What this indicator is saying about investors' complacency

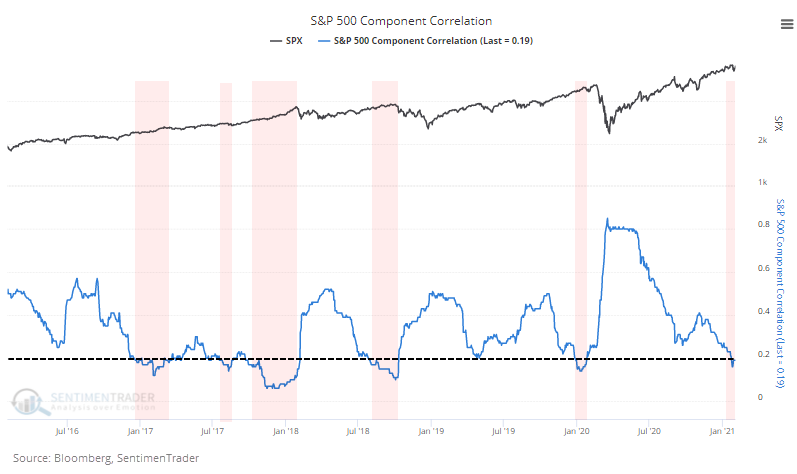

It's a truism of markets, lasting decades if not centuries, that when investors panic, they sell everything together. When they're comfortable, they buy and sell securities on their individual merits.

That's why we see correlations among stocks and other assets rise during times of anxiety and fall during periods of complacency. This is notable now because the correlation among stocks in the S&P 500 has plunged to the lowest level in over a year.

Correlations have gyrated in a wider range in recent years, so we can transform the data series above into a z-score. This compares the current reading to the average over the past year and adjusts for the standard deviation among those readings. This measure dropped below -1.5 in late January and has stayed right around that level.

When the S&P 500 has been at or near a high and the correlation z-score drops below -1.5, the index has had some trouble holding its momentum.

What else we're looking at

- Full returns following a large deviation move below average for S&P 500 member correlation

- A look at what happens to cyclical/defensive stocks, small/large caps, and growth/value following these signals

- Gold is close to ending one of the most impressive uptrends in 45 years

- What is so special about the 11th day of the month?

- A measure of gold's trend versus major currencies has hit an extreme

| Stat Box The S&P 500 has jumped more than 1% on 3 out of the past 4 days, to hit a new all-time high. It's only done this 18 other times since 1928, the last one being in June 1999. |

Sentiment from other perspectives

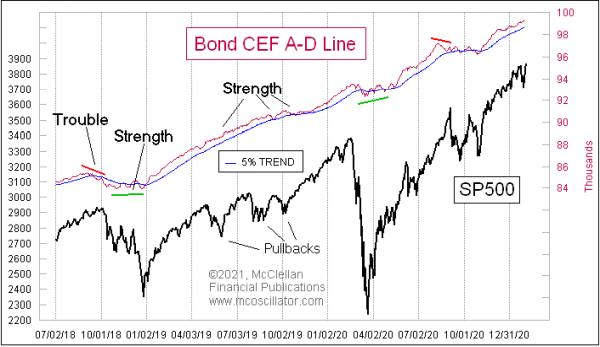

Closed-end bond funds are still holding strong. Signs that investors are euphoric are everywhere, but so far, there haven't been many signs that it's leading to a breakdown in leading areas of the market, such as credit-sensitive issues. Source: Tom McClellan

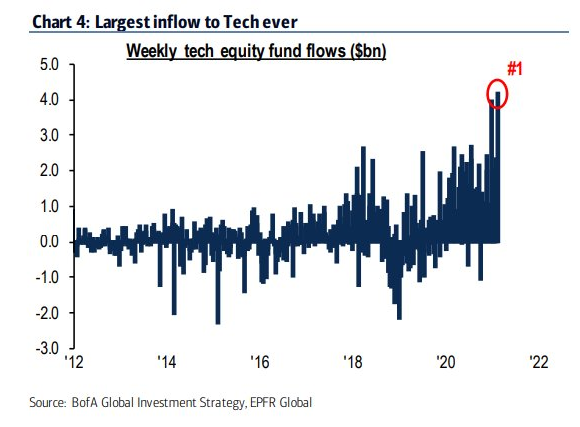

Might as well bet on tech. As long as things are humming, investors are comfortable putting a record amount of money into tech-focused ETFs. Party on! Source: Mike Zaccardi

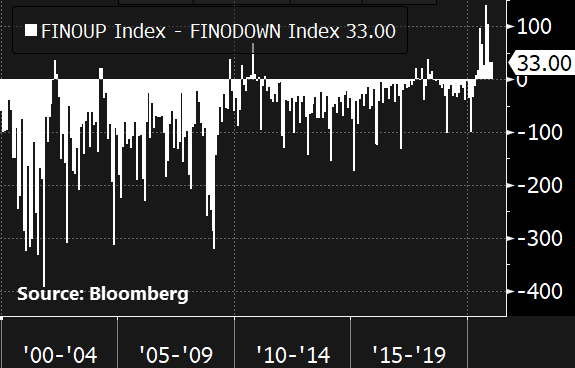

Companies are optimistic, too. The difference between the number of companies raising their financial outlooks minus lowering them has been above zero for 9 months in a row. Source: Bloomberg TV