Top 5 stocks mask some underlying issues

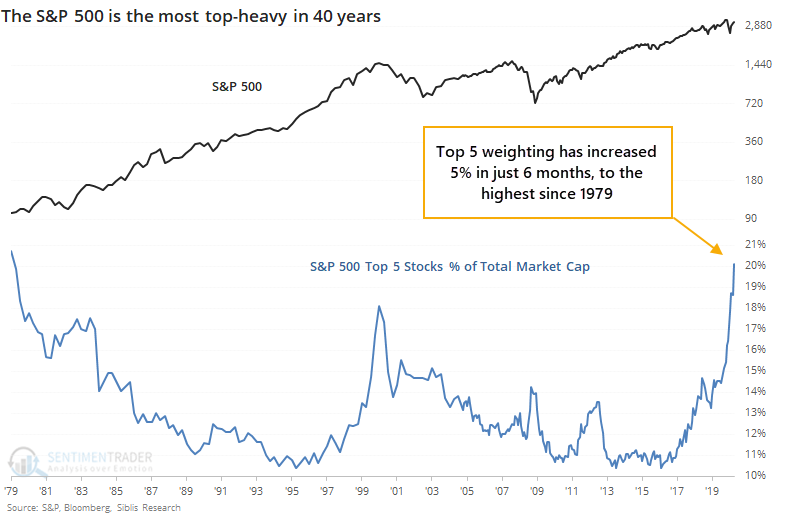

Thanks to the big tech stocks that we're all so familiar with, the most important equity index in the world has become historically top-heavy.

For the first time since 1979, only 5 stocks account for more than 20% of the S&P's market cap. Back then, it was IBM and AT&T with more than 6% weight each, followed by GM, GE, and Kodak.

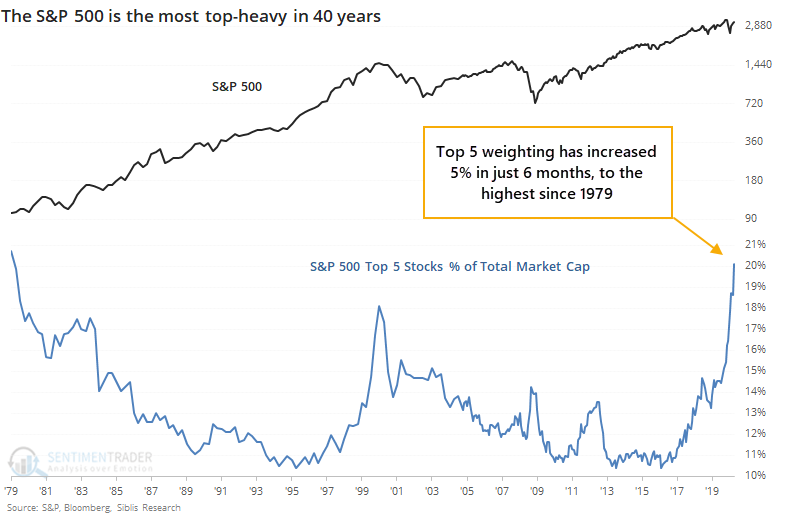

Over the past year, the rate of growth in these stocks relative to the overall market just surpassed the 2000 peak.

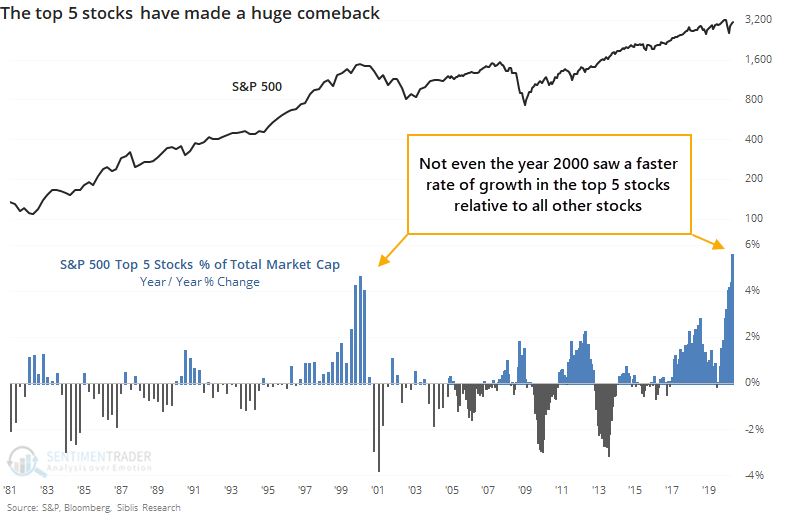

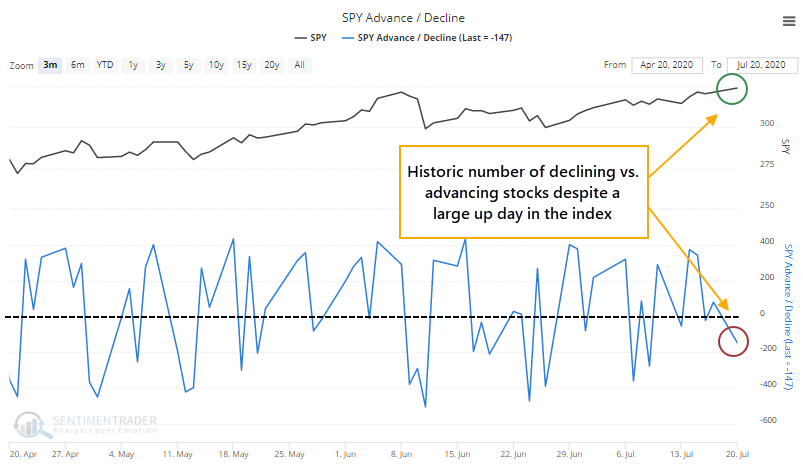

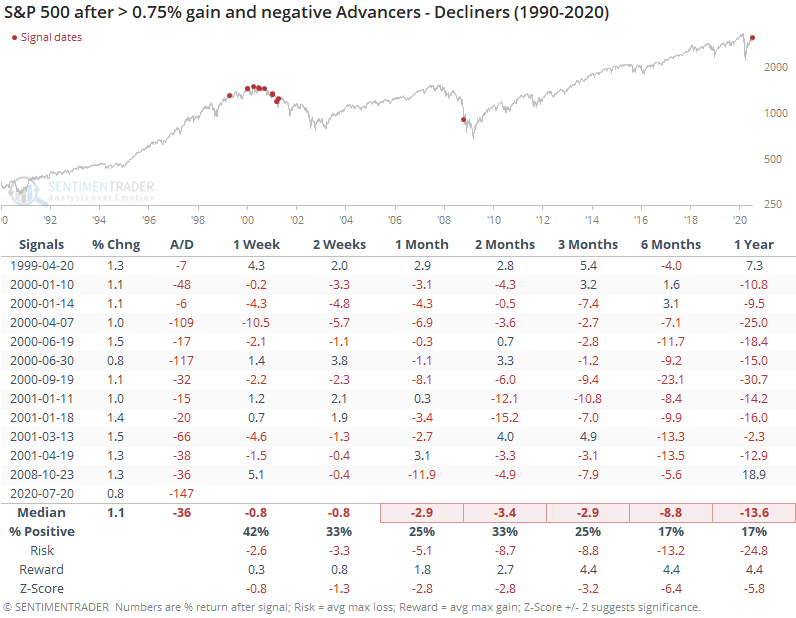

Because the large stocks are dominating the index so much right now, the index itself can show a gain even when most of its stocks are declining. That's what happened on Monday, and to a historic degree. Never before in 30 years has the S&P risen so much on a day when so many more of its component stocks declined rather than advanced.

This has been an absolutely horrid sign for forward returns.

Because most of the signals triggered in 2000, the medium- to long-term results were terrible. The risk/reward ratios over all time frames were heavily skewed to the downside.

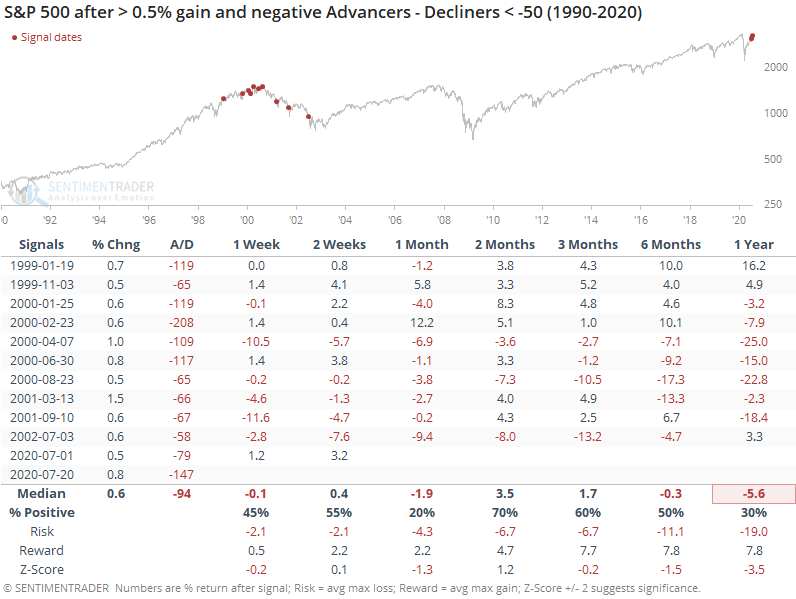

Even if we look for smaller gains in the index but with worse breadth, returns were poor.

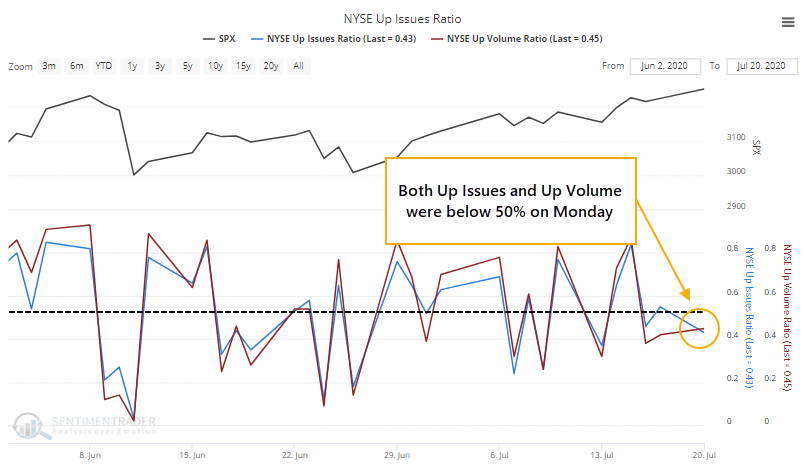

It wasn't just the S&P. Across the entire NYSE, more securities declined than advanced, and more volume flowed into those declining issues.

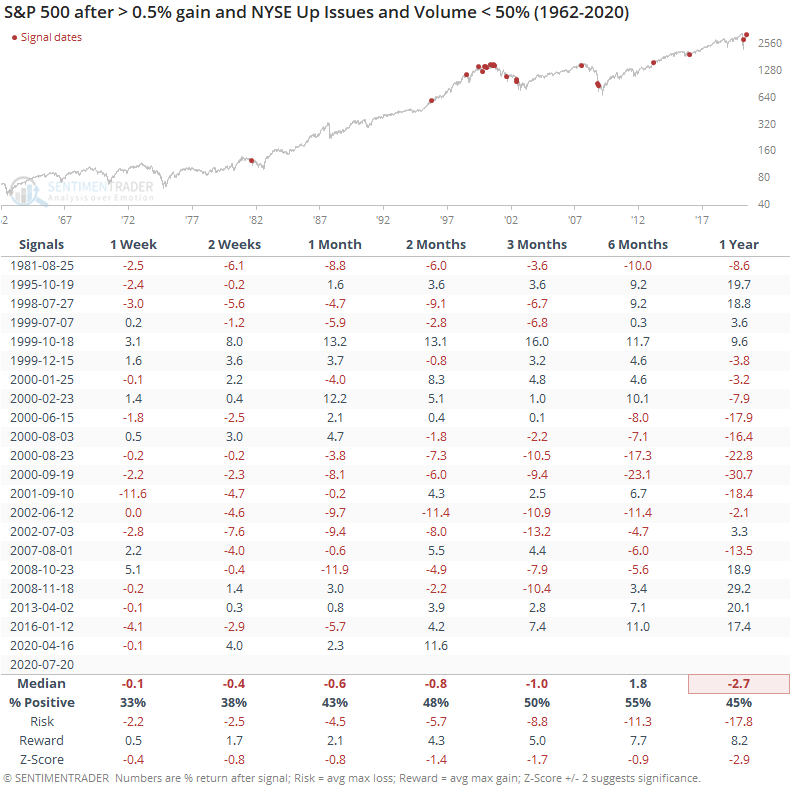

This, too, has not been a good sign.

We tend to not put a lot of weight on single-day breadth readings. Sometimes a single stock can heavily skew volume figures, or some weird news event can trigger an odd reading. It's more worrying when these oddities pile up. We're seeing some evidence of that in recent weeks, and when combined with extremely high optimism, it's a concern.