A Big Turnaround in Financials' Medium Term Trends

Financial stocks have had a big thrust in recent weeks. Dean has highlighted this several times in the premium notes (here and here).

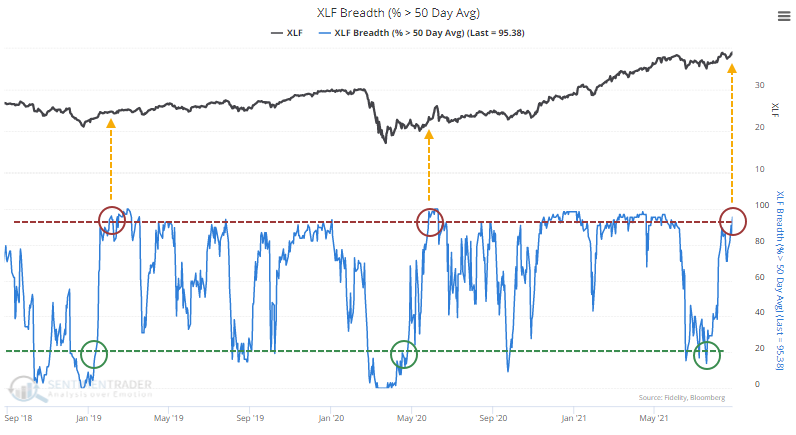

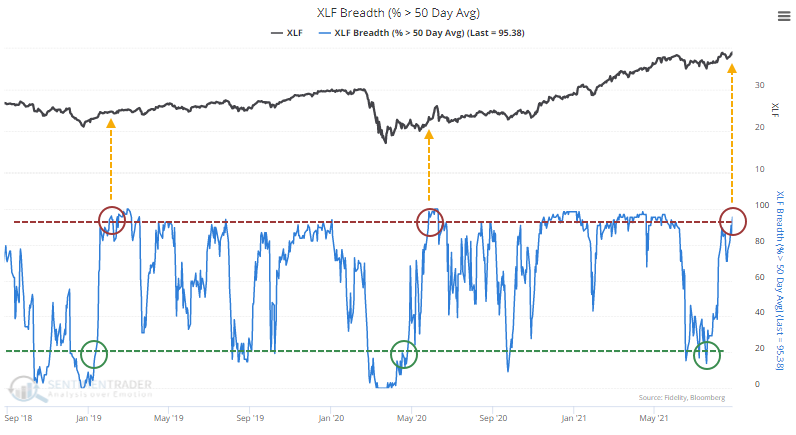

After lagging the broader market and reaching modest oversold levels in June and July, the estimable Liz Ann Sonders noted that the percentage of Financial stocks trading above their 50-day moving averages has gone from a low level to a very high one.

Within 30 days, the sector cycled from having fewer than 20% of its members above their medium-term averages to having more than 95% of them above.

In the past five years, the only times this has triggered were February 2019 and May 2020, both leading to double-digit gains.

A GOOD SIGN OF A QUICK SHIFT IN SENTIMENT

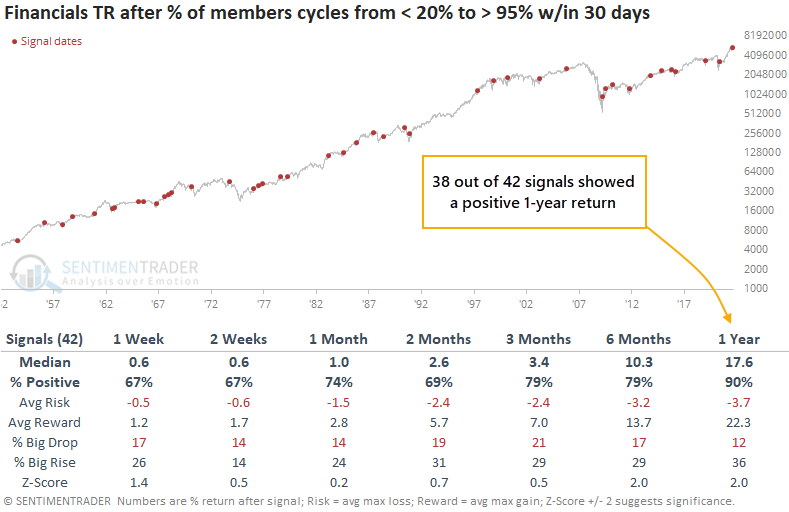

Whenever medium-term participation in Financials cycles from a low to a very high level in a relatively short number of days, the sector has tended to keep going. There have been 42 such signals over the past 70 years, and 38 of them led to a positive one-year total return (with one of the losses being a minuscule -0.3%).

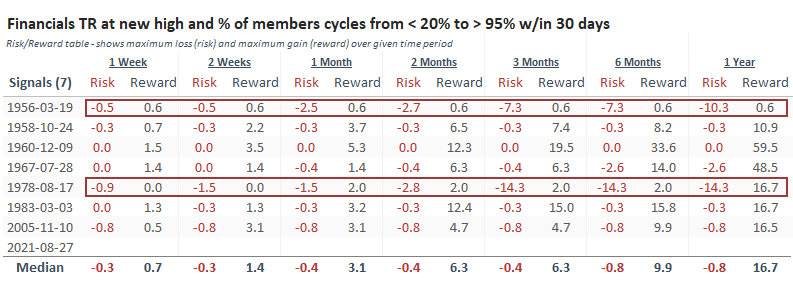

Context is important, so the table below narrows down the signals to only include times when Financials were not in a correction at the time.

Again, returns going forward were good, with the most impressive returns being over the next two months. Reward was more than 5 times risk, and only one signal showed a loss greater than -3.1% (granted, that was a large loss).

WATCH THE DOWNSIDE

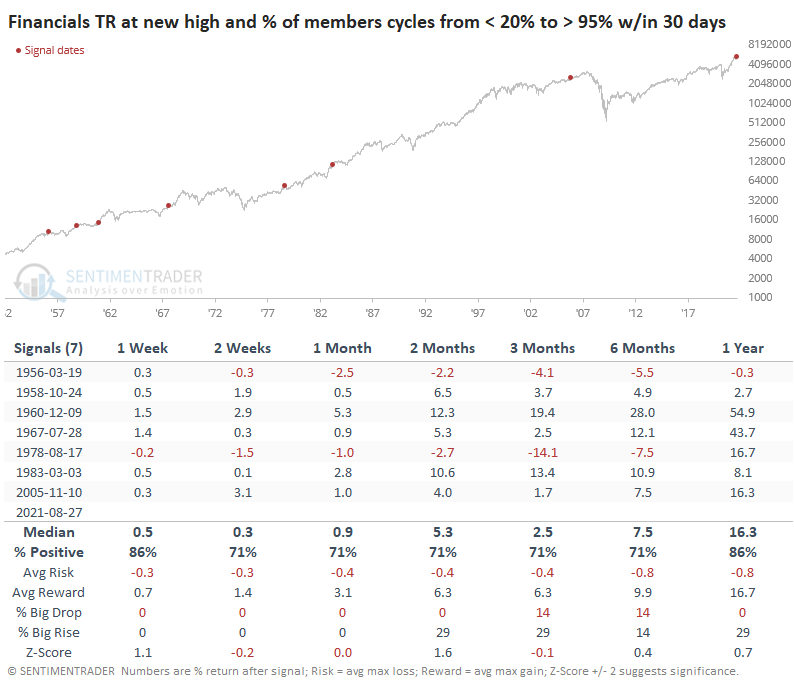

The more we restrict the conditions, the smaller the sample size, but at the same time, get closer to conditions like we have now. So, if we look only at signals that triggered when Financials were sitting at a new high at the time, there was only one (temporarily) large loss.

Again, the most impressive aspect was the risk/reward ratio, which we can see in more detail in the chart below.

It's interesting to note that the two losing signals started losing almost immediately, with very little upside. The five winning signals started winning almost right away, with minimal downside. It's tough to read that much into such a tiny sample size, but it would suggest that if Financials can keep buyers' interest in the week(s) ahead, then it bodes well for the longer term as well.