What it means when Transportation stocks plunge

Transportation stocks' very very bad week

The public shares of companies that haul stuff got whacked this week. All 4 sub-industries of the transportation sector were down 10% or more on the same day for only the 6th time since 1969.

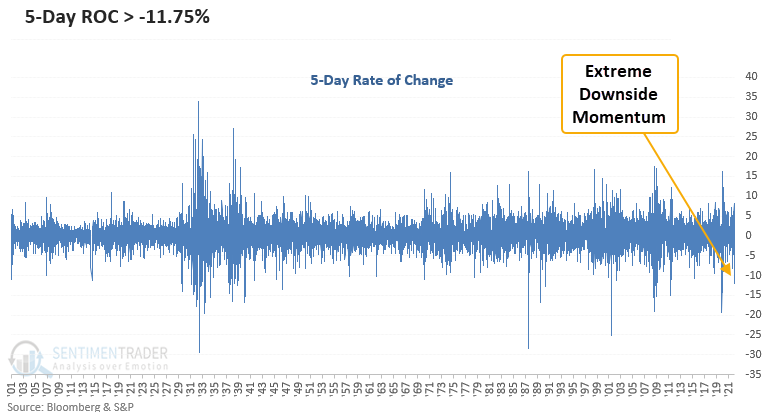

Dean assessed the outlook for the Dow Jones Transporation Index and the broad market when the 5-day rate of change declines by more than 10%, focusing on times when the S&P 500 was within 4 months of a new high.

We haven't seen this type of downside momentum in transportation stocks since the pandemic crash in 2020.

This study generated a signal 10 other times over the past 93 years. After the others, the transportation Index showed unfavorable returns up to 13 weeks later. However, the 6-12-month windows look much better.

Since the financial crisis low in 2009, the transportation industry has experienced 3 cyclical slowdowns that have not resulted in a broad economic recession. So, we need to be careful about what the transportation industry might signal concerning the overall market or a potential recession.

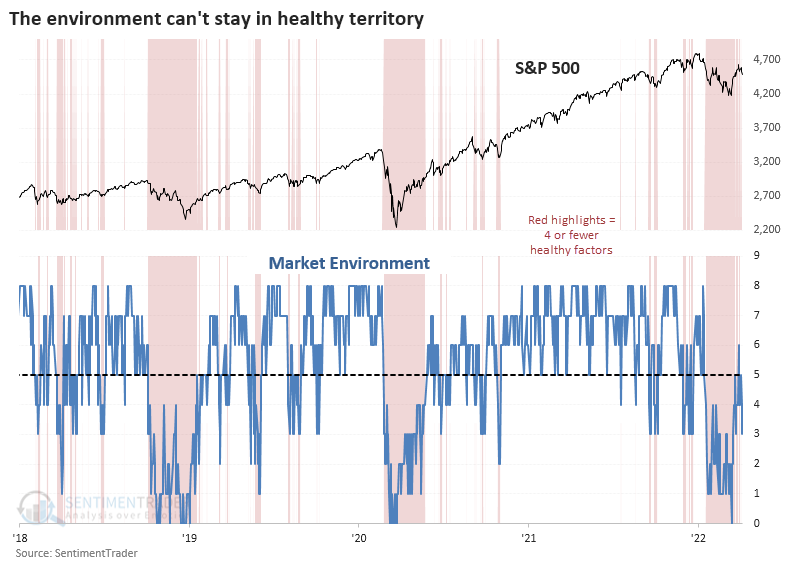

Market environment is struggling to hold turn healthy

After the most benchmarked index in the world fell into a "10-and-10" correction, buyers stepped in with force. Breadth thrusts have been recorded in indexes, entire exchanges, and even in high-yield bonds.

And yet this is all within a post-speculative sentiment bubble and a still-struggling market environment. Even after the thrusts, the environment has not managed to turn consistently healthy.

Over the past 30 years, stocks have spent 65% of the time in a healthy environment and 35% in an unhealthy one. Using next-day returns, since 1990, $10,000 grew to more than $72,000 during healthy environments and only $17,000 during unhealthy ones while suffering a maximum drawdown less than 1/3 as large.