Why the Nasdaq's retracement is so important

The Nasdaq's very quick retracement

In April 2020, we looked at the idea that it's the retracements that matter. At the time, technicians were griping about so-called Fibonacci retracements and the mystic fantasy that auction markets driven by semi-rational actors adhere to a cosmic sense of proportion. They don't.

During bear markets, there typically is not a strong impulse among buyers, and stocks have a hard time retracing much of their decline. That is most certainly what did NOT happen in April/May 2020, and it's not what's happening right now.

Only 15 days from its latest 52-week low, the Nasdaq Composite has already retraced 56% of its decline. That's almost exactly the same retracement the Nasdaq clawed back in the first 15 days of the rally in 2020.

As we saw 2 years ago, swift and significant retracements of declines between an index's latest 52-week high and low have a strong tendency to occur at meaningful troughs.

There have been 12 retracements of 25% or more after 15 days from a low in the Nasdaq Composite's history. Over the next 2 months, there was only a single loss, and the risk/reward was massively skewed to the upside.

Contrast that to rallies that retraced less than 25% of their decline in the first 15 days. This was twice as common, and most of these ended up failing, leading to losses and lower lows. Bear markets tend to see weak buying pressure that falters quickly.

Seasonality and the election cycle

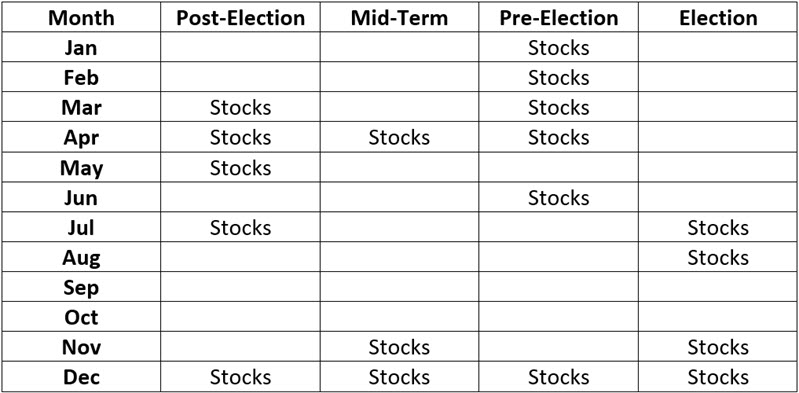

Jay views the Election Cycle as 12 months per year for four separate years - Post-Election, Mid-Term, Pre-Election, and Election. The theory is that the stock market performs better during certain months within this 48-month cycle than during other months. The full cycle appears in the table below.

The 18 months containing the word "Stocks" implies that we want to be in the stock market during these months. These are "favorable" months. Stocks are essentially neutral during months that do not contain the word "Stocks." They should not be considered outright bearish (although long-term results during these months have been quite unfavorable).

Note that April of 2022 is listed as a "favorable" month. Does this mean that stocks are guaranteed to trade higher this month? Not at all. For a better idea of what it does mean, from 12/31/1899 through 3/31/2022, the Dow Jones Industrial Average gained +587,733% during "favorable" months...and lost -84.8% during "unfavorable" months.