Traders seems to be betting on a volatility event

Key points:

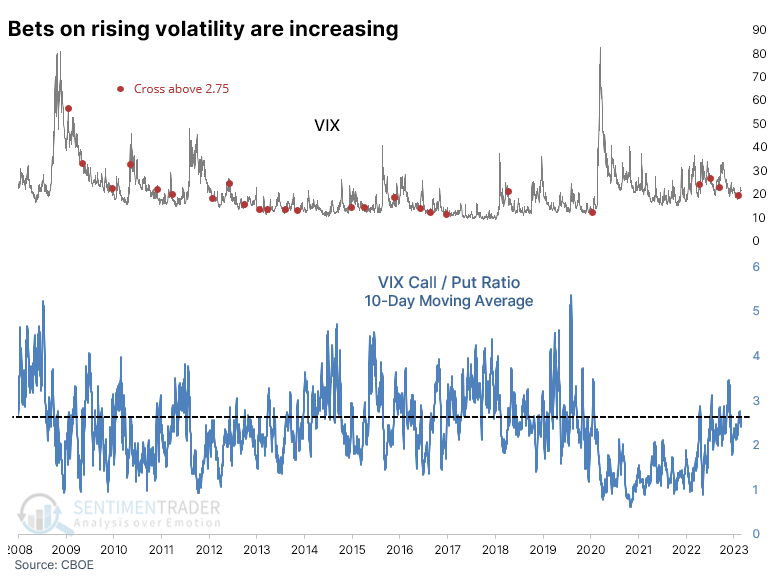

- The ratio of call option volume to put option volume on the VIX "fear gauge" is high

- The ratio of outstanding calls to puts is also high, an indication of traders betting on a volatility event

- Historically, high call/put ratios on the VIX have been inconsistent market predictors

The ratio of VIX call to put options is high and has been for months

There is always something for investors to wring their hands about. Financial media is only too eager to supply that demand because they know that fear sells. It always has and always will.

One of the latest worries is that traders are building up bets that volatility is about to increase. As noted by The Wall Street Journal:

Fear is creeping back into the stock market. To protect against a potential downturn, traders are scooping up hedges at the fastest clip since the onset of the Covid-19 pandemic. More call options betting that the Cboe Volatility Index, or VIX, will rise have changed hands on an average day in February than at any time since March 2020, Cboe data shows.

There are guesses about who is placing the bets and what it might mean for stocks. However, there isn't any hard data, so let's plug that gap.

Over the past ten days, the ratio of call option volume to put option volume has risen, but it's been elevated for months. It's in the upper end of its range, but nothing extreme. When the ratio crossed 2.75, which it did recently, it didn't mean anything consistent for the VIX.

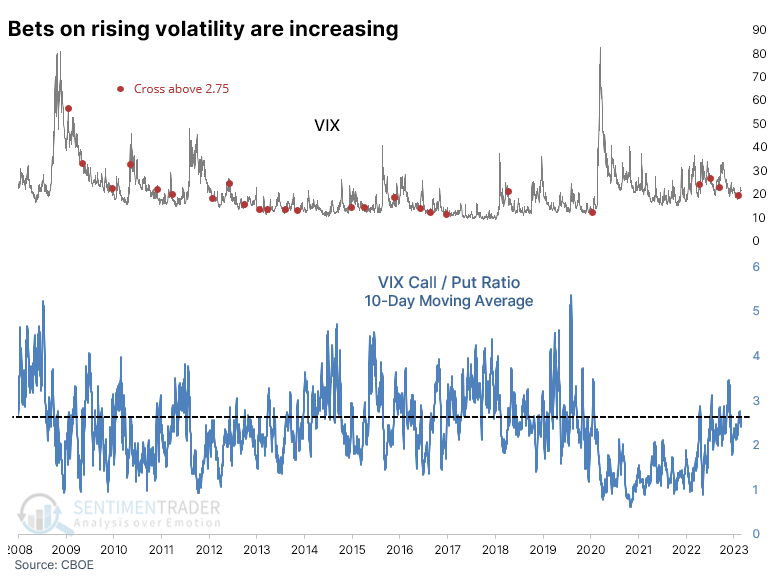

The VIX is almost impossible to trade, as the ETF proxies are nearly perfect wealth-destroying machines. If we look at rises in the VIX Call/Put Ratio and their impact on an index like the S&P 500, there wasn't much cause for concern. It did precede a few nasty drawdowns, but over the next two months, 13 out of 15 signals saw a rally in the S&P (both of the negative returns were double-digits, though).

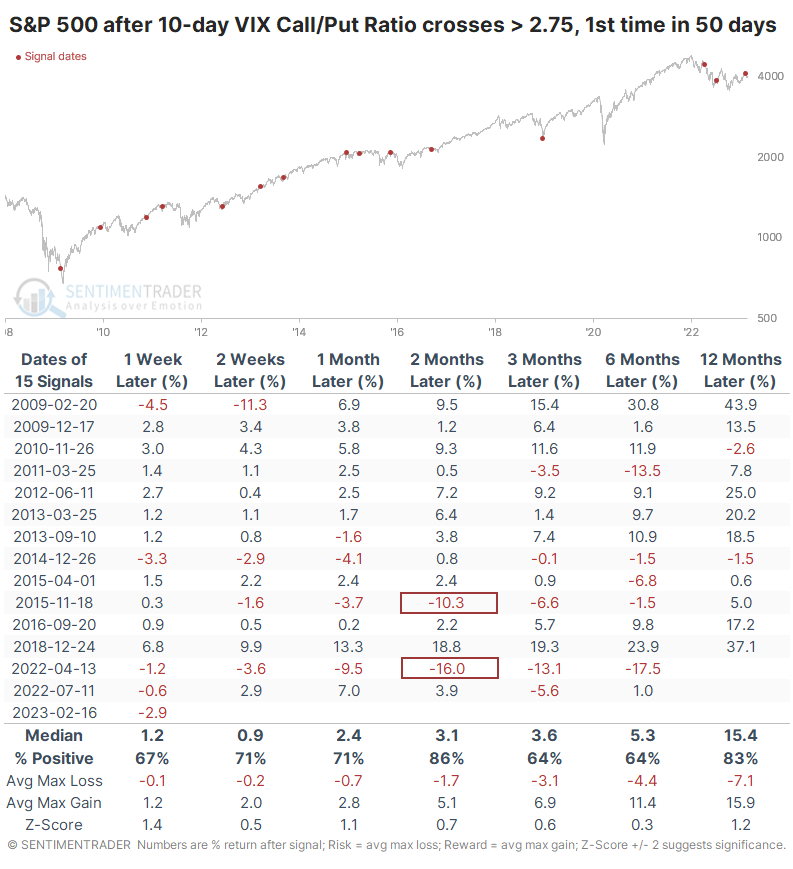

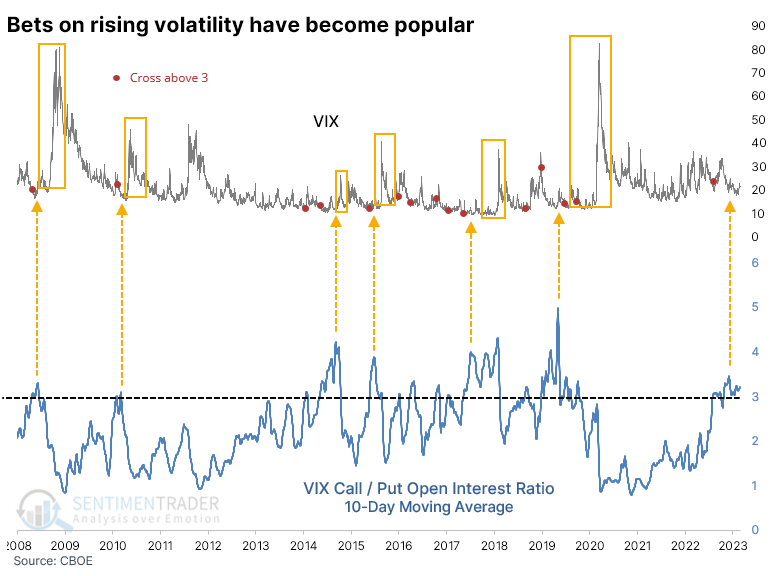

The elevated call volume has been sticky, meaning many call options haven't expired and are still outstanding. So, the open interest of calls relative to puts is high; it's more than 3-to-1. Again, this has been assumed to be bullish for volatility and bearish for stocks. One could kinda-sort make that argument as long as one was willing to wait anywhere from weeks to years for the "volatility event" to occur.

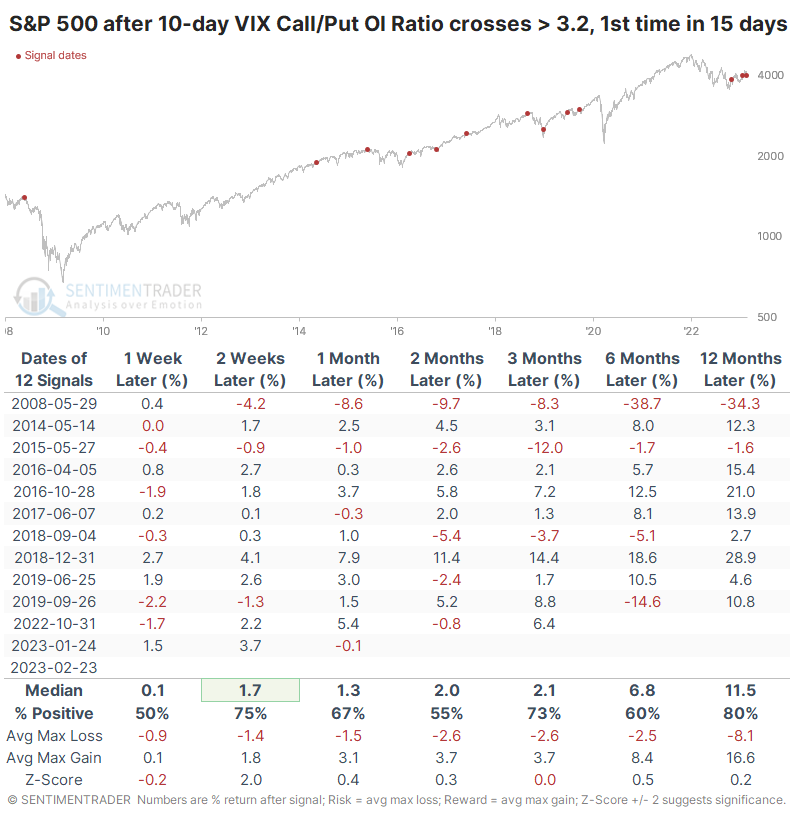

Whenever the ratio of outstanding call options to outstanding put options crosses 3.2 to 1, which it did last week, the S&P suffered a few nasty declines. Still, it would have been frustrating to consistently trade on this idea, as most of the signals preceded gains.

What the research tells us...

After months of mostly bullish market developments, there have been some recent concerns. Buyers have mostly stepped away, causing drawdowns of uncomfortable magnitude and persistence after the most recent round of thrusts. Those are legitimate concerns based on historical reactions.

Other concerns, including the build-up of trading in call options on the VIX, are mostly made up. So many games are played in the volatility space that laypersons can't make any conclusions about the traders' outlook. Even if we were arrogant enough to assume we knew they were betting on a rise in volatility, based on the ratios above, they don't have a good record anyway.