Three "all clear" signals to watch for

Key points:

- If you were able to sit out part of the stock market decline, the good news is that you likely preserved some capital

- The bad news is that you now have to decide when to get back in

- A few specific indicators do an excellent job of telling us when the worst is over

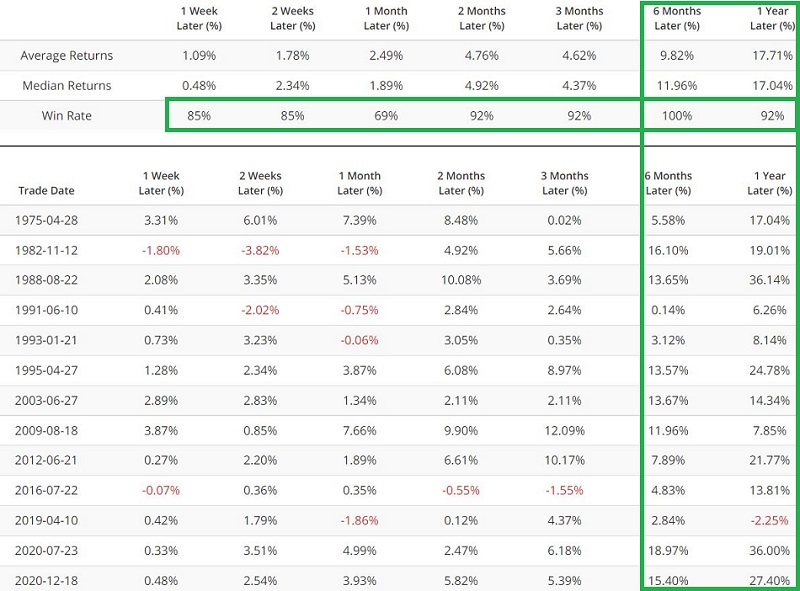

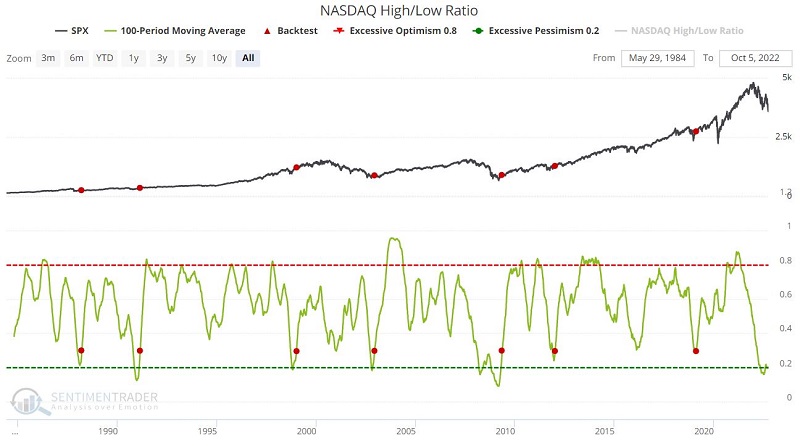

Nasdaq new highs and new lows should turn higher

During a bear market, the number of stocks making new 52-week lows typically outnumbers the number of stocks making new 52-week highs, often by a wide margin. To measure this, we follow the ratio of Nasdaq stocks making new highs divided by Nasdaq stocks making new highs and new lows each day. During a significant bear market, this number can fall to a significantly low level.

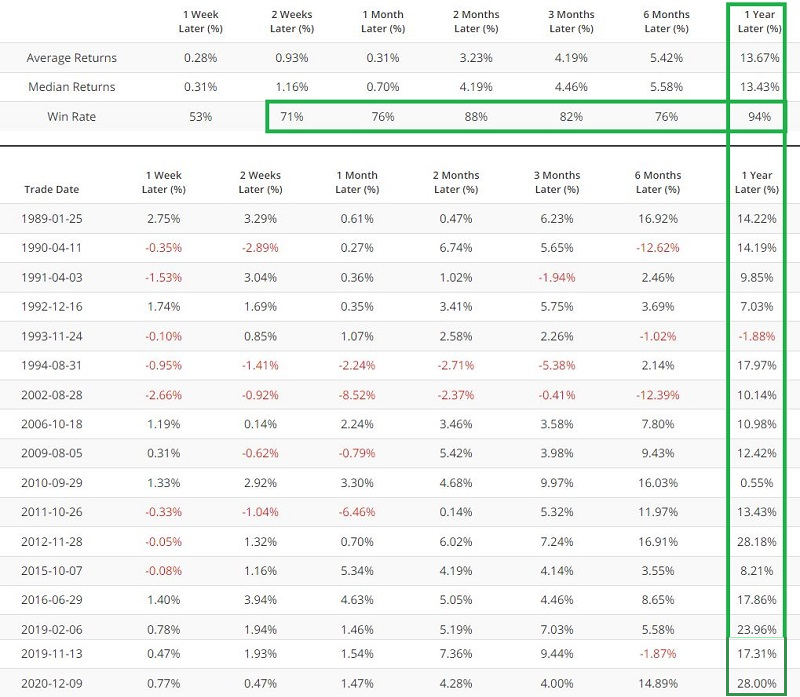

To identify an "all clear" signal, you can look for the 100-day moving average to rise above 0.29. In other words, the 100-day average must drop below 0.29 and then climb back above it. The chart and table below display the signals and subsequent S&P 500 Index performance.

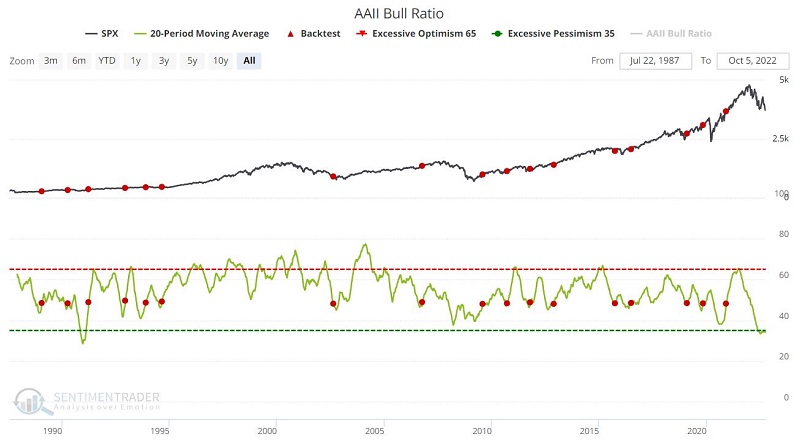

Bullish versus bearish sentiment should start to rise

Human nature being what it is, the investing public typically becomes more bearish the longer a bear market lasts and the more significant the decline.

We use the weekly bullish and bearish readings recorded by the American Association of Individual Investors (AAII) as one measure of investor sentiment. The Bull Ratio is calculated by dividing the bullish percentage by bullish plus bearish percentages.

To identify an "all clear" signal, you can look for the 20-week moving average of weekly readings to cross above 48 for the first time in six months. The chart and table below display the signals and subsequent S&P 500 Index performance.

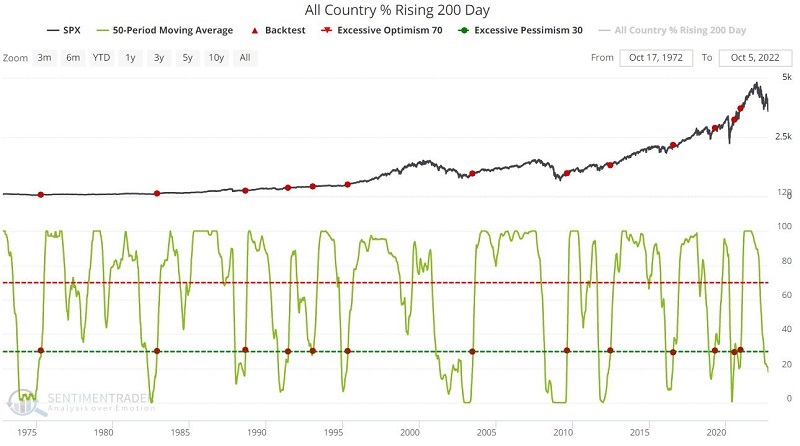

Price trends should start to curl higher

The most crucial arbiter of bullish and bearish trends is price action itself.

A standard definition of a bull market is when a major stock market index is above its 200-day moving average. The trend is confirmed as bullish when the 200-day moving average itself is in an uptrend, meaning today's 200-day moving average level is above its reading on the previous day.

To measure this, we take a global approach and follow the stock indexes for over 20 countries. We calculate the percentage of these indexes with a rising 200-day moving average. To identify an "all clear" signal, you can look for the 50-day moving average of this weekly percentage to cross above 30 percent. The chart and table below display the signals and subsequent S&P 500 Index performance.

What the research tells us…

None of the above indicators will get you in at the bottom. Some investors will lament that the signals from these indicators are late. But one of the most underappreciated accomplishments in investing is to buy in when the probabilities of an advance - even a continuing advance - are at their highest. When the signals shown above eventually trigger, history suggests that investors can move heavily into the market with high confidence.