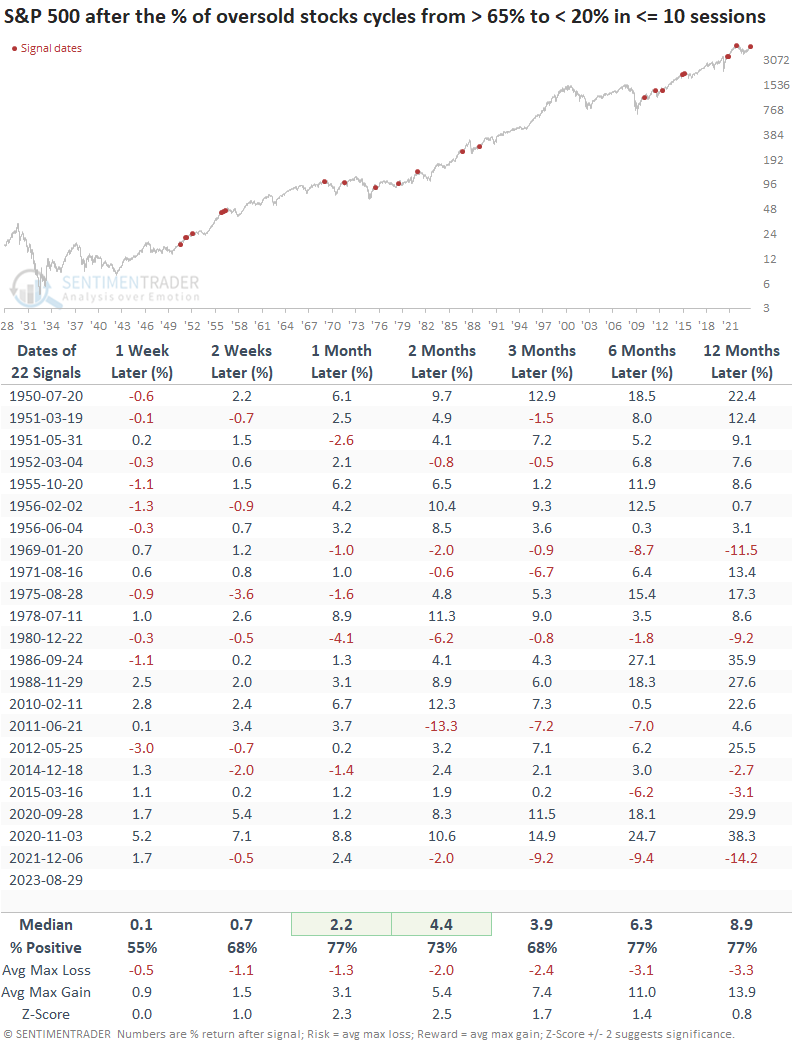

A bullish reversal from an oversold condition

Key points:

- The percentage of oversold stocks cycled from greater than 65% to less than 20% in seven sessions

- Similar oversold reversals in an uptrend led to mostly higher stock prices over the next two months

Should we buy the dip?

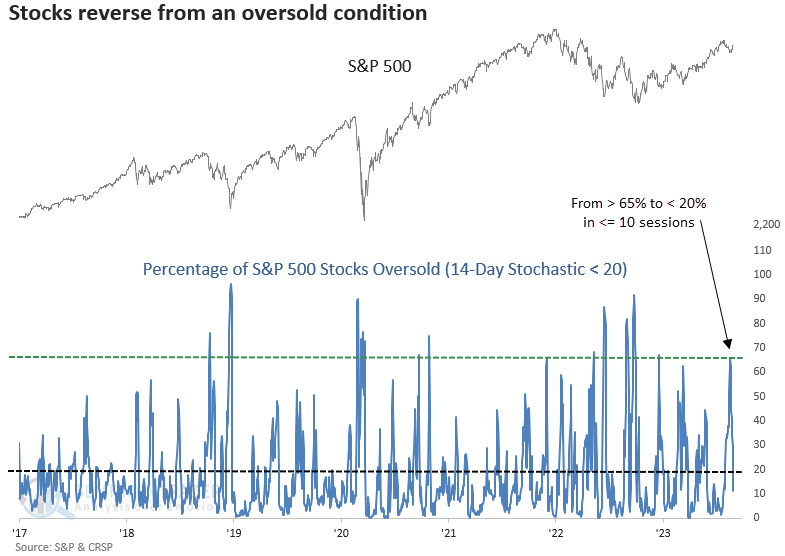

The recent pullback in the S&P 500 appears to be a routine correction, with the index falling almost 6% on a peak-to-trough basis. Shallow drawdowns are typically associated with oversold conditions from short-duration breadth-based indicators. Long-duration measures tend to hold up, as I highlighted in my note titled, a bullish increase in new lows.

One short-duration indicator that reached a washed-out status is the percentage of oversold stocks. This breadth-based time series measures how many issues have fallen below a reading of 20% using a 14-day stochastic.

The percentage of oversold stocks in the S&P 500 rose above 65% on 2023-08-18. Subsequently, it reversed below 20% in ten or fewer sessions, triggering a bullish reversal signal within an uptrend.

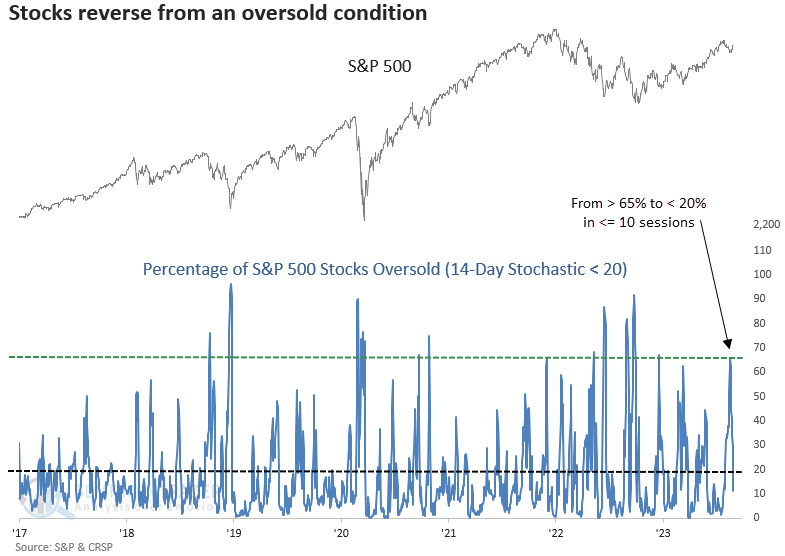

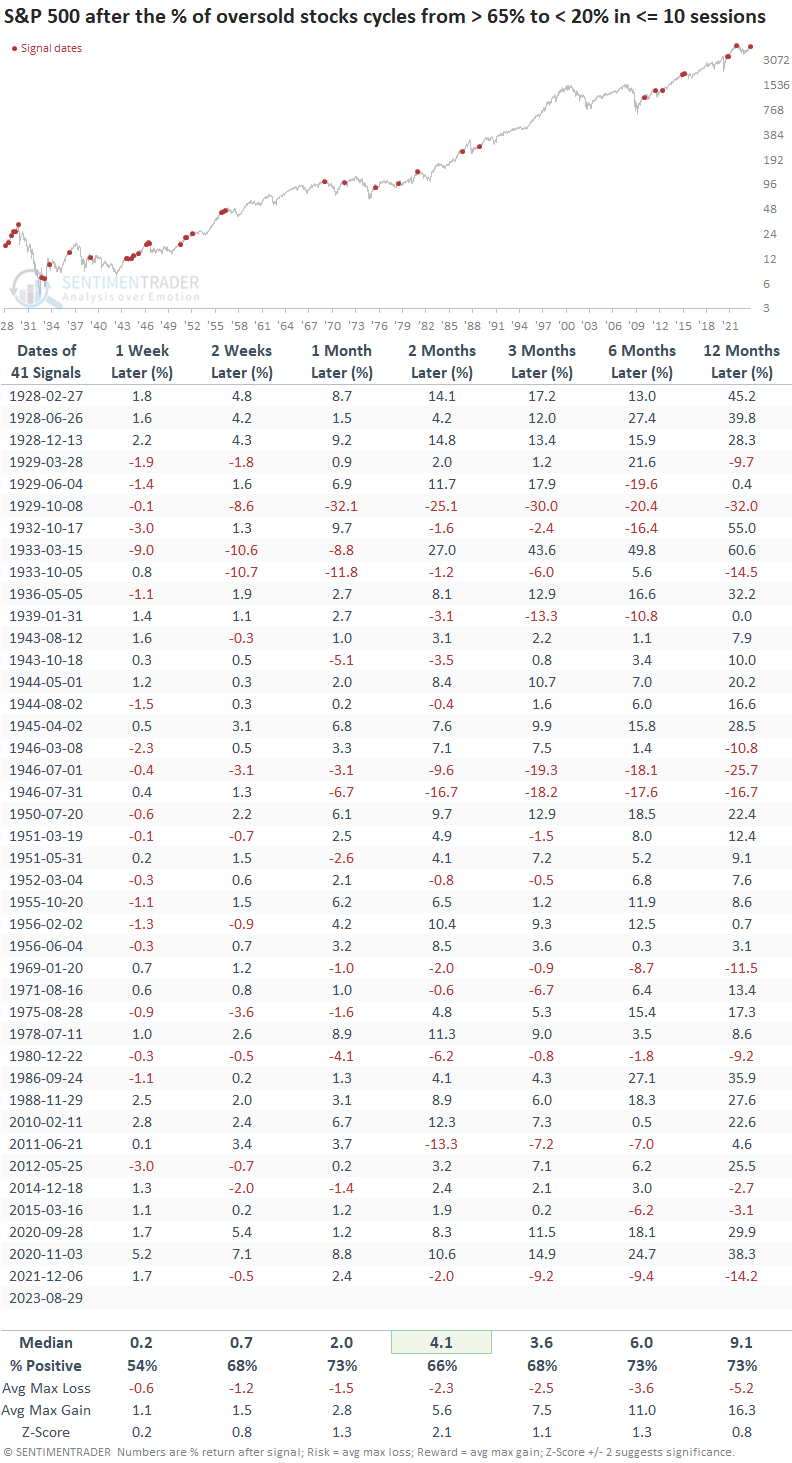

Similar oversold reversals in an uptrend led to positive returns

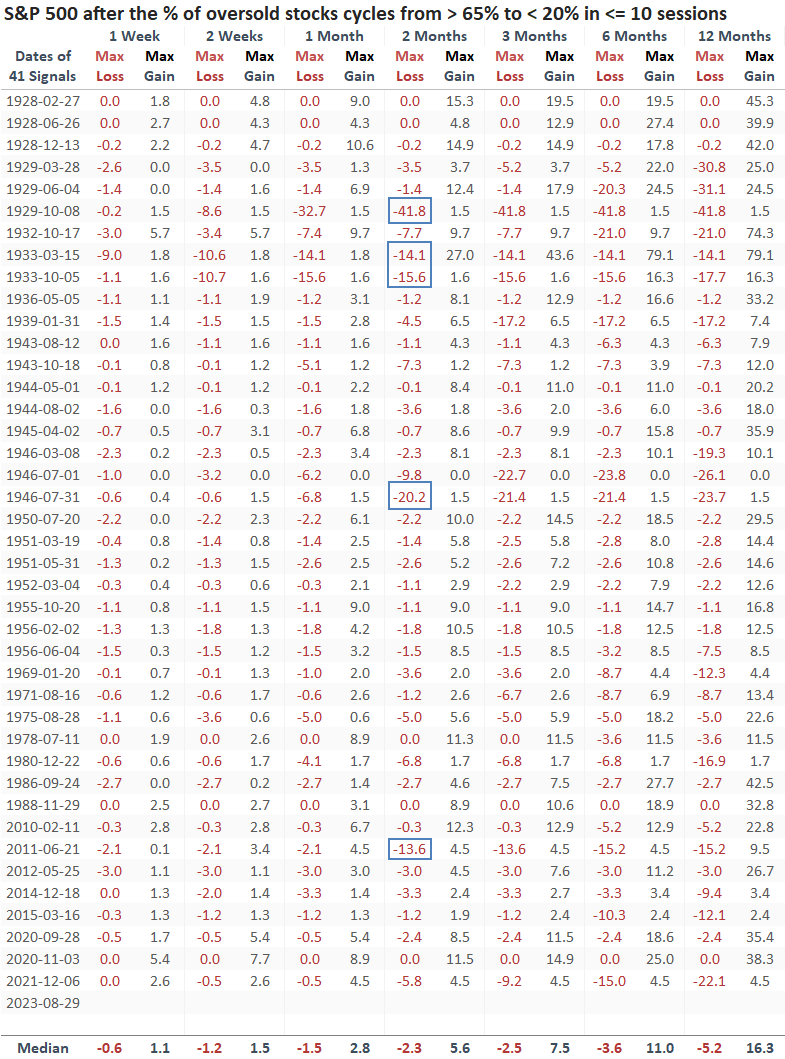

When the percentage of oversold S&P 500 stocks (14-day stochastic) cycles from greater than 65% to less than 20% in ten or fewer sessions with the S&P 500 above its 200-day average, the world's most benchmarked index tends to reestablish its uptrend. Over the next two months, the S&P 500 was higher at some point in 39 out of 41 precedents.

If I include a sell condition to the study that exits the S&P 500 when the index closed at a 20-day high or low, whichever occurred first, the S&P 500 closed at the 20-day high 80% of the time. So, the odds favor a new year-to-date high for the S&P 500.

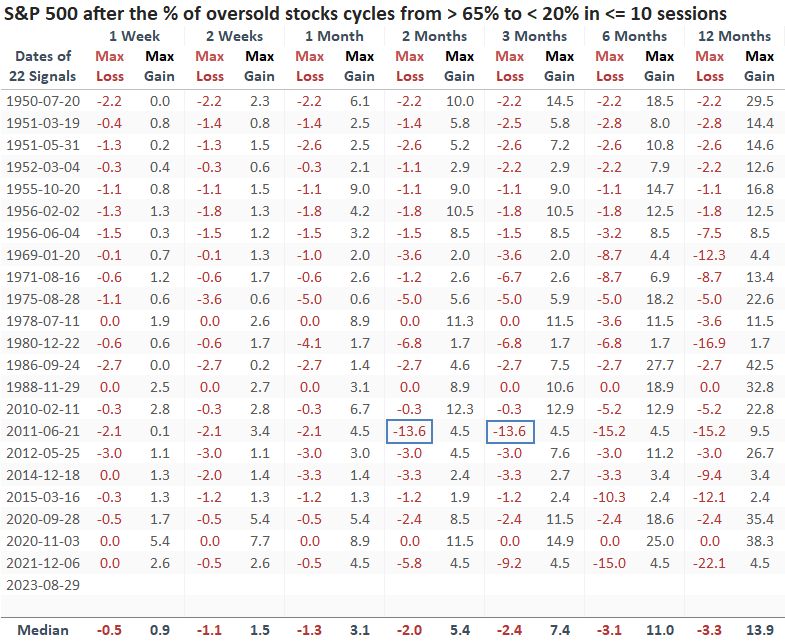

The danger associated with buying oversold conditions is that the alleviation of selling pressure might manifest as a short-lived relief rally that eventually proves unsuccessful, causing stocks to record even lower lows. Considering that just five precedents display a maximum loss exceeding -10%, the likelihood of a substantial drop from this point seems minimal.

Results since 1950

Suppose we examine precedents after the 1929-42 secular bear market. In that case, the results are more favorable. Over the next two months, the S&P 500 was higher at some point in all but one case.

Since 1950, only one precedent resulted in a max loss of greater than -10% over the subsequent two and three-month time horizons.

What the research tells us...

The S&P 500 and other indexes have experienced a second drawdown phase in 2023, causing multiple short-duration breadth indicators to reach levels commonly associated with a standard bull market correction. On such indicator, the percentage of oversold stocks rose above 65% and subsequently reversed below 20% in fewer than ten sessions. After similar signals, the S&P 500 demonstrated a tendency to restore its uptrend. This was especially pronounced starting in 1950.