, the S&P 500 declined by an additional 4.8% and 3.8%, respectively. Furthermore, the S&P 500 recaptured the signal date close within 31 days in 1979 and 5 days in 2018.

What the research tells us...

What the research tells us...

When new lows contract as an index closes at a new low, the improvement in market breadth creates a bullish divergence pattern. Similar setups to what we're seeing now have preceded rising stock prices with solid risk/reward profiles across all time frames. When it comes to divergence signals for new lows, all bets are off if lows expand beyond the maximum level achieved during the drawdown period.