Why the recovery in Consumer Staples looks promising

Key points:

- Consumer Staples stocks have enjoyed a quick thrust in short-term breadth

- There is also a long-term recovery in internal momentum

- Corporate insiders have pulled back on selling

- Each of those factors has typically led to solid medium- to long-term gains for Staples

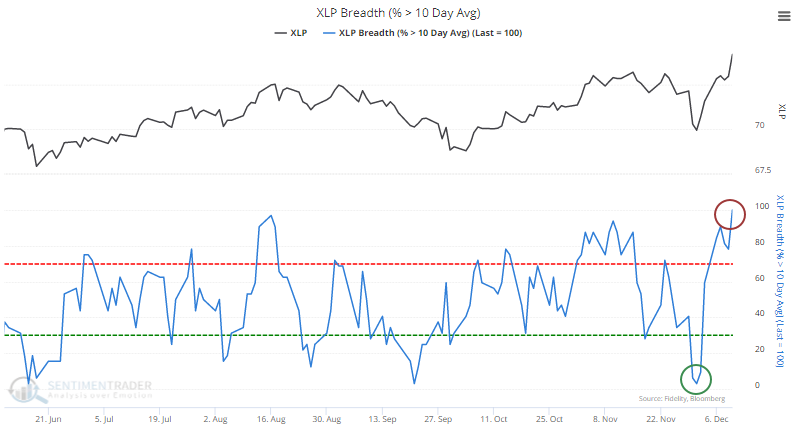

Short-term thrust in Staples

While breadth in more speculative areas is struggling, it most certainly isn't among more defensive names. On Monday, we saw how internals on the Nasdaq 100 are lagging the index. Broader breadth has been pretty good, even thrusty, and that's thanks to other sectors like Consumer Staples.

Heading into this week, there was a massive and sudden shift in short-term trends in Staples. Within a little over a week, fewer than 5% of stocks in the sector were trading above their 10-day moving averages, and then every single one of them was.

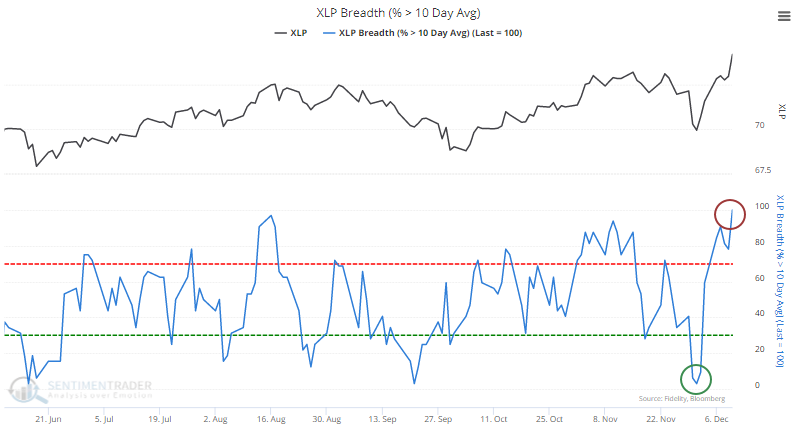

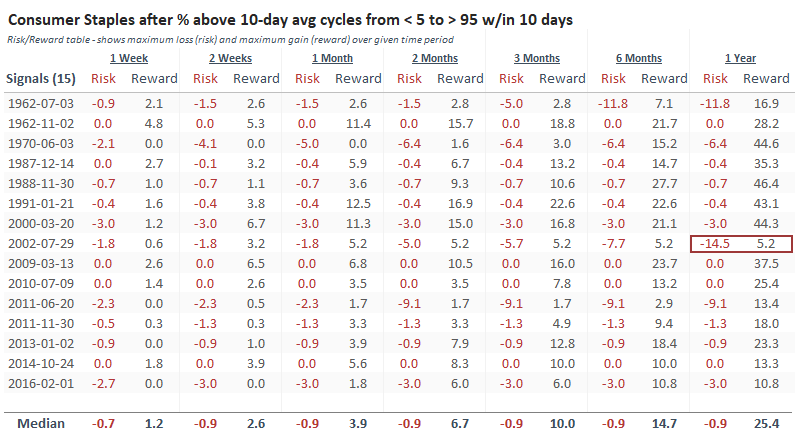

Even though it's a shorter-term gauge, we've seen that quick shifts suggest a reliable change in sentiment in prior years. That has been the case for Staples as well. Out of 15 signals, there were few losses after a month and beyond.

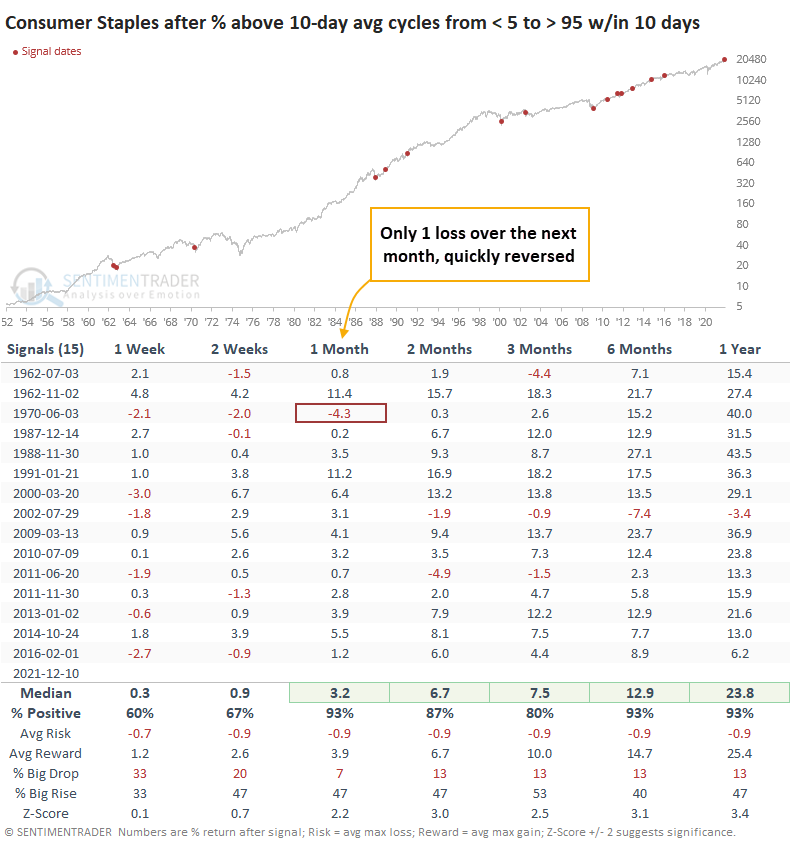

The precedents showed an excellent risk/reward profile and probability of a big rise versus a big drop. While a couple of the signals ended up giving back the early gains, the sector continued to enjoy large and consistent gains in the months ahead overall.

Looking at the Risk/Reward Table, only 1 of them showed more risk than reward during the following year; the others were heavily skewed to "reward."

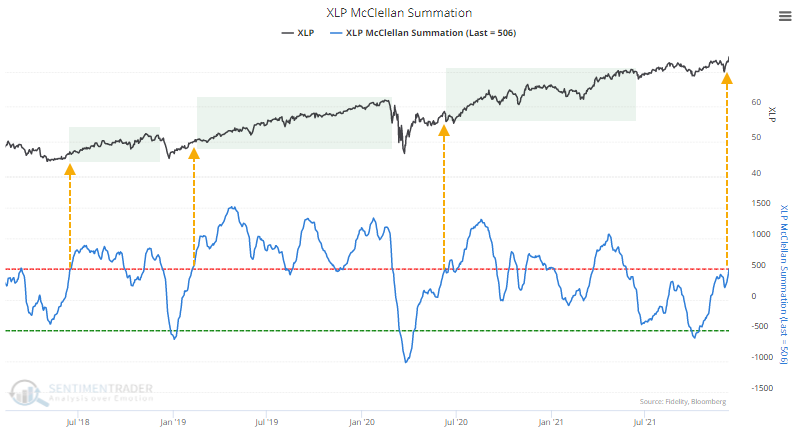

Staples' longer-term recovery

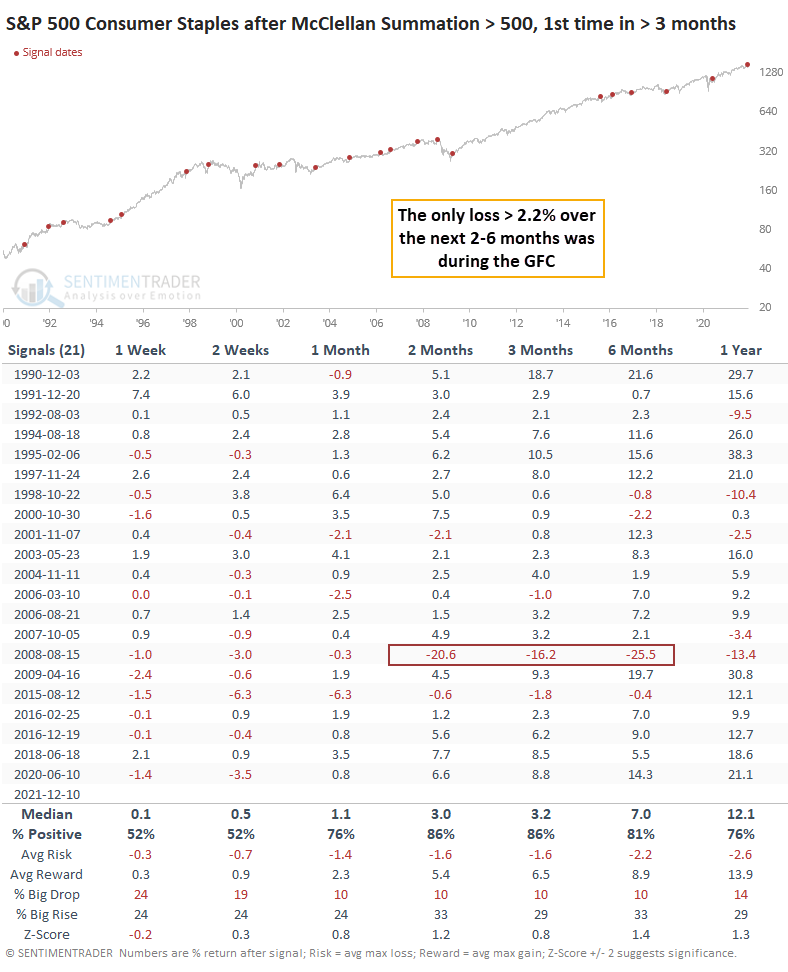

The short-term reversals in many stocks have helped push the long-term McClellan Summation Index for Staples above +500 for the first time in more than 6 months. In recent years, a move above +500 was the kick-off before significant, sustained gains in the sector.

Looking back more than 30 years, the first reading above +500 in several months preceded consistent gains. The only loss of more than 2.2% during the next 2-6 months was during the Great Financial Crisis.

Dispersion is high as the smart money pulls back on selling

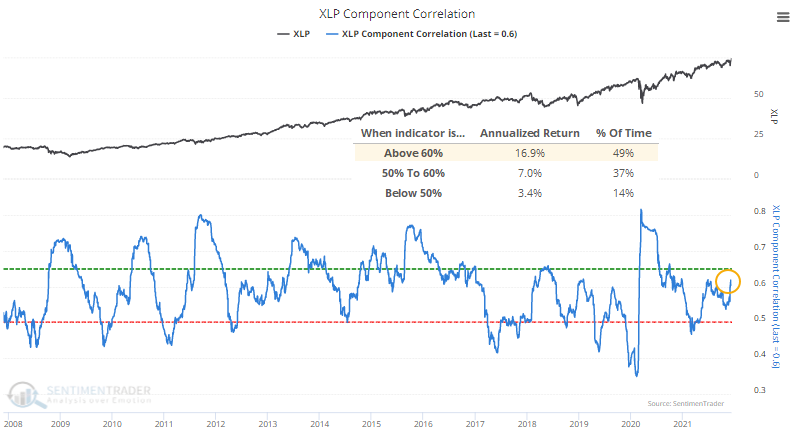

Even though Staples stocks have been doing well, there is still some dispersion within the stocks in the sector.

The component correlation between the average stock and the index is still relatively high. That's a good thing; it suggests a healthy amount of investor skepticism. We should worry more when correlation among the stocks is low because it highlights periods of complacency.

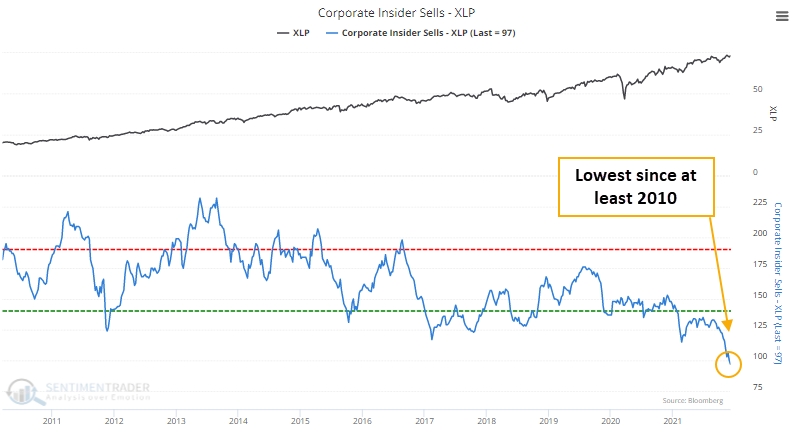

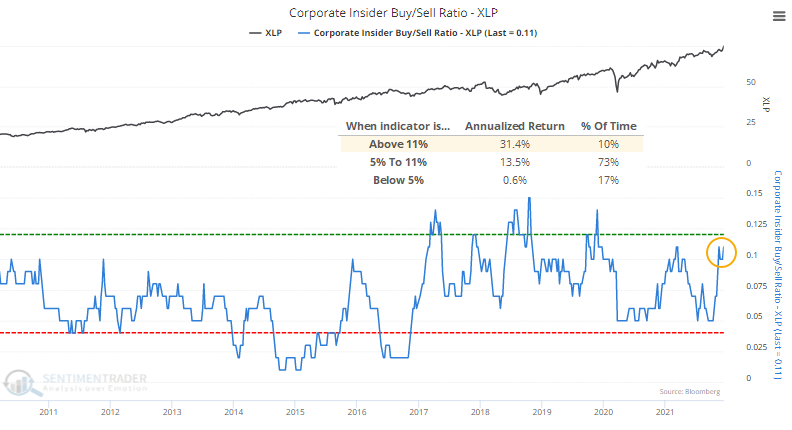

Buying activity hasn't been very inspiring among corporate insiders, but selling transactions have dropped off to a decade low.

That dynamic has kept the Corporate Insider Buy/Sell Ratio for the sector on the upper end of its range. Annualized returns were impressive when the ratio was high, well above returns at the opposite end of the spectrum.

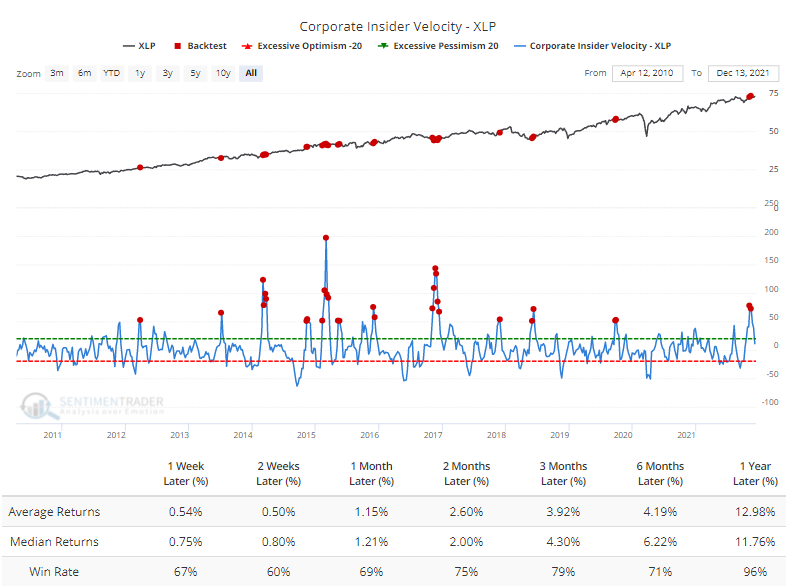

The recent jump in insider buying versus selling transactions pushed Insider Velocity above 50%, which the Backtest Engine shows was a good sign for future returns, especially over the next year.

What the research tells us...

From a broader market perspective, it's curious that we see negative thrusts and divergences in higher-risk areas like the Nasdaq 100 and the opposite in defensive sectors like Consumer Staples. That's not a big vote of confidence in stocks in aggregate.

For Staples themselves, this kind of activity has been a good sign for the medium- to long-term. Staples have a poor seasonal window during January-February, and other indicators are mostly neutral. But the combination of a positive short-term thrust under the surface, improving long-term internal momentum, and a lack of insider selling suggests higher prices.