A commodity super cycle with no losers

It's been a heckuva run for most assets in recent months, even formerly left-for-dead ones like commodities.

More and more, there are calls that we're in the beginning of a commodity super-cycle, those multi-year cycles when broad baskets of things that people pull out of the ground actually rise in price.

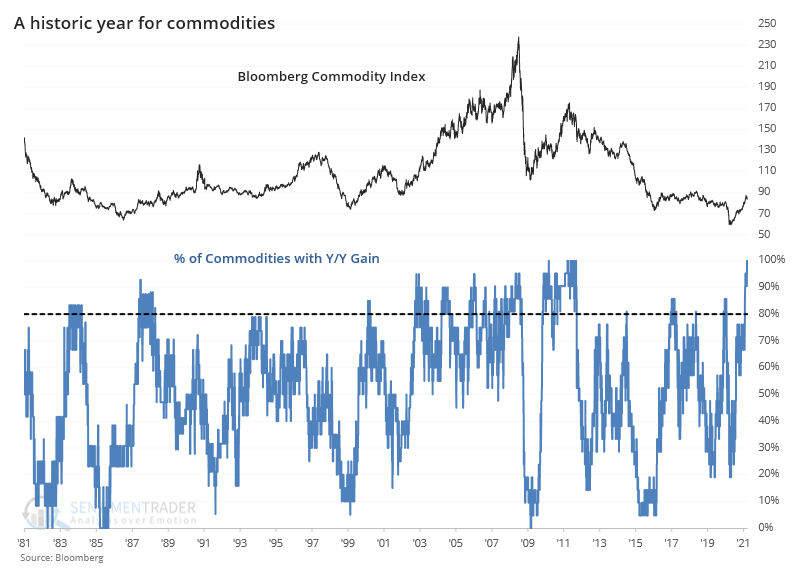

It's been a while since that concept wouldn't be laughed at. But for one of the few times in 40 years, every major commodity contract is now showing a year-over-year gain.

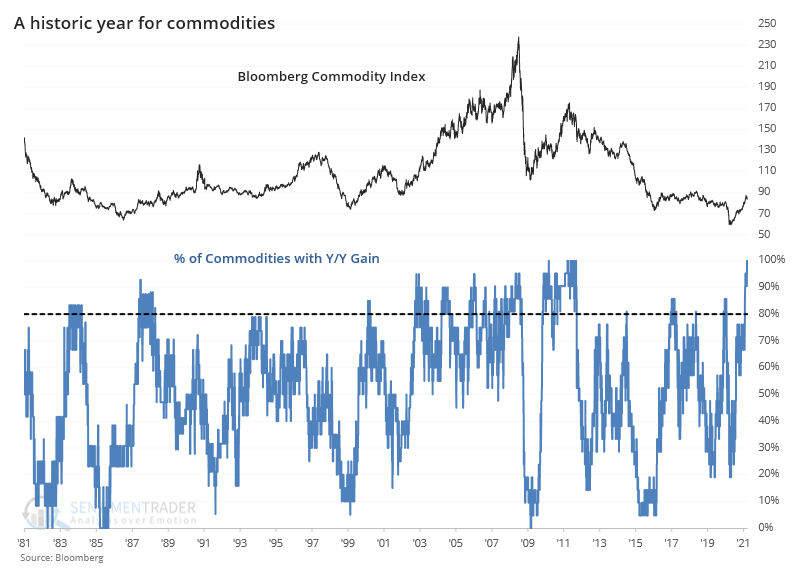

And those gains have been spectacular, with a median return of more than 50%. That's on the cusp of challenging the best median return in 40 years, with the only comparable thrust coming out of the financial crisis in 2009.

If we focus on the breadth of the price increases among commodity contracts, then we can look at other times when a majority of them were showing gains and see if it suggested a high probability that it was a new super cycle.

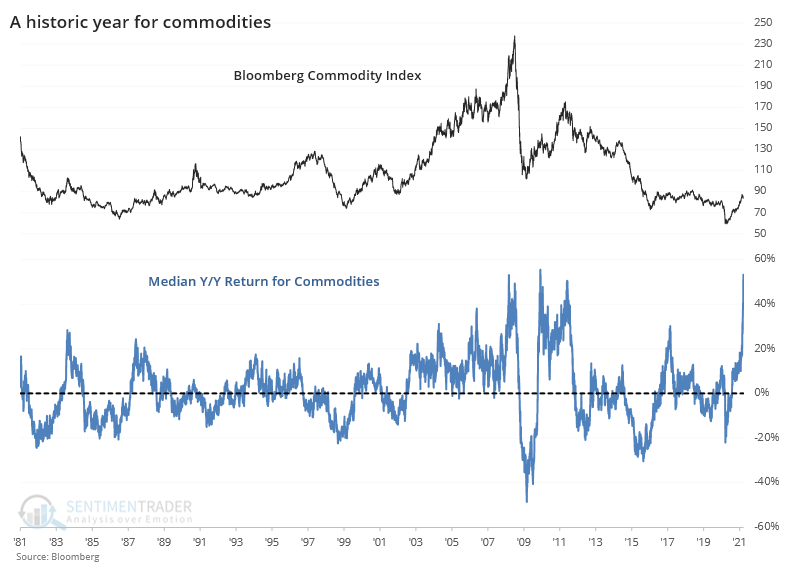

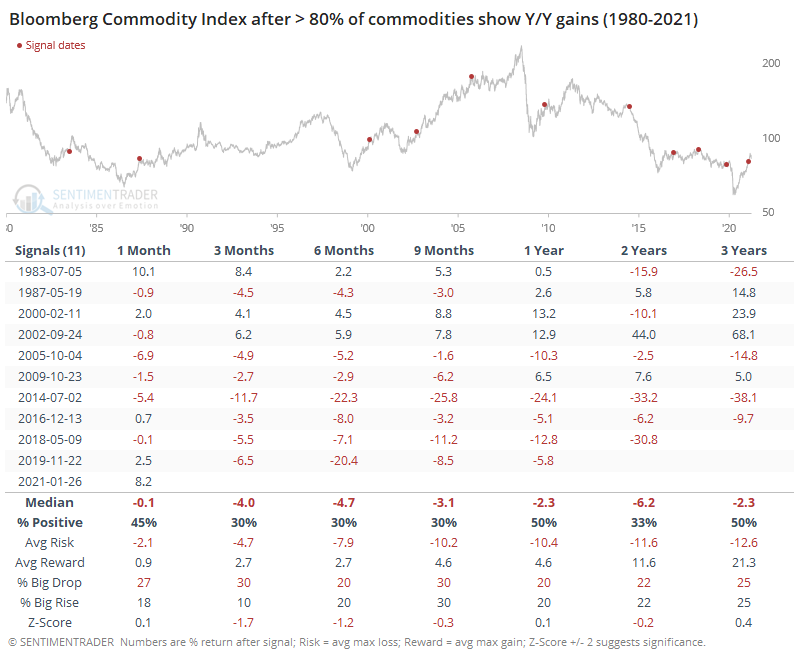

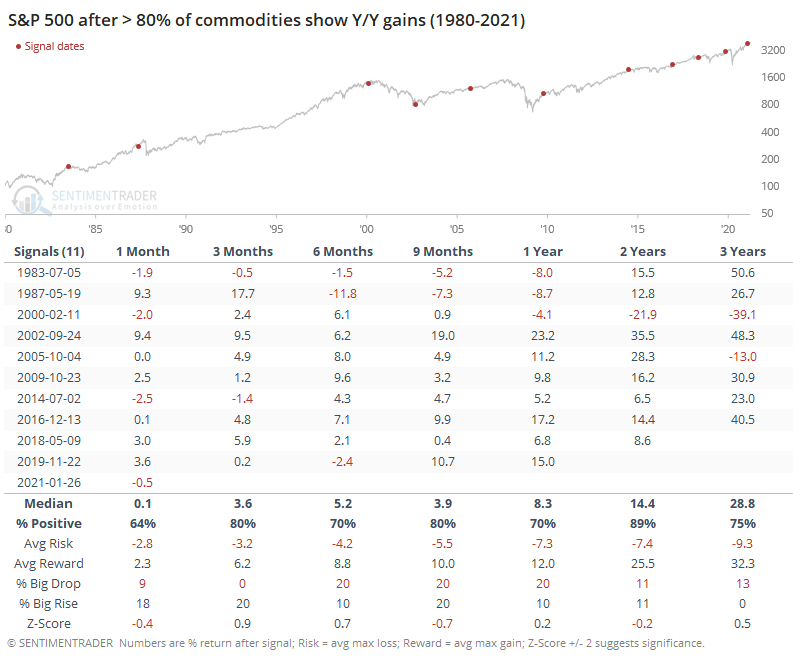

The table below shows each distinct occurrence since 1980, with forward returns in the Bloomberg Commodity Index.

It's not encouraging to commodity traders. Most of these triggered near the peaks of swings in the broader commodity complex, and future returns were very poor, especially in recent years. That's not to say there weren't exceptions - it did precede consistent gains in 2002, and even in 2000, most of the time frames showed gains.

Notably, these commodity thrusts did, however, tend to lead to gains for stocks. Over the next 6 months, 10 out of the 11 signals preceded a gain in the S&P 500.

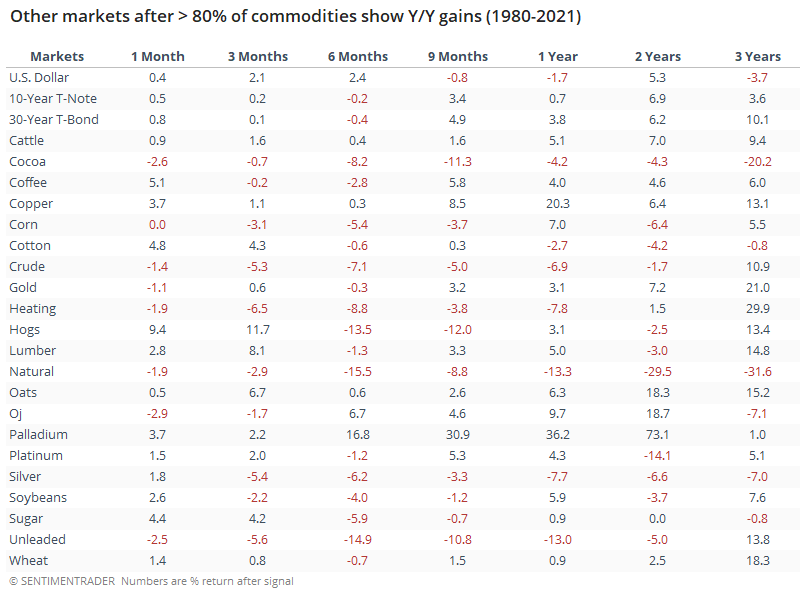

In terms of individual contracts, palladium tended to fare the best, with copper, gold, and platinum also (mostly) showing gains. Oats, wheat, cattle and orange juice showed the best returns among other contracts.

Whenever we see moves like this, there is a strong tendency to assign a narrative and make assumptions based on predictions about the future. Some of those will undoubtedly prove astute.

We focus much more attention on quantifying how investors tended to behave under similar market movements to glean insights on how they might react going forward. Based on that alone, the other times we saw broad-based and massive swings in commodity contracts, investors showed more of a tendency to pull back rather than press those bets, especially over the medium-term. Commodity bulls need to pin their hopes on the idea that this is more like 2002 and less like most other historical periods.