The volatility of everything is spiking

Key points:

- Implied volatilities in stocks, bonds, currencies, gold, and oil are all spiking

- This is only the 11th cross-asset volatility spike in 30 years

- After similar behavior, stocks and the dollar tended to rally while gold and oil fell

Traders are pricing in volatility spikes...everywhere

We saw last week that while investors are pessimistic (especially in stocks), they're not panicking. When true panic grips markets, it's usually reflected in credit, and it's just not happening to any great degree yet.

That's not to say there isn't volatility. There is, and it's everywhere.

Options traders price in rising volatility in stocks almost exclusively when they're declining. That's when investors panic. But in other markets, from bonds to FX to commodities, implied volatility just as often spikes when prices are rising quickly as when they're falling. When volatility across assets spikes at the same time, you know some crazy sh** is going down.

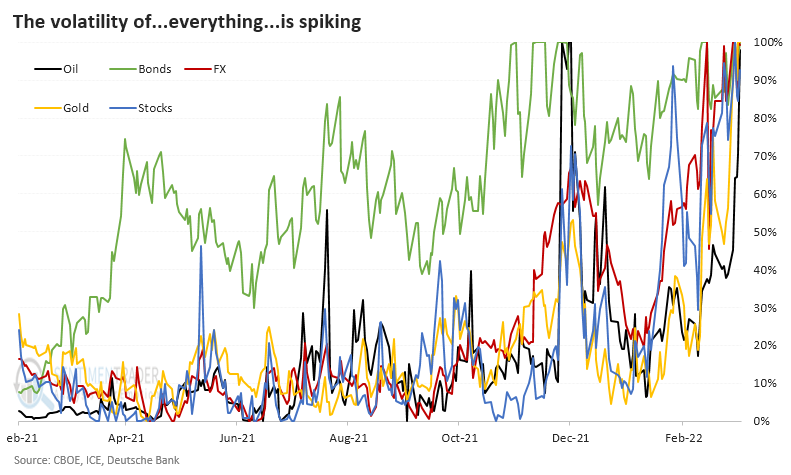

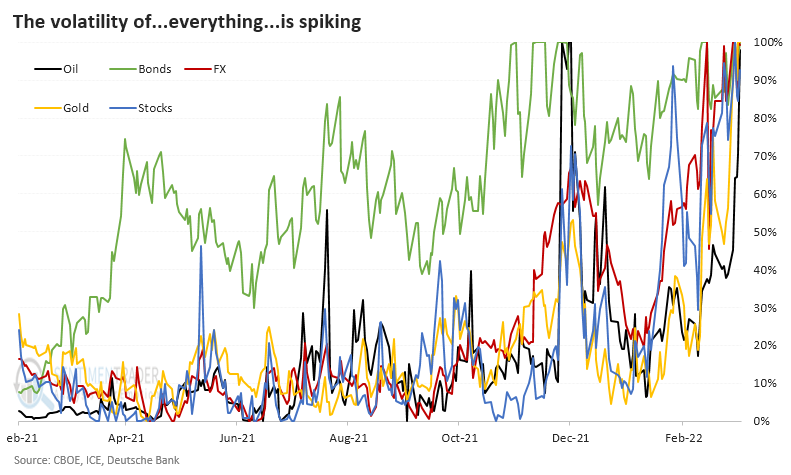

That's what's happening right now-for one of the few times in history, implied volatility in stocks, bonds, currencies, gold, and oil is spiking simultaneously. This is one of only a handful of times that every market is seeing the highest (or nearly the highest) volatility in the past year. The chart below shows volatility expectations for each market as a percentage of their one-year ranges.

The average volatility gauge across markets is in the top 2% of their yearly ranges. That's an incredible bout of cross-asset concern that we've rarely seen in the past 30 years.

Volatility spikes tend to be good for stocks and the dollar, bad for gold and oil

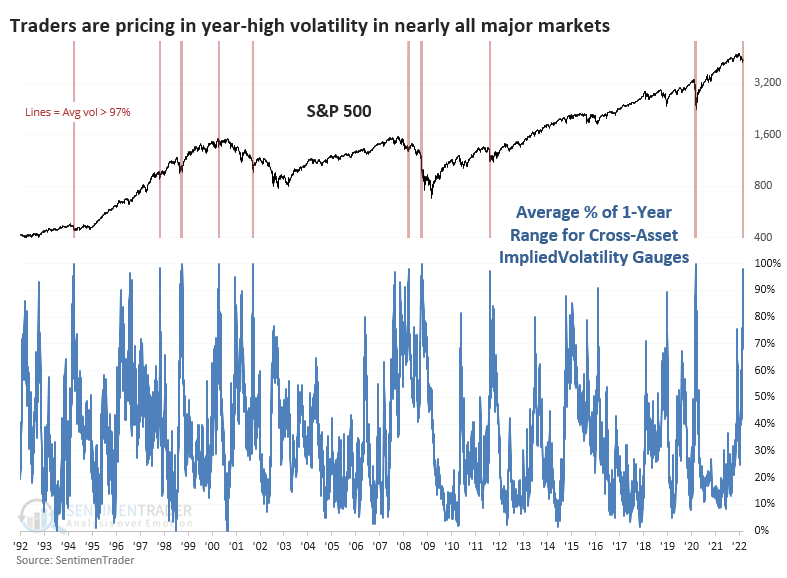

For the S&P 500, these bouts of high anxiety across markets have preceded excellent medium-term returns. The only real exceptions, unfortunately, were the last two. While it preceded a significant relief rally early in 2008, when it triggered again in October of that year, the final melt-down phase of the Global Financial Crisis was in full force. The same happened during the pandemic crash.

However, during other crises, it proved to be a good buying trigger for stocks, at least for a multi-week to multi-month rebound (including the Russian devaluation in 1998).

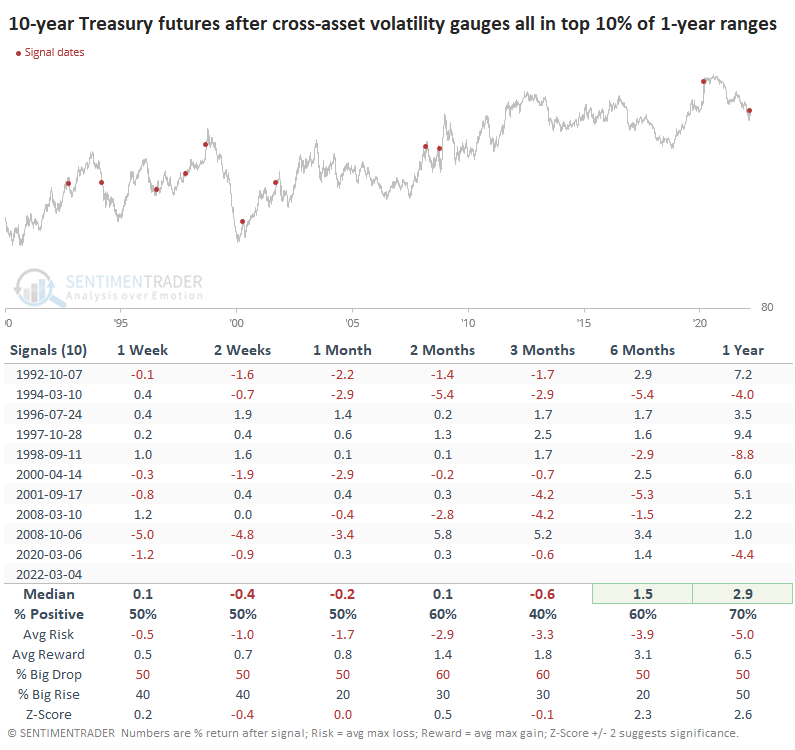

For bonds, it was more of a mixed picture. The futures on 10-year Treasuries showed inconsistent gains, though there was a slight positive correlation between short-term and long-term returns. If investors bid up Treasury prices in the week(s) after these volatility spikes, it was a better sign for their long-term prospects as well.

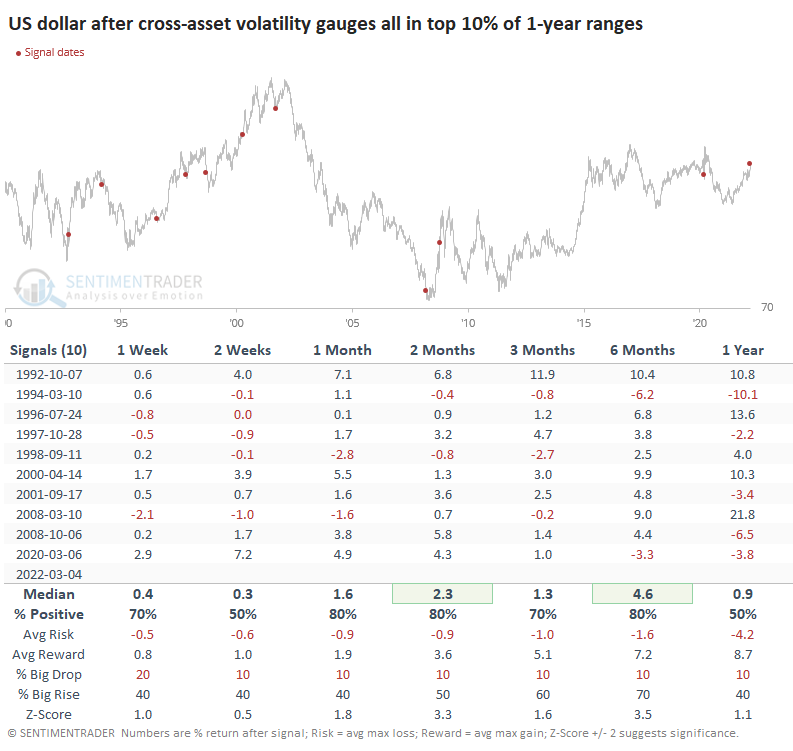

The dollar has often served as a safe-haven vehicle along with Treasuries, and several of these cross-asset volatility spikes coincided with a rising dollar. The buck tended to keep going in the months ahead, showing a positive return over the next 2 months after 8 of the 10 signals.

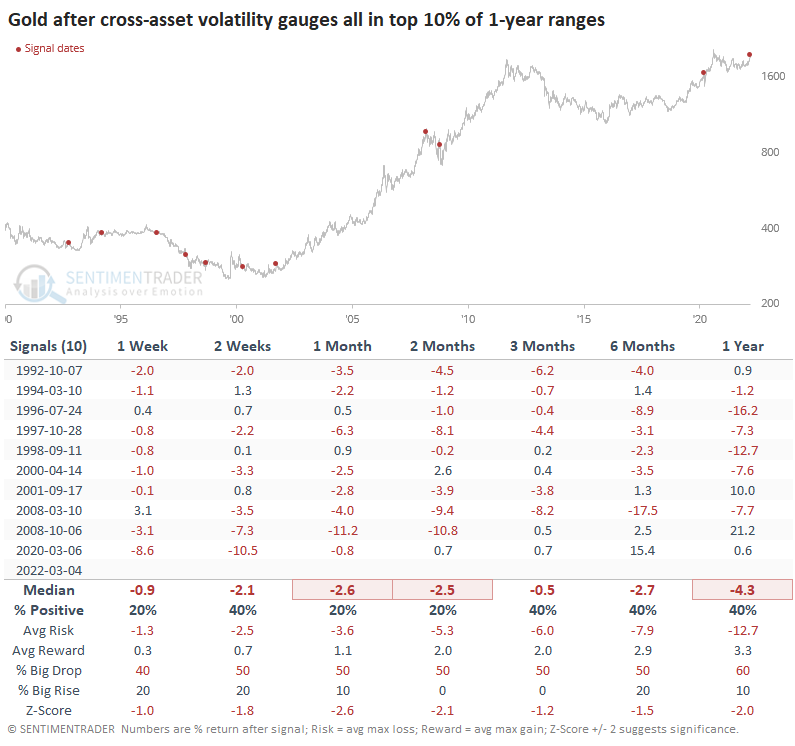

Gold is considered a good place to park "the world is going to hell" bets, and most of these crises saw the metal being bid up in the weeks prior. Unfortunately for gold bugs, it had a heck of a time holding onto those gains. Either 1 or 2 months later, gold sported a negative return every time.

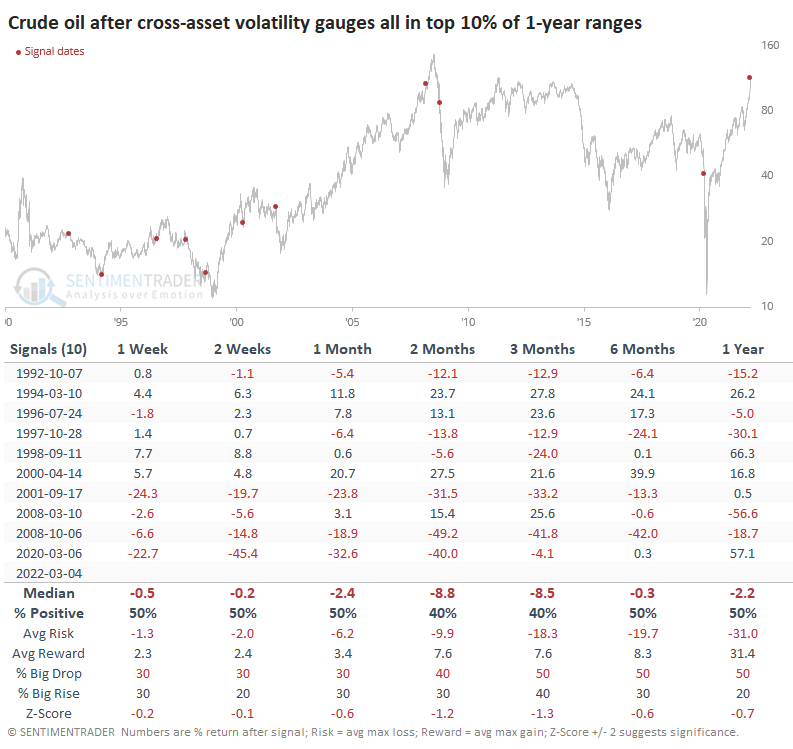

Crude oil also had trouble holding gains from these volatility spikes, especially in recent decades. This market, in particular, is subject to booms and busts based on supply/demand and geopolitical machinations and is the least subject to historical analysis because of it.

What the research tells us...

The Panic Button indicators we looked at last week are climbing quickly - it's up to 0.5 from 0.0 last week. But that's still far below all-out credit panic readings of 3.5 and above. That's not necessarily bad because investors do NOT want credit markets to sow panic. If and when they do, it's typically only during waterfall crashes. While investors are highly anxious, so far, the damage is relatively constrained, which should be a good thing from a multi-month point of view.