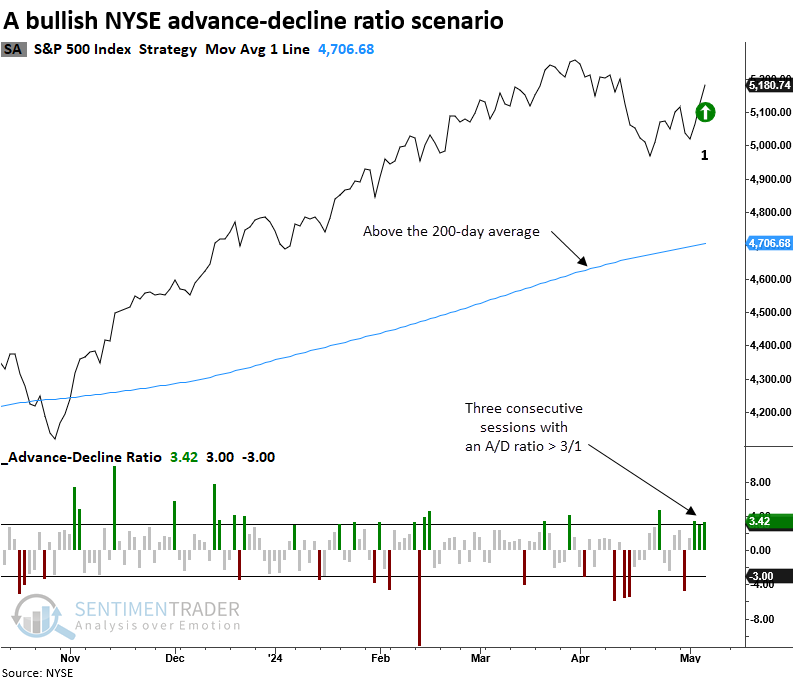

The NYSE advance-decline ratio triggered a bullish signal

Key points:

- Over the prior three sessions, advancing issues on the NYSE have significantly outpaced declining issues

- Similar advance-decline ratio skews preceded outstanding returns and win rates for the S&P 500

- Cyclicals tended to outperform the S&P 500 and defensive groups across most horizons

Advancing issues on the NYSE have outpaced declining issues by a wide margin

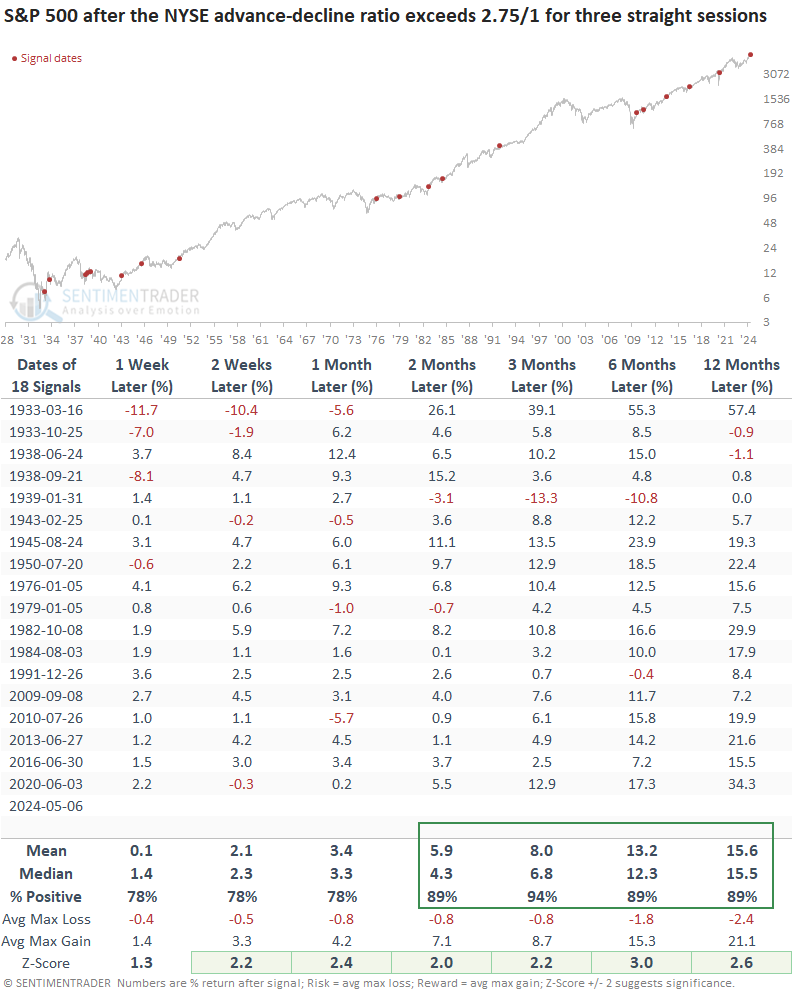

For only the 32nd time since 1931, the NYSE advance-decline ratio exceeded a threshold of 3 to 1 for three consecutive trading sessions. If I include a 200-day moving average filter to capture precedents that occurred with the S&P 500 above its long-term moving, like now, instances drop to 14, highlighting the rarity of this event.

The previous signal occurred in June 2016, leading to a robust rally.

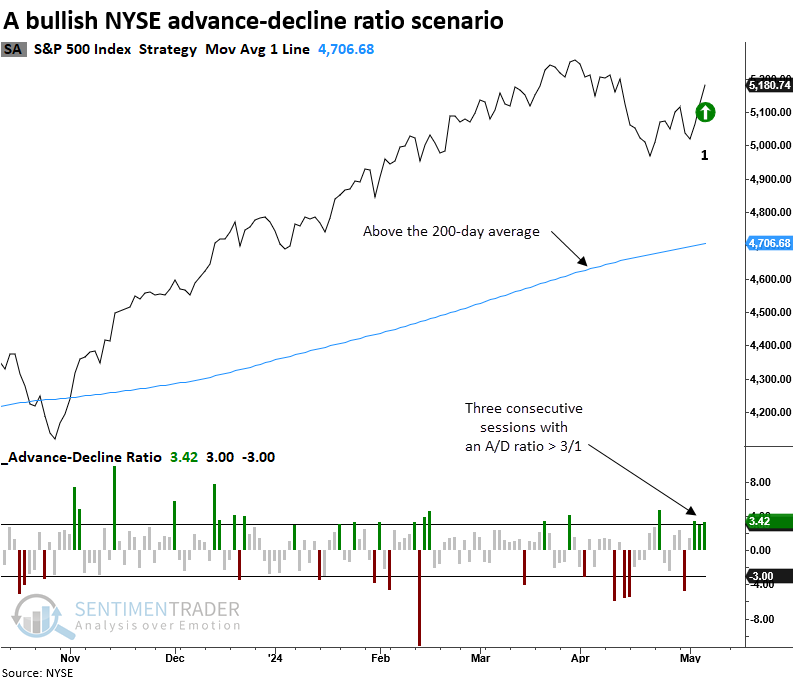

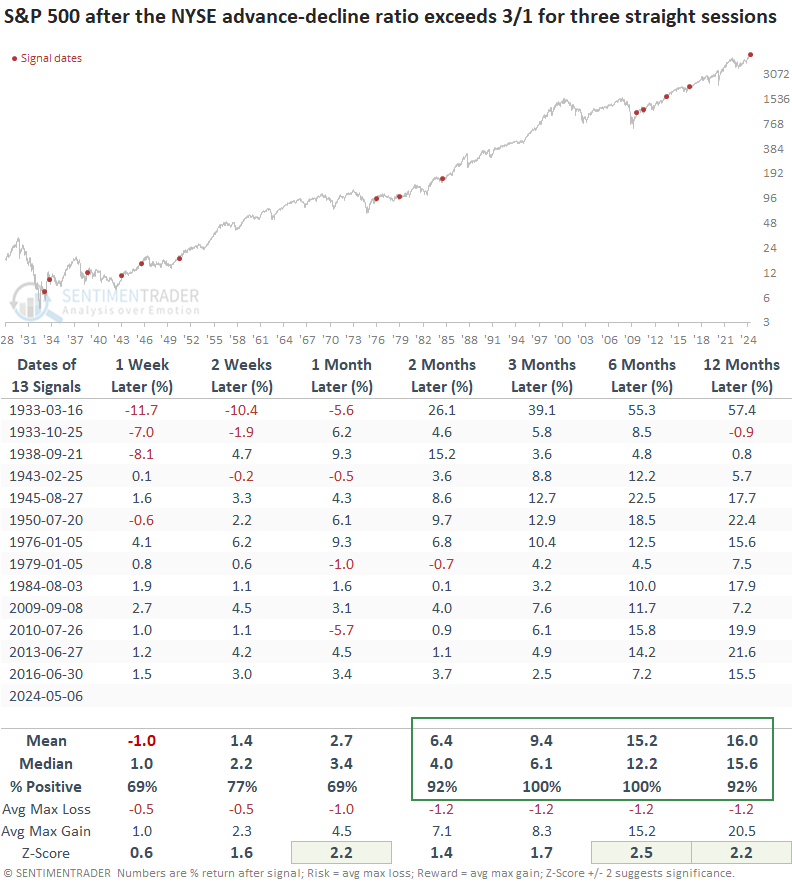

Similar A/D ratio conditions preceded an extremely favorable outlook for stocks

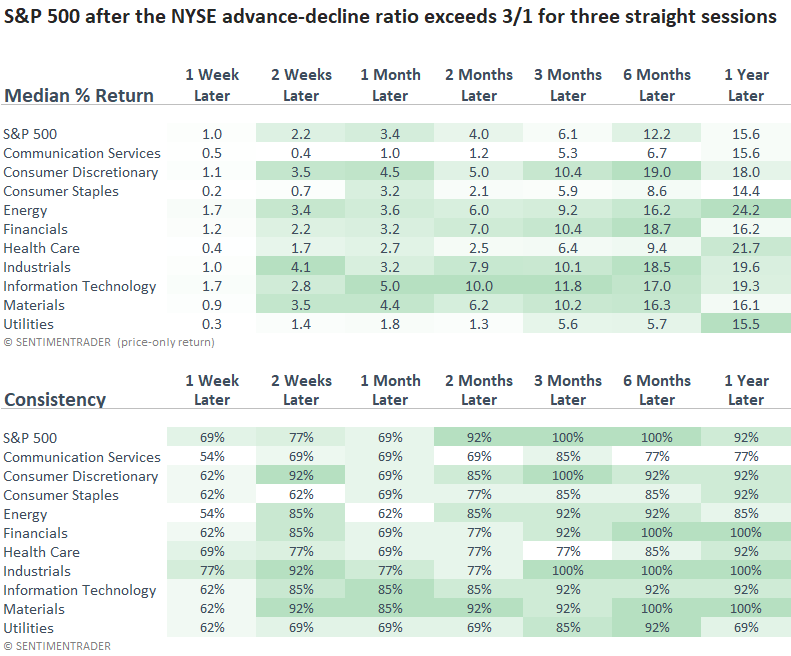

Following three successive instances where the NYSE advance-decline ratio exceeded 3 to 1, with the S&P 500 above its 200-day average, the world's most benchmarked index rallied 100% of the time over the subsequent three and six months.

A year later, the S&P 500 exhibited gains in 92% of occurrences, with the only loss being a 0.9% drop in 1933.

Since the 1929-42 secular bear market, there hasn't been a single instance of a maximum loss exceeding -10% over the subsequent year, a truly remarkable environment.

Suppose I lower the ratio threshold from 3/1 to 2.75/1 to increase the sample size. In that case, returns and win rates remained excellent, with 6 out of 7 horizons exhibiting significance relative to historical returns over the study period.

Unsurprisingly, cyclical-oriented sectors outperformed defensive groups across most time frames, with win rates exhibiting similar tendencies.

What the research tells us...

Following drawdowns ranging from 5% to 8%, which are typical corrections within a bull market, most indices are now working on reclaiming their upward trajectories. Favorable market breadth conditions bolster the case for a resumption of the uptrend. Over the last three sessions, advancing issues on the NYSE have outnumbered declining issues by a 3 to 1 ratio. Similar market breadth conditions produced outstanding results for the S&P 500, especially over medium and long-term horizons. Should history rhyme, investors who favored cyclical stocks over defensive ones enjoyed substantial rewards.