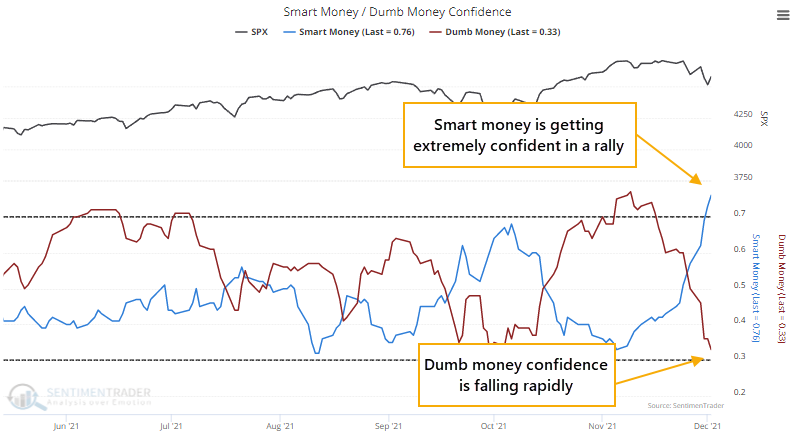

The spread in sentiment between Smart and Dumb Money is historic

Historic spread between Smart and Dumb Money

The past couple of weeks has triggered a drastic shift in sentiment. The confidence in a rally among Smart Money indicators has jumped. It would be even more extreme if there wasn't a curiously large plunge in "smart money" commercial hedger positions in equity index futures.

We can see the stark change in attitude below. Despite the weird increase in a net short position in index futures, Smart Money Confidence jumped to 77%, the highest since late April 2020. Dumb Money Confidence plunged to 30%, the lowest since early April 2020.

This adjustment in behavior has caused the spread between them to rise above 45%. The S&P 500's annualized return when the spread is above 45% was +52.6%, nearly 10x the return when sentiment was neutral.

| Stat box Fewer than 10% of Consumer Staple stocks were above their 10-day moving averages only 3 days ago, now more than 90% of them are. The sector has enjoyed such a quick rebound in short-term trends only 3 other times - Nov 30, 2011, Jan 2, 2013, and Oct 21, 2014. |

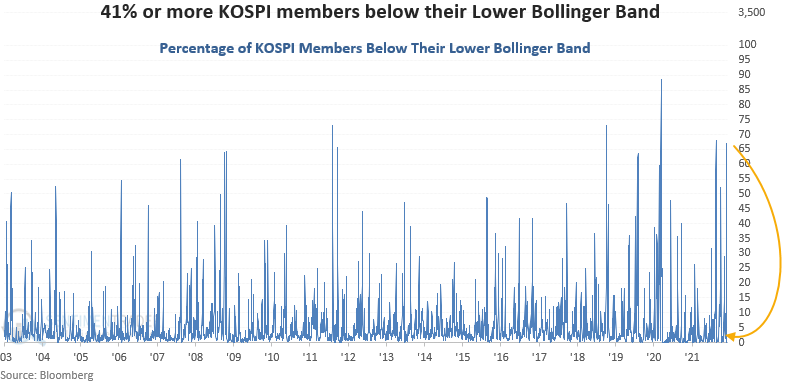

A buy signal from the Kospi

A new signal from a mean reversion model that utilizes the percentage of KOSPI index members below their lower Bollinger band registered an alert on Monday.

Dean noted that the Bollinger band signal identifies when the percentage of index members trading below their lower Bollinger band cycles from a high to a low level. The percentage of KOSPI members below their lower Bollinger band recently increased to the 7th highest level in history.

This signal has triggered 19 other times over the past 18 years. After the others, future returns and win rates were good on medium-term time frames.

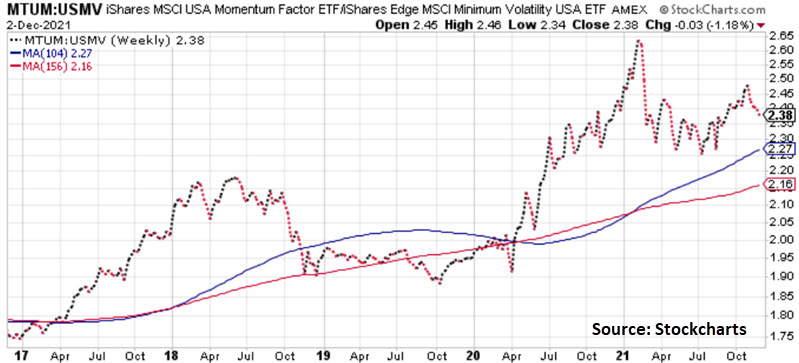

Relative trends mostly remain in force

Jay highlighted relative trends in and among stock indexes, assets, and bonds.

The example chart below shows MTUM (iShares MSCI USA Momentum Factor ETF) versus USMV (iShares Edge MSCI Minimum Volatility ETF). Typically, momentum stocks outperform during bullish market conditions, and low volatility stocks outperform during bearish market conditions. The longer-term trend still favors momentum stocks. However, low volatility has gained ground since early 2021, and the relationship has been unchanged from 13 months ago. Watch this one for a potential early warning sign.

Sentiment has whipsawed quickly over the past month, from extreme optimism to some signs of extreme pessimism. Most of the intermarket relationships that have been in force for the last year remain in force, however. At some point, the domination of U.S. Large-Cap stocks will end, but so far there is little sign of it.