The top 5 stocks are driving this rally, and that's not good

The big winners just keep on winning, and it's starting to unnerve a lot of investors. It turns out they have a good reason for concern.

Most of us have seen some version of a chart like this from Goldman Sachs floating around:

Some combination of FAANG or FAAMG (Facebook, Amazon, Apple, Netflix - or Microsoft - and Google) has been handily beating most other stocks. And that matters, because those stocks are huge, and they're driving a big portion of the gains.

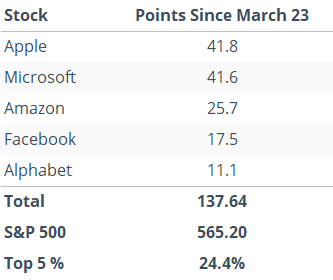

In the 35 days since the March 23 bottom, the top 5 drivers within the S&P 500 have accounted for 138 points out of the total 565 that the S&P has gained. So, only 5 stocks have accounted for more than 24% of the total point gain.

But...so what? Does it matter? Don't the top stocks always drive the index? Our good friend Tony Dwyer, the excellent strategist at Canaccord Genuity, helped answer this question in recent days, and it's not pretty.

To check, we'll look for every time the S&P 500 set a 52-week low, then rallied for 35 sessions. Over those 35-day periods, we'll look at the total points gained in the top 5 stocks versus the total points gained in the entire S&P 500.

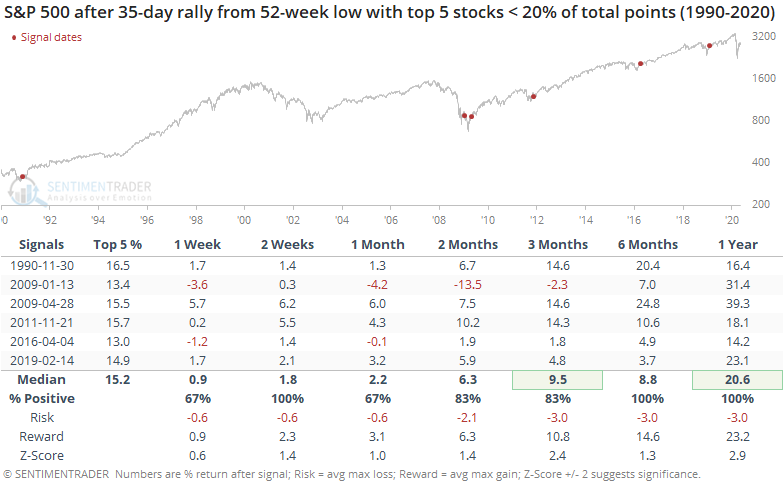

Below, we can see the rallies that saw the top 5 stocks account for less than 20% of the S&P 500's total point gain.

This was a good sign, with only one of them being a fakeout that ended up leading to a lower low. Each of the others proved to be sustainable, with excellent gains in the months ahead and a very positively skewed risk/reward ratio.

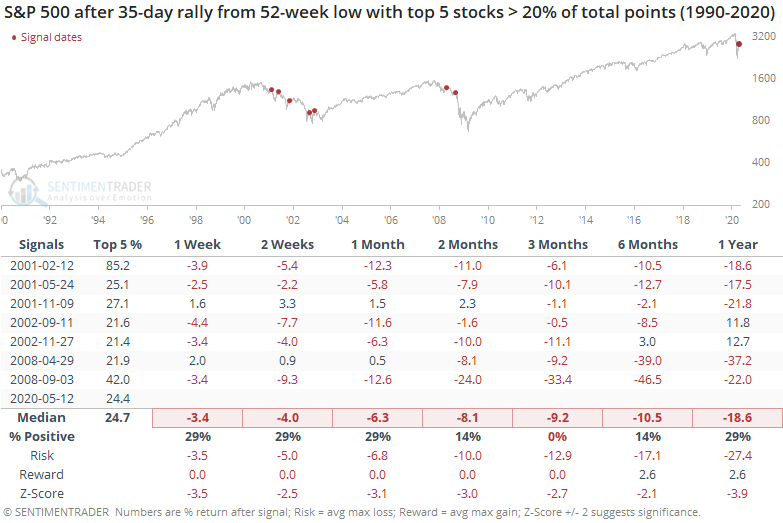

Now, let's check the 35-day rallies when the top 5 stocks accounted for more than 20% of the S&P's total gain. Bulls may want to avert their eyes.

Every one of these proved to be a false rally, with the S&P losing ground over the next few months after each one. The risk/reward was horrid.

At 24.4%, the current weighting of the top 5 isn't as egregious as the worst time periods (like February 2001's weight of a whopping 85%) but it's definitely in the top tier.

There is no question we've seen unprecedented developments over the past two months. That makes any historical comparison questionable. From what we can see, though, when the initial rally off of a low is driven primarily by only a mere handful of stocks, it has been very difficult for the broader market to continue its gains.