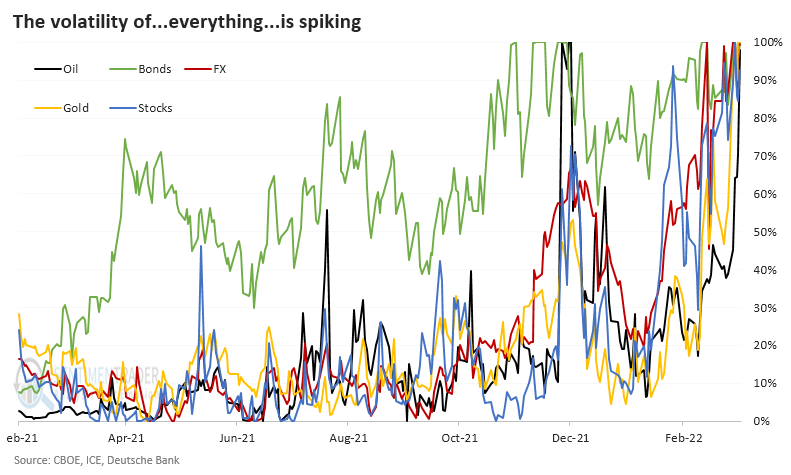

What cross-asset volatility spikes mean for markets

Options traders are pricing in volatility spikes in everything

We saw last week that while investors are pessimistic (especially in stocks), they're not panicking. When true panic grips markets, it's usually reflected in credit, and it's just not happening to any great degree yet.

That's not to say there isn't volatility. There is, and it's everywhere.

Options traders price in rising volatility in stocks almost exclusively when they're declining. That's when investors panic. But in other markets, from bonds to FX to commodities, implied volatility just as often spikes when prices are rising quickly as when they're falling. When volatility across assets spikes at the same time, you know some crazy sh** is going down.

That's what's happening right now-for one of the few times in history, implied volatility in stocks, bonds, currencies, gold, and oil is spiking simultaneously.

The average volatility gauge across markets is in the top 2% of their yearly ranges. That's an incredible bout of cross-asset concern that we've rarely seen in the past 30 years. The assets in question showed stark differences in forward returns after the other 10 spikes since 1990.

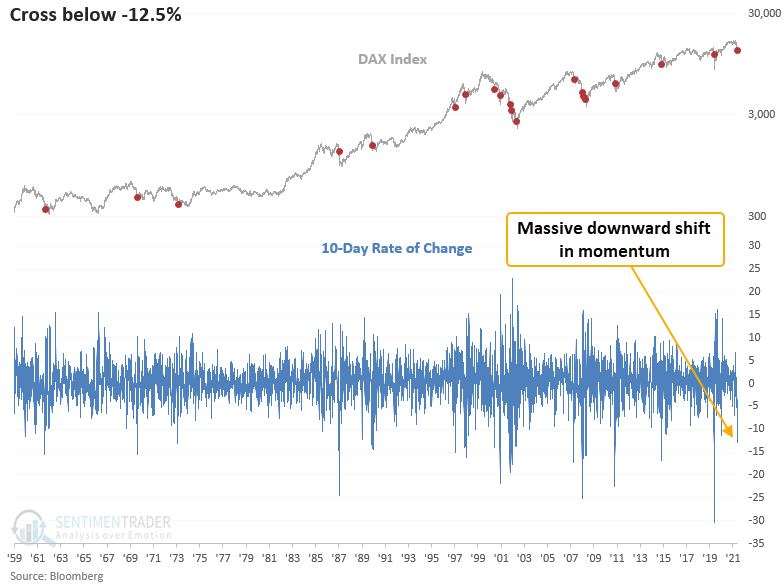

The DAX is crashing

Dean noted that among major markets, almost none are suffering more than the German DAX. The index has declined more than 12.5% over just a 2-week period, one of its worst stretches in history.

The DAX has been one of those indexes where poor momentum tends to beget more poor momentum.

Similar crashes have been triggered 19 times in the history of the index. Its forward returns were not encouraging in the short-term.