3 Reasons to be Concerned About Bitcoin's Prospects

Cryptocurrencies have had one of the most explosive weeks in years.

After a plunge, recovery, plunge, and another recovery, traders became pessimistic enough to push some sentiment gauges to their lowest level in a year or more, which is already leading to a short-term bounce.

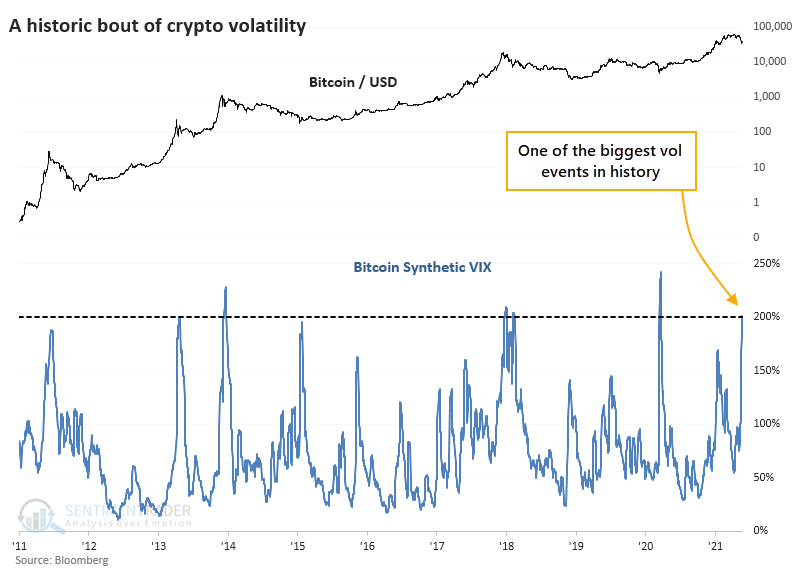

More than any other factor, volatility drives sentiment, especially in this market. So if we focus on that, we can get a handle on similar conditions.

One of the better ways to do this is to use the same calculations to create a synthetic VIX for stocks, which we last discussed in July. The calculation is based on five different models using open-high-low-close data.

This isn't as clean for crypto because there isn't necessarily a good cutoff point to determine trading sessions. We rely on Bloomberg's data of the Bitcoin/USD cross rate to determine session times.

When we use these models to craft a synthetic VIX, it spits out a number that has been matched few times in bitcoin's history, at just over 200%.

The only time that a volatility event like this marked a bottom was in March 2020, at the height of pandemic-related liquidations. That came after eight months of selling pressure, while this one did not - crypto markets were hitting record highs only a month ago.

There were three other times when bitcoin was recently at a peak, and then volatility spiked, twice in 2013, then again in 2017. All three preceded large and persistent losses for the coin.

| Stat Box Our Optimism Index Geo-Map shows that among all countries, investors are the least optimistic about Chile. Its 20-day Optimism Index just dropped below 25. Over the history of the ECH fund, our Backtest Engine shows 9 other signals. It was too early during the pandemic, and outright failed in 2013. But the 7 other signals all preceded rallies over the next two months averaging more than 7%. |

What else we're looking at

- Full details following volatility spikes in bitcoin

- What happened after long uptrends in bitcoin came to an end

- Returns following bouts of extreme short-term bitcoin pessimism

- A measure that shows a new extreme in corn

- A way to take advantage of a QQQ Bollinger Band signal using options

- Stocks in Taiwan have triggered another notable trading signal