The worst six months are even worse during bad (so far) years

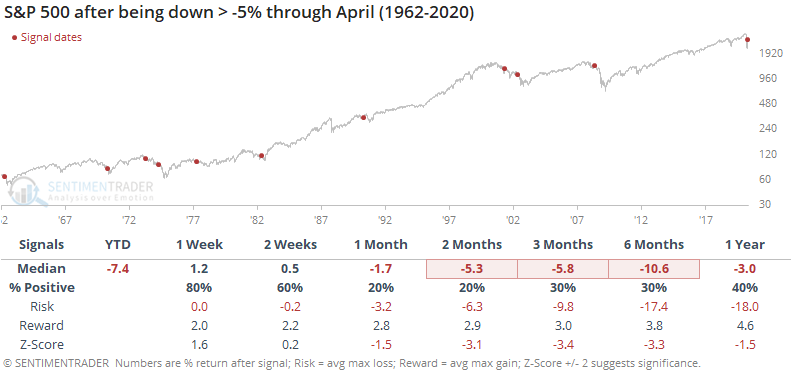

Those next 6 months could be a challenge based on the calendar. We've all heard about 'sell in May and go away' and it has been particularly acute during down years. When the S&P 500 was down at least 5% year-to-date through April, the months ahead were skewed more toward risk and less toward reward.

It has been particularly dastardly over the past 60 years. The next 2-6 months were not pleasant.

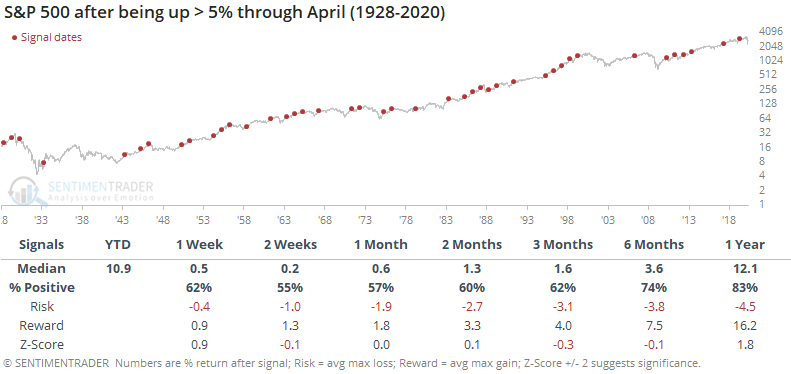

Contrast that to the returns during the 42 years when the S&P was up at least 5% through April.

When the S&P was down 5% or more heading into the summer, the next 6 months averaged -1.4% with a 47% win rate, compared to an average of +3.6% and 74% win rate during up years.

Seasonality is a tertiary input at best, but it suggests that upside over the summer months might be hard to come by given the already-weak conditions.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- With a surge in buying interest, stocks enjoyed a "double" Zweig Breadth Thrust

- Market returns after plunges in GDP

- Personal spending also plunged, and what that meant for stocks