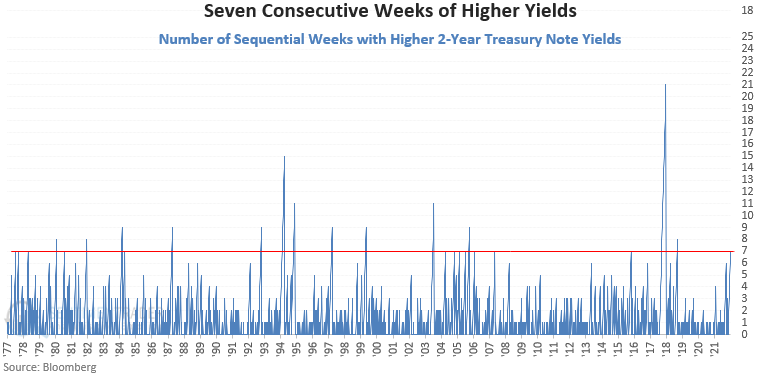

What happens when interest rates rise for 7 straight weeks

2-year yields have risen for 7 straight weeks

The 2-year Treasury note yield has increased for 7 consecutive weeks.

Dean assessed the outlook for stocks, bonds, and commodities after similar runs, screening out repeats by requiring the count to reset to zero before triggering an additional signal. This is the longest streak in several years.

This signal has triggered 25 other times over the past 45 years. Only 5 of them coincided with a significant peak in the 2-year yield. S&P 500 performance and win rates show somewhat tepid results on short to medium-term time frames.

| Stat box Traders are trying to jump on the renewed rally in semiconductors, pouring more than $850 million into the SMH semiconductor fund on Wednesday. That's the largest single-day inflow in the fund's history. |

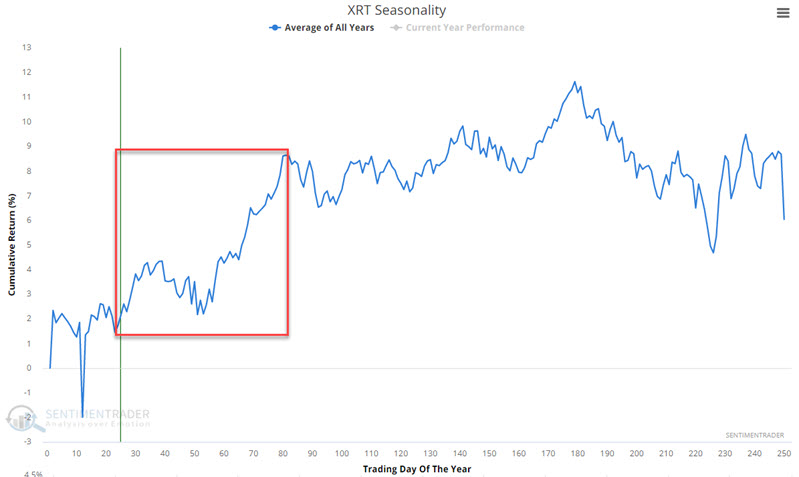

Retailing stocks are entering a positive window

Investors abandoned retailing stocks in January. Conventional wisdom argues that rising rates will slow the economy, which will be bad for the retail sector. However, sentiment and seasonality make a different argument.

Jay showed the chart of the annual seasonal pattern for the XRT retailing ETF. Note the highlighted period of strength that extends for nearly the next 3 months.

Retail stocks showed a positive return during this window during 12 out of 15 years.